Widowhood Financial Planning for Women

Losing a spouse can be overwhelming, and financial decisions may feel heavier than usual. The goal is not to rush. The goal is to stabilize first, then make thoughtful decisions at the right pace.

If this is you, you’re in the right place

- You’re unsure what needs to happen now and what can wait.

- You’re receiving forms, calls, and advice from multiple directions.

- You want calm, structured guidance without pressure.

- You want to protect yourself from avoidable mistakes.

What to do first

- Ensure you can access cash and pay bills.

- Gather key documents and account information.

- Identify the benefits and deadlines that matter.

What can usually wait

- Major investment changes.

- Big home decisions; unless required for cash flow or safety reasons.

- Permanent choices before you understand options.

Decisions that deserve extra care

- Social Security survivor choices.

- Inherited retirement account decisions, especially IRAs.

- Insurance and tax choices in the year of death and beyond.

How Apprise supports you through widowhood

- Create a simple plan for stability and next steps

- Coordinate cash flow, taxes, and investment decisions

- Provide an ongoing process as life and priorities evolve

Start with the checklist

Two quick questions

Do you offer hourly or one-time planning? No.

What is your minimum fee? In most cases, clients should expect an annual minimum fee of $8,000.

Why Choose Us

INTEGRATED APPROACH

Our approach to wealth management helps clients align their capital with what matters most to them.

It is through detailed financial conversations encompassing all aspects of our clients’ lives that we empower people to make informed decisions.

It is through detailed financial conversations encompassing all aspects of our clients’ lives that we empower people to make informed decisions.

ACCOUNTABILITY

As fiduciaries, we give you guidance you can trust, and we care about your financial life. We provide advice that uses simple language to explain complex topics, helping to foster financial literacy.

Our feeling is that the quality of our advice is based on the depth of the relationships we build with each client. We are committed to helping you meet your financial goals.

PEACE OF MIND

We do our best to avoid elevating stress levels. Therefore, you will never see a market barometer or breaking news on this site – that is simply more noise.

At Apprise, we understand that short-term tactics can be important but they must be executed based upon wise strategic decisions rather than best-guess predictions.

At Apprise, we understand that short-term tactics can be important but they must be executed based upon wise strategic decisions rather than best-guess predictions.

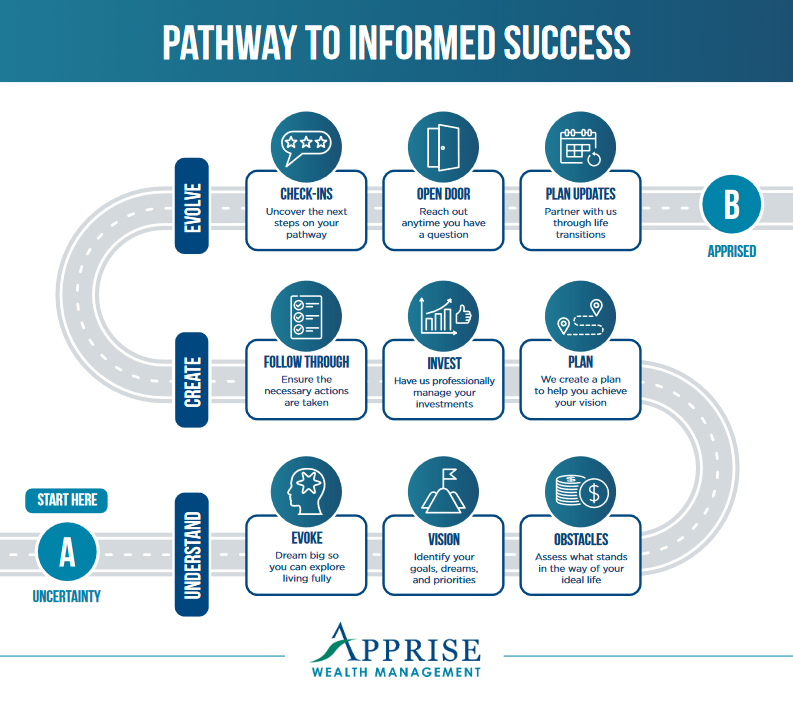

Pathway to Informed Success