It’s been a rough start to the year for investors. We learned that in December inflation reached its highest level in 40 years. Based on consensus expectations, the Fed will start raising interest rates as early as mid-March. Stock market volatility has increased. This past Monday’s returns were particularly volatile. At its intraday low, the S&P 500 Index was down 4.9% from Friday’s close. After a late surge, it ended the day 0.6% higher.

The S&P 500 has dropped more than 9% so far this month. The tech-heavy Nasdaq has fared even worse, tumbling close to 15%. That puts it in correction territory – a decline of at least 10%.

Stock market volatility can ramp up on occasion. Long-time investors should expect it. Even though the market rises about three out of every four years, on average, it also sees double-digit declines in two-thirds of all years. But in years when the market corrects by 10% or more, we still end up with a positive return in three out of every five years. Plus, in two out of every five years in which we experience a double-digit correction, the market still finishes with double-digit gains. (Data cited was sourced here: This Is Normal.)

History also tells us that bear markets – defined as a decline of 20% or more for a broad market index – occur once every four to five years.

What’s going on? Why has stock market volatility increased?

We never know for sure what drives markets higher or lower. But concerns about inflation and higher interest rates are at least partly at fault. Economic growth remains strong. The Bureau of Economic Analysis released its initial estimate of fourth-quarter U.S. gross domestic product (GDP) growth on Thursday. On a quarter-over-quarter basis, annualized growth was 6.9% versus expectations of 5.5% growth. In the third quarter, GDP grew by 2.3%. GDP grew by 5.7% for all of 2021. This marked the fastest pace since 1984. Consumer spending remains solid, offsetting negative impacts from the Omicron variant’s spread.

Policymakers don’t want growth overheating. Higher interest rates can limit growth, as it makes it more expensive to borrow money.

A brief look at inflation and interest rates

Many investors are concerned about higher interest rates. We have been in a low-rate environment dating back to the financial crisis of 2007-2008. The Fed has kept interest rates at or near zero for a considerable period. Low rates make it hard for investors to earn much money on their cash or fixed-income investments. One can argue that has led many investors to increase their investments in the stock market. Why? If we can’t earn much on cash or bonds, we turn to stocks.

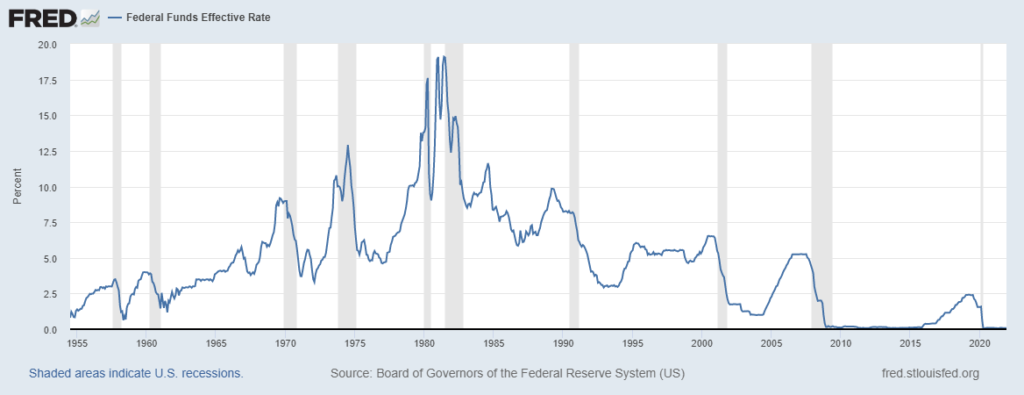

The Fed has signaled its intention to start raising rates as soon as mid-March to help ward off higher inflation. Many expect four 0.25% rate increases this year and four more similar increases next year. Eight increases over the next two years would mean the Federal Funds rate would be 2%. As shown in the chart below, that is still very low historically.

Expectations are that inflation will peak within the next few months. But the overall pace will keep things challenging for consumers, businesses, and economic policy. While wages advanced at a faster pace last year than before the pandemic, they failed to keep pace with inflation. For example, in December, wages rose 4.7% year-over-year.

If inflation outpaces wage growth, consumers have less buying power. That can also limit demand.

The Fed doesn’t want to raise interest rates too aggressively. Doing so could lead to a recession. Based on the current consensus, interest rates will remain low. That means they shouldn’t be too much of a drag on economic growth.

The stock market’s performance can at least be partially tied to expectations of higher interest rates. The S&P’s forward price-to-earnings ratio (P/E) has fallen in anticipation of higher rates. Why? Historically, the market’s P/E falls when the Fed raises rates and rises when the Fed lowers rates.

A shift from “free” to merely “cheap” money

For more than a decade, the cost of capital has essentially been free. This has helped stimulate the economy. It has also encouraged more debt-based consumption and benefited corporate profits. This period is coming to an end. The Fed is winding down quantitative easing (QE) and moving away from its Zero Interest Rate Policy. Investors are factoring in many unknowns. When will the Fed start raising rates? How much will rates increase? What will the economic impact be? Will it slow inflation? What will be the effect on corporate profits?

