This year’s market was anything but normal. Of course, when it comes to markets, we should expect the unexpected. Think about this for a minute. The average return for the S&P 500 is about 8%. But in a given year, you are more likely to see a 20% return rather than an 8% gain. Remember that averages are just that. They represent a group of widely different outcomes. We should not expect normal, or average returns.

Seeing something happen that you didn’t expect to happen should be the rule. Not an exception. Looking back at 2021, the biggest personal surprise was the rise of inflation. This year’s price increases were first viewed as a fleeting phenomenon caused by supply chain disruptions. As the year progressed, companies with pricing power used it to their advantage. As a result, the consumer price index delivered its largest increase in decades.

I am grateful for those who have allowed me to work with them in 2020. I appreciate those who have read my weekly blog and participated in this year’s webinars as well as November’s Female Investor Workshop. (Note: Look for word of a similar workshop offering again in January. You can expect to see other workshops in 2022 as well.)

I hope you made it through the year with your health and sanity. I hope you can say the same for your loved ones, too. Despite the continued overhang of the pandemic on our personal and professional lives, I trust that you have had more opportunities to see your loved ones in 2021. May 2022 bring nothing but better times for everyone.

I hope everyone has been enjoying the holiday season. Merry Christmas to those who celebrate. Happy New Year to all! May the year ahead be full of joy, happiness, and success for each of you.

I am rarely, if ever, one to exaggerate, so I feel comfortable saying that this year has been unlike any most investors have seen before. It included the continuation of a global pandemic and two new virus strains. We saw solid economic growth and experienced the highest inflation we’ve seen in nearly four decades. Against this backdrop, the stock market – as measured by the S&P 500 Index delivered strong returns. As of mid-day Thursday, the S&P 500 is up about 26% year-to-date. The S&P has also set 69 new closing highs this year.

Bond investors have not fared as well. Based on the iShares U.S. Aggregate Bond ETF (AGG), the broad bond market has fallen more than 3% year-to-date. Despite the weak performance, we do get reminded of the important role that bonds can play in balanced portfolios on days like November 26th. On that day, the S&P fell by 2.3% its worst return so far this year. We saw bond prices, as measured by AGG rise, softening the impact of the day’s decline.

It’s also important to remember to look at gains and losses in percentage terms rather than in absolute numbers. In the grand scheme of things that 2.3% loss is not that significant. That same day, the Dow Jones Average fell a little more than 900 points. That sounds scary. But it was only a 2.5% decline.

WHAT HAPPENED IN THE MARKET THIS YEAR?

Using this article (subscription required) from the Wall Street Journal as a guide, let’s take a look at some of this year’s key market-related events:

- January 27: Meme-stock mania went mainstream. Share prices for companies such as GameStop, AMC, and BlackBerry, which were once scorned by many investors, soared. The rally left many Wall Street shorts reeling as amateur investors profited from the gains.

- February 4: The global chip shortage made headlines. It led Ford to announce plans to reduce the production of its top-selling F-150 pick-up truck.

- March 18: Supply-chain issues became more prevalent. Honda and Toyota announced plans to halt production at North American plants. Why? Shortages and transportation bottlenecks were disrupting global manufacturing activities.

- March 23: A container ship blocked the Suez Canal. The ship got stuck sideways, blocking traffic for more than a week.

- April 16: The SEC dampened interest in special-purchase acquisition companies (SPACs) through its closer scrutiny of such companies. The SEC warned that some SPACs could restate their financial results due to overly optimistic revenue projections.

- May 12: We saw the first report of higher inflation. Consumer prices jumped 4.2% year-over-year in April. According to the Labor Department, the gain was the largest since 2008.

- October 11: As a former equity analyst covering the energy sector, I couldn’t help but notice that S. crude oil closed above $80. The last time it closed at that level was in 2014. Prices were also up 125% versus October 2020.

- October 28: The combination of a surge in covid cases and supply bottlenecks caused third-quarter economic growth to slow to 2%. This marked the slowest pace since the recovery began in mid-2020.

- November 3: The Fed closed a chapter on its pandemic-driven stimulus program. It approved plans to begin scaling back its bond-buying program.

- November 28: A new coronavirus strain – omicron – was identified by the World Health Organization. The stock market delivered its worst trading day of the year.

- December 10: The Labor Department reported that November inflation levels hit a nearly four-decade high of 6.8% year-to-date. That’s the fastest pace since 1982.

