If you create a picture of a widow in your mind, who is she like? I imagine you picture a woman in her late 70s or older. That’s not what the U.S. Census Bureau says. According to this article, the average age of widows is 59 – some articles claim it’s even lower, too. I admit I was shocked when I read that figure. Plus, if that’s the average, many widows must be much younger.

Approximately 75% of women become widows. This should not surprise you. Women have longer life expectancies. They tend to marry older men, too. The average age difference for a heterosexual couple is more than two years. The actual difference can depend upon your religion and where you live, too.

Why Does This Matter?

At Apprise, about two-thirds of our client relationships are led by a woman. This goes beyond those who are single, married, widowed, or divorced. It also includes couples where the wife is the primary point of contact.

It goes beyond that though. I often talk to husbands who are worried about their wife’s ability to manage her financial situation if they pass away first. For younger generations, some of the old stereotypes are changing. Managing finances and making financial decisions is becoming more of a joint decision. For many older couples – especially for baby boomers and beyond – the husband has managed the finances through much of their lives.

Some couples start working with a financial advisor before retirement is imminent. They have saved for retirement, but they don’t know if they saved enough. Others would like to better understand what they can afford to do in retirement. Some recognize the differences between asset accumulation – saving for retirement – and asset decumulation – spending what you have saved for retirement. We are unfamiliar with the tax rules that apply when we start withdrawing money from our retirement accounts. Getting professional advice can help lower the tax cost of withdrawing money from your retirement accounts. That leaves more money to either spend today or save for tomorrow.

How Can You Protect Your Loved Ones?

If you love your wife and want what’s best for her, there are a few things you can do.

1. Have a conversation. Communication is essential. None of us want to confront the idea of our death. We don’t want to imagine our wife living without us. We don’t like the idea of not being there for our kids either – no matter how old they are.

Have a candid discussion about what she will face. Her issues will go beyond finances. Widowhood will impact her physical and mental health, too. An unexpected death can have an even greater impact. The adverse physical and mental health ramifications of widowhood include psychological distress, physician visits and institutionalization, and higher rates of morbidity and mortality.”

The loss of a spouse can change relationships with family and friends. It could also cause her to relocate.

None of these things is easy to manage even in good times. They can be even harder if she suffers through them while she is still grieving your loss.

2. Make a plan. Ask what you can do today to help ease her burden. What kind of help does she think she’ll need? Create a team of people she can call on if/when she needs help. This group can include an accountant, an estate attorney, and a financial advisor. It can also cover the softer side such as therapist(s) and trusted friends.

3. Consider steps to improve her financial situation. Here’s where good advice can help.

a. Social Security Claiming Strategies. As discussed more in this blog, the decision about when either member of a couple should start claiming benefits should not be made in a vacuum. Consider both members of the couple. This matters even more when a wide age gap between spouses exists.

Remember that your Social Security benefit grows from age 62 – the earliest age at which you can start collecting benefits – to age 70 – the maximum age you can wait to start collecting benefits. The surviving spouse receives the higher of the couple’s two benefit amounts. If possible, the higher earner should wait until 70 to start collecting benefits. The surviving spouse will appreciate the extra income after you’re gone.

b. Tax Planning. Good tax planning while both members of a couple are still alive can pay big dividends in the future. When you die, your wife will lose the lower of your two Social Security benefits. But she will probably inherit any funds you have in tax-deferred retirement accounts. If you have a pension, she may get the same benefit – or less – depending on the elections you make.