Unfortunately, as with many aspects of investing, we don’t know the answers to these questions with any degree of certainty. It’s also one of the reasons to hold a diversified portfolio with exposure to different classes of assets.

A look at rising interest rates and bonds

In general, market interest rates and bonds move in opposite directions. In other words, as rates increase bond values decline. If you hold more short-term bonds, you may be able to mitigate some of the risks associated with rising rates.

In short, bond prices fall when rates rise to make the income you earn from two similar bonds somewhat equivalent. For example, say you own a 10-year bond paying a 3% coupon. If market rates increase to 4% a year later, the asset will still pay you 3%, but the bond’s value may drop. Higher rates make the original 3% bond less attractive to investors. It sells at a lower price to compensate for the fact that it provides the holder with less income.

Could this get worse?

We broadly define a bear market as a drop of 20% or more for a broad market index. Bear markets happen about once every four to five years. Could we be in the early stages of a bear market? We could. Then again, we might not. Unfortunately, while we can identify bear markets easily when we have the benefit of hindsight, we do not know when one starts. Nor can we forecast the next one with any degree of certainty. We don’t know how long any market cycle will last either. We also can’t predict how high a bull market will take us or how far a bear market will fall.

What should investors do?

First, don’t panic. Diversified portfolios are designed to help limit your losses when the market falls. If you are working and adding money to the market each week, you can buy the same assets in your retirement account that you were buying in the past. Lower prices mean you can buy more shares. They also can lead to larger gains when the market recovers.

If you’re no longer adding new money, the bucket strategy discussed in this blog can help. On average, prior bear markets have lasted 18-24 months. Holding enough in cash or cash equivalents to meet your needs over that period, can reduce the need to sell investments at a loss. After the market recovers, you can rebuild your cash position. Remember that when you invest in the market, you are expressing a belief that you expect the market will rise over the long term.

It’s also helpful to not pay too much attention to market-related news. Or, if you do, try to dismiss recency bias. (Recency bias – the tendency of stock market participants to evaluate their portfolio’s performance based on either recent results or their perspectives of recent results.)

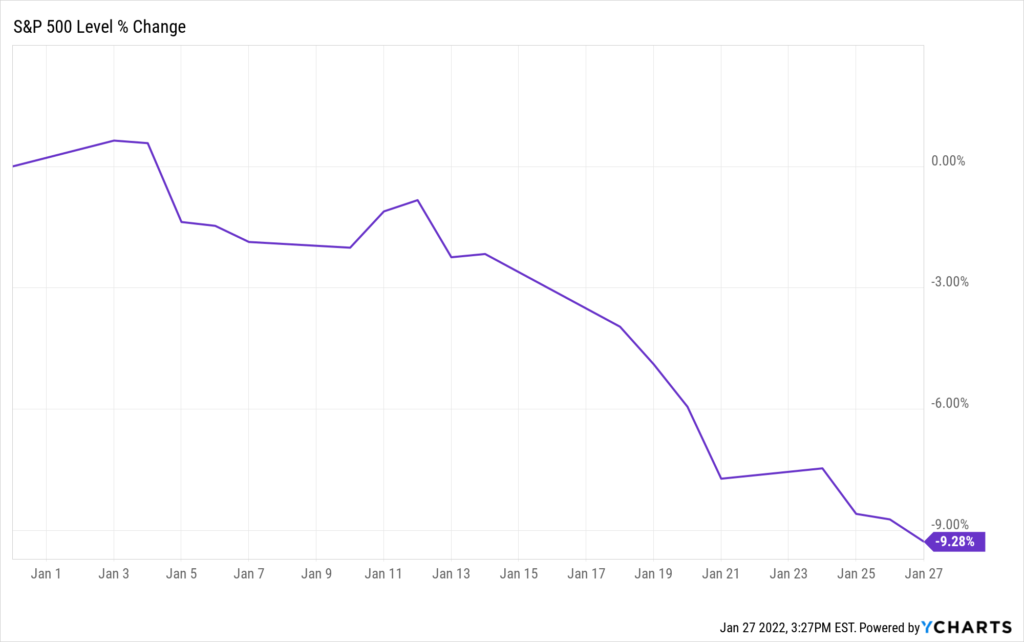

For example, if you spend too much time looking at short-term charts like the one below – showing what looks like a steep drop – your level of concern about the market will likely increase:

If you don’t plan to retire in the next few days, weeks, or months, the above chart doesn’t mean much. The truth is that many investors do not plan to retire for years, or even decades.

