Anyone can suffer from FOMO – Fear of Missing Out. Making decisions based on FOMO can be dangerous, especially when it comes to investing. We see the potential for quick gains and want to participate.

At the same time, we should try to limit the role fear and greed can play in our investing process. Why? We often sell low out of fear. Instead, greed can cause us to buy high. Investing based on these emotions can limit our investment returns.

Some investing trends have staying power, but how do we separate the good from the bad. Participating in the latest fad can be too risky for the average investor. Over the last year or so, four of the biggest investment fads have related to cryptocurrency, Special Purchase Acquisition Corps (SPACs), pot/cannabis, and meme stocks.

Properly timed investments in assets included in any of these four categories could have led to meaningful gains. It could have also meant large losses. Let’s take a quick look at some examples.

CANNABIS/POT STOCKS

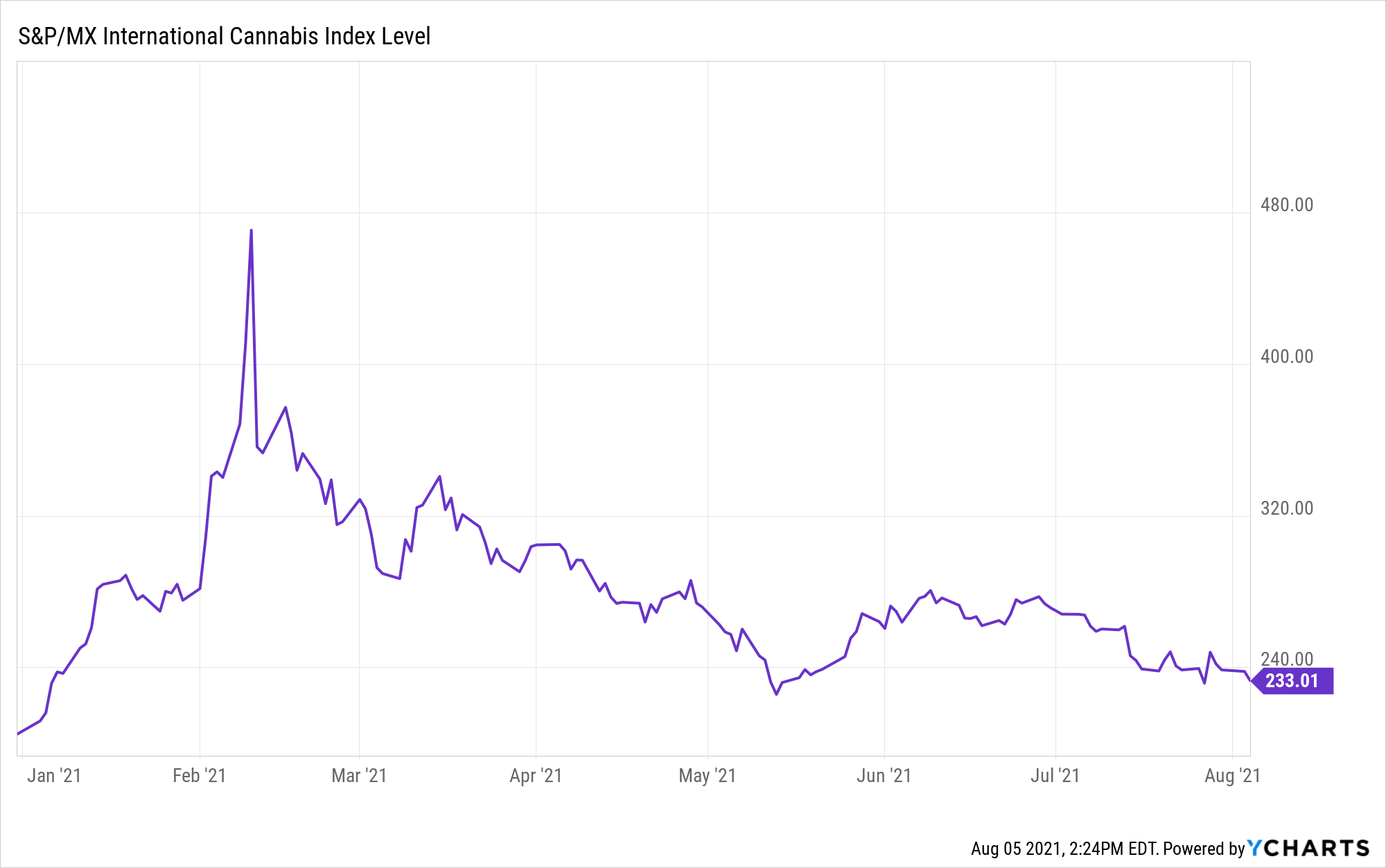

The first chart shows the year-to-date performance of the S&P/MX International Cannabis Index. This index has moved higher year-to-date. But if you bought it in February, you could be down quite a bit.

