Apprise’s Five Favorite Reads for the Week of June 29, 2025

Multigenerational family vacation planning tips to create lasting memories, balance needs, and align with your financial goals.

Multigenerational family vacation planning tips to create lasting memories, balance needs, and align with your financial goals.

Learn how to protect your finances during divorce by avoiding 3 common mistakes women often make. Start fresh with confidence.

Discover how life-centered financial planning helps you align your money and resources with your values, especially during significant life transitions.

Discover how to reclaim your freedom to choose your life by aligning your reactions, goals, and values during times of transition.

Discover how to avoid the retirement tax trap no one talks about—especially if you’re widowed, divorced, or entering retirement alone.

Feel lost after a major life change? A fresh start is possible. Discover how financial planning after major life changes can help you move forward with clarity and confidence.

Start teaching kids about money with simple, age-appropriate lessons that build confidence and lifelong financial habits. Here’s how to begin.

Discover key tax strategies for navigating taxes after a big life change. Learn about Social Security taxation, RMDs, and Roth conversions to create a confident plan.

Reflections on Warren Buffett’s retirement 2025 and key life and investing lessons from his final shareholder meeting.

Discover how a 1% daily improvement can transform your Return on Life (ROL) over time. Learn simple strategies for small wins and big changes.

Feeling uncertain about your next chapter? Discover how financial planning for life changes can bring clarity and confidence.

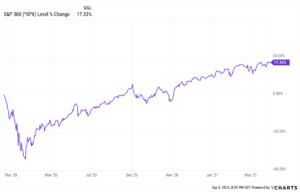

How to stay grounded amid market volatility in 2025—what the April 9th rally teaches us about long-term investing.

"*" indicates required fields

Alleviate stress and see where you are and what you need to do next for a comprehensive financial plan tailored for you.