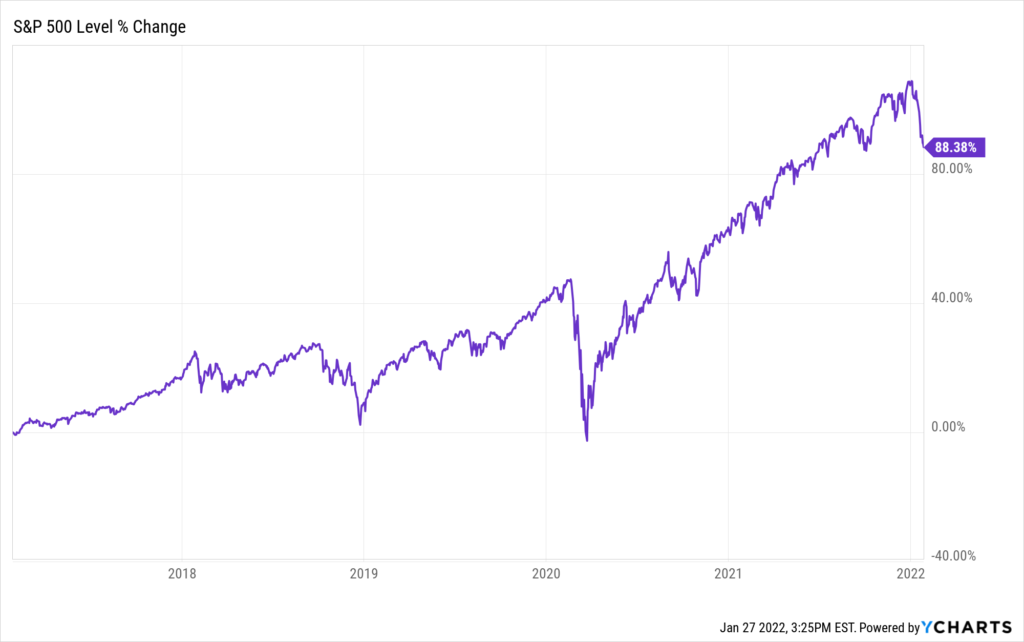

As a result, more investors should focus more on charts such as this one:

The 9% drop we’ve seen over the last month looks much less meaningful when viewed with a five-year perspective. Focusing on short-term movements can cause us to act emotionally. That could lead to making investment decisions we wouldn’t make if we took a more objective approach.

Some tax considerations

If you are thinking about completing a Roth conversion this year, now can be a good time to do it. Lower stock prices will allow you to move more shares from your IRA to your Roth IRA. If the share price of the assets you move to your Roth IRA recovers, you get the benefit of having that growth be tax-free. It’s also a good time to consider Roth conversions. (See here, here, or here for more about Roth conversions.)

For example, those who completed Roth conversions during the sharp market downturn in March of 2020 realized significant tax benefits when the market recovered. The market fell more than 30%. Say that you held shares of an S&P 500 ETF that were trading at $100 per share before the pandemic. A 30% drop would mean a share price of $70. Say that you wanted to do a $21,000 Roth conversion. Before the drop, you could convert 210 shares. After the decline, you could convert 300 shares.

The S&P is more than 90% higher today. Your 300 shares are worth about $40,000. If you converted those shares before the market decline, they would only be worth about $28,000. Completing the conversion during the market downturn leaves you with another $12,000 in your Roth IRA today. The best part is that you don’t pay any taxes on the additional gains.

If you have a large taxable account, you may also want to consider taking tax losses. These losses can offset other gains. You can also deduct up to $3,000 of excess losses on your tax return. You can even replace the security you sell with something similar – but not identical. Remember that if you sell a security at a loss, you cannot repurchase it until at least 31 days have passed. Otherwise, you will have a wash sale. The loss will be disallowed.

Closing Thoughts

What’s happening in the markets right now can feel scary. Inflation has reached the highest levels we’ve seen in about four decades. Plus, we expect the Fed to start increasing interest rates in mid-March. The causes may be different but every time there’s a correction, something drives it. Rising interest rates, international tensions (such as we’re seeing with Russia and Ukraine), significant negative business developments, and even the current pandemic all provide examples of events or circumstances that can negatively impact the market.

The one we’re experiencing now could get worse. I’m not saying it will, but history tells us it could. If investing in the stock market didn’t involve risk, the potential returns would be a lot lower. Stock market corrections, and even bear markets, have happened in the past and will happen again.

While we don’t know when market pullbacks will come, we should view them as opportunities. They present the possibility to add holdings at more attractive prices. Over time, these periods have historically presented opportunities.

Recent stock market volatility can also provide a good, and needed, reminder to reconsider your allocations and risk tolerance. Investors often chase assets providing the best recent returns. That can lead to a portfolio that is not aligned with your target allocations or your risk tolerance. If recent stock market volatility has you spooked, your portfolio may be too risky for you.

As investors, we should also be thankful that stocks go down sometimes. Why? If they always went up, they would be riskless. Risk-free assets provide minimal returns. The short-term pain that comes with losses is the price we pay for the possibility of meaningful long-term gains. Plus, if you have available cash and the courage to withstand the potential for further declines, other people’s fear could work to your benefit. It could allow you to buy attractive long-term assets at even better prices.

If you would like some help reviewing your portfolio or would like to discuss your risk tolerance, please schedule a free call. We would be happy to review them with you. You can also send an email to philweiss@apprisewealth.com.

I’ll be back next week with “Apprise’s Five Favorite Reads of the Week.”

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us: Twitter Facebook LinkedIn

For firm disclosures, see here: https://apprisewealth.com/disclosures/