Many publicly traded cannabis companies remain unprofitable. They are often viewed as overvalued. The stocks often trade on a multiple of sales rather than earnings. Many investors believe marijuana will be legalized at the federal level. Investors in pot stocks expect this will lead to strong industry growth.

BITCOIN

Next, let’s look at bitcoin. Again, if you owned shares since the beginning of the year, you would show gains. But if you purchased coins from mid-February through mid-May you would have meaningful losses. From mid-April through June 25th, bitcoin lost nearly half its value.

There are also more cryptocurrencies than many of us can count. The technology behind bitcoin is fascinating. There could be a need for a digital currency at some point, too. But do you want a medium of exchange – money – to fluctuate in value as much as bitcoin does?

MEME STOCKS

Now, let’s check one of the first popular meme stocks, GameStop. If you were fortunate enough to own shares at the beginning of the year, you would have more than doubled your money. If you bought shares at the highs in late January, you would be down more than 50%.

In case you don’t know, meme stocks are companies that have seen a recent surge in viral activity. This activity is usually fueled by online social media platforms such as Reddit and Twitter. They create buzz about a particular stock. This leads retail traders to buy the stock expecting the share price will rise.

SPACs

I have one more chart for you. DraftKings has been one of the most successful SPACs. If you held shares all year, you would have strong gains. But not if you bought at the April highs. If you did, you would be down about 30% – and close to 50% at this year’s low.

In case you are not familiar with the term, SPACs can also be referred to as “blank-check companies.” They begin with no assets or operating business. They raise money with an initial public offering of stock. They use those funds to acquire another business. After the IPO, a SPAC’s management team typically has two years to complete an acquisition. The SPAC’s shareholders must approve the acquisition.

Management only has two years to complete an acquisition. That means it could agree to a deal that isn’t in the shareholders’ best interests. Why? If they don’t, they could lose out on the 20% finder’s fee they get for putting the deal together.

SHOULD THESE INVESTMENTS BE IN YOUR PORTFOLIO?

Any of these assets can make good investments if the purchase – and sale – are well-timed. They also add more of a trading or speculative element to your portfolio. Is that what you want from the money you save for your future? Probably not. None of them are held in any Apprise client’s portfolio.

You might consider buying investments like these on the dip. But keep in mind that even a small amount of any of these assets can alter your portfolio’s risk profile. A little bit can have a significant impact. (For example, see this article discussing the effect holding bitcoin can have on a 60/40 portfolio.)

IGNORE THE MARKET NOISE

The financial media often promotes the idea of beating the market. That’s a great theory. But beating the market also implies taking on risk. When it comes to investing for retirement, we believe you shouldn’t strive to beat the market. We prefer a simpler, more personal goal. Invest in a way that allows you to live your desired lifestyle in retirement.

That’s why we focus on having a process in place that informs our investment-related decisions. It can reduce your investment-related stress. It can also take some of the emotions out of your investments.

It also helps if you can ignore the noise. News outlets sell news. It’s in their interest to make it as sensational as possible. Such sensationalism is not part of our mindset.

The easiest way to avoid letting the 24/7/365 pace of news affect your investing is to turn it off. That’s why we rarely watch the financial news. We read it and make sure we know what’s going on. That way we don’t hear the newscaster’s emotions. It limits the chance of knee-jerk reactions to the news as well.

Besides, if you’re still working, you won’t use the money you save for retirement until years from now. With today’s longer life expectancies, even the money you save for retirement will be used over a period of 20 years or more. There’s no need to fret about short-term market gyrations. History usually shows that the market comes back.

What happens over two weeks or a month – or even longer – will be insignificant compared to the potential long-term gains from a successful investment.

CLOSING THOUGHTS

If you like the excitement that comes with investing in assets such as crypto, keep them in a small portfolio dedicated to such investments. Only put as much in that portfolio as you can afford to lose. Some call this a “cowboy” or “cowgirl” portfolio.

Keep the extra volatility that comes with such investments out of your retirement portfolio. Slow and steady wins the race. Set yourself up to live your desired lifestyle in retirement. Remain disciplined. That can keep you excited about investing even when the market goes down.

In fact, a falling market can prevent the best opportunities for long-term growth. If your portfolio makes you worry too much, you will likely miss out on such opportunities. That could cost you more than you can make from any of the volatile investments I’ve mentioned here.

At Apprise, we call our process the “Pathway to an Informed Retirement.” Would you like help creating your pathway? Would you like someone to review your portfolio and help you determine how risky it might be? If the answer to either question is yes, please schedule a free call. We would be happy to speak with you.

Thanks for reading. I hope you can find some inspiration from this week’s blog. These shorter blogs leave more time for family and enjoying the summer. We also have some changes in store coming this fall that I hope you will appreciate.

I’ll be back next week with “Apprise’s Five Favorite Reads of the Week.”

Have a great week.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/