THOUGHTS ON RECENT MARKET VOLATILITY

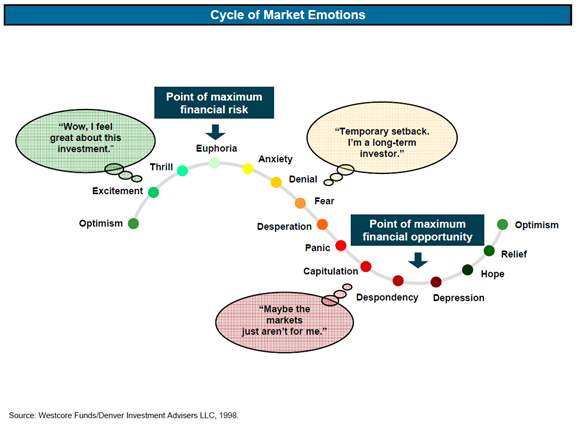

Recently, market returns have been more volatile. What happens in the market on a day-to-day basis is beyond our control. How we react to daily returns is not. I’ve shared this chart before. The “Cycle of Market Emotions” is one of my favorites. I think it’s worth sharing it again:

I often remind both clients and prospects that two of the worst things we can do as investors are “buy high” and “sell low.” One of my goals as a financial advisor/wealth manager is to help clients put a plan in place that can help them limit the impact their emotions have on their portfolios. Big gains are nice, but our goal should not be to beat the market. It should be to live our desired lifestyle in retirement. Trying to beat the market implies taking on more risk. That can also lead to larger losses, especially in a down – or even highly volatile – market.

How we react to volatility matters. Many think of volatility as risk. From an investing perspective, volatility refers to the fluctuation of returns – whether up or down. I prefer to think of risk in terms of loss. What are the chances that we will see a permanent loss in our investment? That’s something we want to avoid. It also matters much more than day-to-day price fluctuations.

Watching the value of your portfolio tumble can hurt. It can spark insecurity. It can lead to a loss of confidence. If it happens, remember your plan and your long-term goals. If you’re still on track, you should have less reason to worry.

SOME WAYS TO HANDLE MARKET VOLATILITY

When markets become more volatile, the best course of action is often inaction. While uncertainty in the market and the world at large can lead to periods of panic, letting panic seep into your portfolio can become counterproductive. If fear, concern, and greed overtake the market, try and turn off the investing news, ignore your brokerage account, and focus on the importance of other aspects of your life besides your investments.

Remember as investors willing to think long term, how the impatience of others can create opportunity. Try to keep headline-driven events from prompting hasty reactions. If you look, you’ll see the world continues to go on around you. Businesses remain open and many companies are successful. If others are doing something, that does not mean you have to do it as well.

If you have no plans to withdraw money from your account for several years, then the market’s return on a given day matter less. For those who are saving regularly, a falling market works to their benefit. Yes, that can sound crazy on the surface. Think about it though. It’s true.

For example, say that you add money to the market through your 401(k) every two weeks. You buy shares of an asset that cost $100 each. You invest $1,500. That means you buy 15 shares. What happens if the market suffers a 25% decline? Your shares are now worth $75 each. If you continue to invest $1,500 a paycheck, you’ll buy 20 shares. Then assume that the market recovers and your shares once again sell for $100. The 15 shares you bought at $100 are once again worth $1,500. But the shares you bought at $75 are now worth $2,000 – 20 * 100.

You realized a $500 gain by buying shares in a depressed market. When you save for retirement and put your money in the market, you are showing that you have a positive long-term market view. There’s no reason to invest if you don’t think the market will move higher. Volatility (aka fluctuation in share price) can create opportunity. Embrace it. Take advantage of it.

I realize that the picture can be different once your retire and are no longer adding money to the market. That leaves you with less of an opportunity to benefit from market downturns. Investors need to be prepared to sit tight through market downturns. If you can, you want to avoid turning paper losses into actual losses. Part of my approach for retirees who need to withdraw funds from their accounts to cover living expenses involves setting aside an amount of cash that will cover 12-24 months of living expenses.

You can use such cash to fund needs during a market downturn. You can then sell securities when the recovery takes hold and replenish your cash. This helps accomplish an important goal: Avoid selling low.

In my blog “Creating a Retirement Paycheck,” I share more thoughts about this bucket approach. Retirees can use it to help prepare for the market downturns that we will all experience as investors from time to time.

THE ADVANTAGE OF TIME FOR INVESTORS

Time is one of the true advantages that individual investors have over traders. Time allows us to hold onto our stocks rather than be forced to sell them. I have held some stocks in my portfolio for more than 25 years. Nobody can promise you that a diversified stock portfolio will go up over time, but if you look at five-year holding periods or longer, history suggests that the odds are strongly in your favor. What will happen over five months or five quarters is unknown.

