A Comprehensive Review of Health Savings Accounts (HSA) – 2024-2025 Update

Do you contribute to conventional retirement accounts? See why Health Savings Accounts can be the best method to save for retirement.

Do you contribute to conventional retirement accounts? See why Health Savings Accounts can be the best method to save for retirement.

Our five favorite reads from the past three weeks. Plus: how you can simplify for better return on life!

Discover essential insights on how taxes impact your retirement income and strategies to help optimize your lifetime tax bill.

Essential strategies for retirement planning for single women. Learn how to assess finances, set goals, maximize contributions, and create a diversified portfolio for a secure retirement.

Our five favorite reads from the last three weeks. Plus: What Does Financial Independence Mean to You!

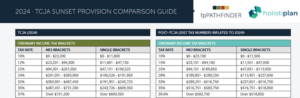

Discover essential tax planning tips for women facing new beginnings. Learn how upcoming tax law changes in 2026 can impact your finances and steps to prepare. Watch now for expert advice and strategies to secure your financial future.

Discover the benefits of opening a Roth IRA for your child’s summer job or internship. Empower their financial future and teach valuable investment habits.

Our five favorite reads from the past three weeks. Plus, an intro on Improving Mindfulness for Return on Life!

This week’s Tuesday Tip addresses how Roth conversion strategies can be helpful in your tax planning for 2025. Please watch the video to learn more.

Discover key tax planning tips for 2025 to help women facing new beginnings navigate financial changes. Stay informed and prepared!

Our five favorite reads from the last five weeks. Plus, an introduction on Family Summer Planning as Part of Your Life Plan!

When asked to recommend a book about investing, Megan and I have the same answer: Morgan Housel’s The Psychology of Money.

"*" indicates required fields

Alleviate stress and see where you are and what you need to do next for a comprehensive financial plan tailored for you.