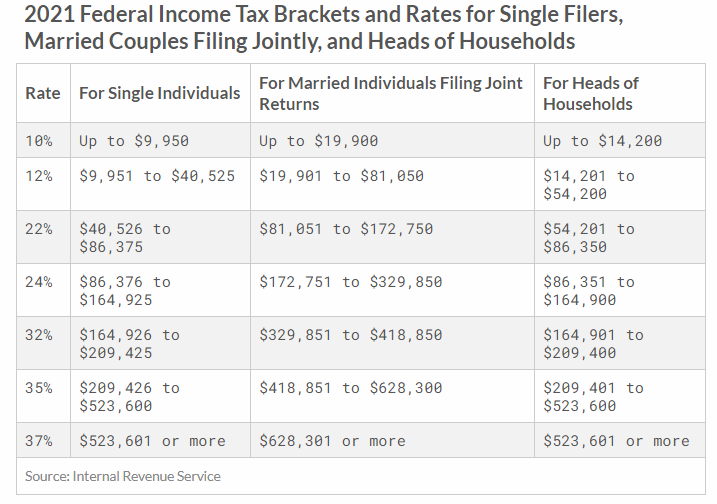

This means your wife can end up with a somewhat lower level of income, but her tax filing status will ultimately convert to Single. That means a higher tax bill. The following example is based on the tax rates in the table below. Assume your taxable income is $100,000. If you file a joint return, you find yourself in the 22% marginal tax bracket. If your filing status is single, you move to the 24% marginal tax bracket. It can get worse. If your taxable income is $220,000, your tax rate increases from 24% (married filing jointly) to 34% (single). (Note: Your marginal tax bracket refers to the tax rate paid on your last dollar of income.)

Here’s where Roth conversions can help. Decide the highest tax rate you’re willing to pay, to fill a certain tax bracket. For example, consider filling either the 22% or the 24% tax bracket. That will reduce the size of your required minimum distributions when you reach age 72. That means your taxable in future years will be lower. It can reduce your wife’s tax burden. If there’s still money left after your wife passes, Roth conversions may also allow your kids to receive at least some money held in an Inherited IRA tax-free. That will reduce their tax burden as well.

The best time to consider this type of strategy is usually if you retire before you start taking your RMDs. Optimally, you want to do so before you start claiming Social Security benefits.

Please note if you would like some help thinking through these issues you can either send me an email at philweiss@apprisewealth.com or schedule a free call using this link.

4. Get organized. Our world becomes increasingly digital every day. Save all your important documents on a thumb drive or a portal provided by your financial professional. Doing so will make it much easier for your wife to locate these documents when you’re gone. It can also reduce her stress level as she won’t have to look for them.

Go beyond the documents though. Make sure your wife knows what financial accounts you have and how to access them. The same applies to your social media and email accounts. New Apprise clients receive a password book they can use to record the usernames and passwords for their online accounts. Of course, you will want to store this book in a safe place. You can also use an online password manager. For example, I use LastPass.

Making sure your wife can access your financial accounts is important. Most of us no longer receive regular statements from financial institutions in the mail. If your wife doesn’t know an account exists before you’re gone, she might not be able to access it when you’re no longer here. Even worse, she might not even know the account exists.

5. Assess your finances. Put together a financial plan to make sure your wife will be well protected when you’re gone. If you haven’t saved enough, you can consider increasing your insurance benefits. You want to be certain you leave your wife well protected. You don’t want her asking, “How did he expect me to get by,” or saying, “He didn’t leave me enough to maintain my standard of living.”

According to the Social Security Administration, the poverty rate for elderly widows is three to four times higher than for their married peers. In 2016, two-thirds of those Americans over the age of 65 living in poverty were women. Without taking some of the steps described above, a woman is more likely to see a meaningful decline in her income when her husband dies.

6. Timing. When it comes to timing, sooner beats later. Having proper planning in place before you’re gone makes it a lot easier once you’ve passed. Your wife’s emotional state after you’re gone can be quite fragile. If the planning has already been done and both spouses have participated, your advisor only has to implement the agreed-upon strategies. This allows your advisor to do complete the necessary tasks in a timely and efficient manner.

SUMMARY

You don’t want to leave your wife in a vulnerable position. Take the necessary steps now to develop a relationship with someone that can help. Work with someone you are both comfortable with and can trust. Take the time to complete a financial plan. Doing so will benefit you today. More importantly, when tragedy strikes, your family’s finances and your wife will be in a better position.

If you truly love her, you should take care of her. This applies even after you’re gone.

If your husband doesn’t take the initiative, you can. As noted above, the majority of Apprise’s client relationships are led by women. Make sure you protect yourself.

If you would like to discuss your financial plan and what you can do to protect your spouse when you’re gone – or yourself when your spouse is gone – please schedule a free call. I would be happy to talk to you. To do so, you can either send me an email at philweiss@apprisewealth.com or schedule a free call using this link.

I’ll be back next week with “Apprise’s Five Favorite Reads of the Week.”

Have a great week.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/