While you’re still working and can accumulate assets, your goals should be as follows:

- Save

- Invest

- Hold

- Repeat

When you retire, the goals change. So do the rules. You move from asset accumulation to asset decumulation. Tax planning techniques take on added importance as you want to try and minimize the tax cost of withdrawing money from your portfolio. You want to consider things like Roth conversions. They can add meaningful value.

What messages can investors take from this year’s markets? First, thinking about specific risk factors that can hurt your portfolio is probably a useless exercise. Instead, we should remember that markets can turn sharply lower from time to time. Investors must remember the importance of holding on through periods of market weakness.

Holding tight is, unfortunately, easier said than done. You must have the psychological wherewithal to hang on through these periods. Fortunately, you can take steps to protect your portfolio before a market shock happens. That can help ease the pain – and the related fear – associated with a downturn.

WHAT COMES NEXT?

You’re welcome to make your guesses and predictions about 2022. But it could be more fun to sit on the sidelines and laugh at the vast majority of them – they will likely be proven wrong by the end of the year.

I suggest you do the same. Rather than focusing on a single year, keep working on adopting a true, long-term mindset. If you can do that, history shows you will likely come out ahead. Given the stock market’s historical performance, it makes sense to maintain an allocation to stocks in most, if not all, market environments.

As we get ready to start another year, we can find many 2022 market forecasts. Don’t place too much faith in such forecasts. Predicting what might happen next week is hard enough. Forget about forecasting what might happen over the next year. The only thing one can comfortably say about the U.S. markets is that we expect them to open at 9:30 AM and close at 4:00 PM about 250 times a year (365 days, less holidays and weekends).

If pushed to provide a view, based on the market’s historical track record, my 2022 forecast is up, not down, for the U.S. stock market. Why? Historically, markets rise more often than they fall. If I forecast market gains every year, I would be right more often than not. (For example, this chart shows the S&P 500 has closed higher about two-thirds of the time going back to 1928.)

S&P 500 Index – 90 Year Historical Chart: Source: Macrotrends.net

Over time, I have become more of an optimist. I also believe it best to look forward to the year ahead rather than lament about what happened in the past. Let’s hope that in 2022 we find a year less dominated by disease and death, by unemployment- or underemployment – and by fear and hatred. A year allowing us to spend more time outside than inside, a year that ends with smiles not hidden by masks. A year where we can travel more freely, return to more ballparks, concert halls, and theaters.

May you continue to have the patience and fortitude to focus on the future. This has been a tough year for many. There are better days to come.

THIS YEAR’S CONTENT HIGHLIGHTS

In closing, I would like to offer one last look back to 2021. I have reviewed the data from the blogs published by Apprise Wealth Management. I want to share 10 items from Apprise’s 2021 content library. The first five are my most read original content blogs. The next five are the most viewed items from Apprise’s 5 Favorite Reads.

- October 24, 2021: “9 Investment and Retirement Tips for Savvy Women.”

- October 10, 2021: “7 Benefits of a Roth IRA.”

- August 29, 2021: “Protecting the One You Love.”

- February 15, 2021: “Creating a Retirement Paycheck.”

- October 25, 2020: “How Long to Keep Financial Documents: Some Guidelines.”

- May 9, 2021: “19 Things Rich People Rarely Do.”

- April 4, 2021: “100 Tips for a Better Life.”

- June 20, 2021: “5 Morning Habits of Highly Successful People.”

- March 7, 2021: “The Algebra of Wealth.”

- December 12, 2021: “Could Roads Recharge Electric Cars? The Technology May Be Close.”

In addition, this was the most viewed item that I shared this year:

- November 27, 2021: Wealth Made Simple Podcast Appearance: “The Intersection of Tax and Asset Management.”

CLOSING THOUGHTS

As an individual, I am often prone to deep reflection. This year, I updated the Apprise website and created more content directed toward the types of clients that I work with most often. I have endeavored to create more content for female-led households as that represents the majority of the Apprise client base. I also created a workshop for Female Investors. If you are interested in joining the next session, please send an email to philweiss@apprisewealth.com. I will make sure to send you more information when it’s available. If you have not yet read “Confessions of a Financial Advisor,” please do. It explains why I work with the clients I work with, and what led me to start Apprise. In other words, it explains my “Why?” Thank you for your time and attention this year. May our futures be even brighter than our pasts.

This will be my last blog of 2021. Happy New Year to all! See you in 2022.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us: Twitter Facebook LinkedIn

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/