In this week’s Tuesday Tip video, are you not sure what to do with an old 401k when in your 50s. Learn your main options, what to avoid, and make your retirement accounts easier to manage. Please watch the video below, or read the transcript that follows, to learn more.

If you are in your 50s and have changed jobs, you may be wondering what to do with an old 401k that still sits in your former employer’s plan.

In this short video, I will walk through your main options so that money does not end up stranded or cashed out by default.

I am Phil Weiss, CPA, CFA, and Registered Life Planner®.

I work with women facing new beginnings, including divorce, widowhood, an empty nest, or a career change.

In my practice, I often see this pattern.

- You have changed jobs a few times and are in your 50s.

- One or more of your old 401(k)s are still sitting at former employers.

- You are not quite sure how they are invested or what to do with them now. You might not even know the account’s value.

The result. It is harder to see your full retirement picture, and that can make decisions about your financial future feel more stressful than they need to be.

Real-Life Example

Let me share a simple example.

I have a client in her 50s who had several small old 401(k)s from earlier jobs. Over time, she had pretty much lost track of them. She knew they existed, but they were out of sight and out of mind.

We worked together to track down each account and combine those old 401(k)s with the rest of her retirement money in an existing IRA.

Now she has fewer accounts to follow, a clearer view of her retirement savings, and the comfort of knowing someone is paying attention to those dollars.

When you are asking what to do with an old 401k when in your 50s, this is often the real goal. Less clutter and more clarity.

Main Options Table

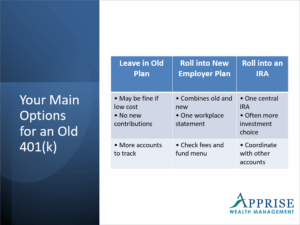

When you think about what to do with an old 401k when in your 50s, you usually have three broad options.

On this slide, you see three columns.

- Leave it in the old plan

- Roll it to your new employer plan

- Roll it into an IRA

Let me touch on each in simple terms.

Leave it in the old plan

This can make sense if the old plan has low costs and solid investment choices. The tradeoff is that you cannot contribute to that plan anymore, and the more plans you have at different employers, the more you have to track. Plus, when you reach a certain age, having multiple 401(k)s means you must take separate distributions from each account.

Roll it into your new employer plan

If your new plan allows rollovers, this can be a clean way to combine old and new 401(k) money. You end up with one workplace plan and one statement, which can make it easier to keep your overall mix on track.

Roll it into an IRA

An IRA often offers more investment choices and can serve as a single home for several old 401(k)s over time. You may find it easier to see your retirement savings in one place and to coordinate your strategy with any taxable accounts you have.

In most cases, a direct rollover, where the money moves directly from one account to another, helps you avoid current taxes on the transfer.

How to Decide, and What to Avoid

So how do you decide which option fits you?

A few questions to ask yourself.

- Do I want to track fewer accounts?

- Which option offers reasonable fees and sound investments?

- Do I want help managing these investments, or am I comfortable doing that on my own?

- How does each choice support the life I want in my 60s and beyond?

There is also one thing I want you to be very careful about.

Cashing out an old 401(k) can trigger income tax and possible penalties, especially if you are under age 59½ and no exceptions apply. That can shrink what you will have available for retirement later, as you will solve a short-term problem with long-term dollars.

If you are unsure what to do with an old 401k when in your 50s, pause before you request a cash-out. Look at your other options first.

Next Steps

Here are some simple next steps you can take after this video.

- Make a list of all the places you’ve worked where you had an old 401(k) and note where it lives.

- Decide whether you are more likely to leave it, roll it to a new plan, or roll it to an IRA.

- For a deeper dive on the pros and cons, you can read my article “Should I Complete a 401(k) Rollover” on the Apprise blog.

And if you would like a calm, clear plan for what to do with an old 401k when in your 50s and beyond, I invite you to schedule a call. You can also sign up to receive our weekly blog.

We can review your accounts together and make sure your retirement money is set up to support the life you want in this next chapter.

FAQ. What to Do With an Old 401k when in your 50s

Q1. What should I do first if I have an old 401(k) from a previous job in my 50s

Start by making a list of your former employers, whether you had a 401(k) there, and where each account is held today. Once you have the list, you can look at your options. leaving money in the former employer plan, rolling it to your new (or current) employer’s plan, or rolling it into an IRA.

Q2. Is it okay to leave an old 401(k) where it is

Sometimes. If the old plan has reasonable costs and solid investment choices, leaving the account there can be fine. The main drawback is complexity. the more accounts you have in different places, the harder it is to see your overall retirement picture. Plus, having multiple 401(k)s can mean taking a separate RMD from each account.

Q3. Why do people roll an old 401(k) into an IRA

Rolling an old 401(k) into an IRA can make it easier by consolidating several old accounts in one place. An IRA often provides more investment flexibility and a single statement, which can simplify your financial life. You may want to consider this when deciding what to do with an old 401k when in your 50s and beyond.

Q4. Should I ever cash out an old 401(k)

Cashing out is usually the option to approach with the most caution. You may owe income tax on the distribution, and if you are under age 59½, you may also face a penalty unless an exception applies. That reduces what you have for retirement later.

Q5. How can a financial adviser help with old 401(k)s

A financial adviser can help you list and locate old accounts, compare your options, and design a retirement strategy that includes those dollars. If you are unsure what to do with an old 401k when in your 50s, having a neutral guide can make the decision less overwhelming.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics, including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us: Facebook LinkedIn Instagram YouTube

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/