Have you heard of the retirement smile? The term describes the typical pattern of retirees’ spending habits throughout their post-work years. It resembles a U-shaped curve when graphed. Let’s review the retirement smile’s components and explore how understanding this pattern can help you plan for a financially secure and successful retirement.

Many struggle to estimate how much they will spend in retirement. This is a regular topic of discussion with clients when working on their financial plans. A common rule of thumb suggests you will spend about 80% of your pre-tax retirement income. However, research shows that spending is not consistent throughout retirement. It also shows that spending lifestyle choices, affluence, and health directly impact spending.

Conventional thinking assumes retiree expenditures, or consumption, increase annually with inflation during retirement. The retirement smile argues otherwise. It suggests higher spending as retirement starts, a drop in spending when you settle down, and an increase as healthcare-related expenses rise.

Let’s walk through the different stages of retirement, so you can better understand the connection between your retirement spending and where the term retirement smile comes from.

Everyone has a different retirement path, so you should create a financial plan based on your situation. Broadly speaking, your retirement has three phases. For most, these are as follows:

- The Early Years: Anticipation and Adventure (Ages 60-70)

- The Dip: Settling Down (Ages 70-80)

- The Rise: Healthcare Considerations (Ages 80+)

Note:

At the end of this week’s blog, I share a personal tribute to one of our greatest investors and thinkers, Charlie Munger, who passed away on November 28th. He was only weeks from his 100th birthday.

Retirement Spending: An Overview

The Center for Retirement Research at Boston College explored consumption rates during retirement. It found that inflation-adjusted (real) spending by retirees fell by 1.5%-1.6% every two years throughout retirement. This means that 20 years into retirement consumption could be 12%-13% lower than at the beginning of retirement. Not surprisingly, it was also discovered that health and wealth were two factors impacting how much retirees decreased spending later in retirement.

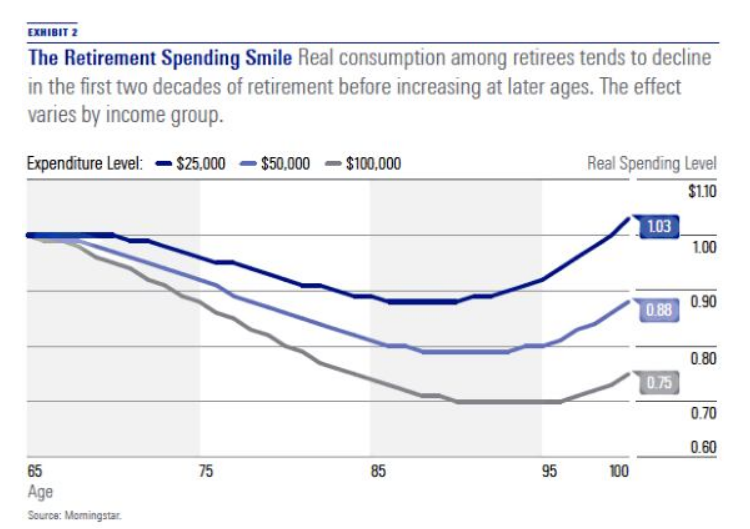

While consumption tends to decline initially, it often increases at later ages, largely due to increased healthcare expenses. Income level also has an impact. Those with higher expenditure levels tend to experience higher declines. (This can likely be attributed to higher discretionary spending levels.)

This article from Morningstar includes this graph depicting the retirement spending smile:

Phase 1 of the Retirement Smile: The Early Years

Sometimes referred to as the go-go years, the retirement smile’s first phase typically begins as you enter retirement. During this period, you’re healthy and eager to do everything you’ve been waiting to do.

This time in life leaves many with newfound freedom. Most parents find the nest empty. Careers reach their end, too. During this period, retirees often experience a surge in spending as they embark on adventures, travel, and pursue hobbies they may have deferred during their working years. They may also eat out more frequently and spend more on discretionary items at the start of retirement. This initial spike in spending is driven by the desire to enjoy life to the fullest after years of disciplined saving.

Some examples of higher spending in the early years of retirement Apprise’s financial plans include the following:

- Different levels of vacation spending as clients age. Spending is highest during the early retirement years.

- New car purchases are often only planned in the early stages of retirement.

- Elimination of expenses such as car insurance at an age the client is comfortable with.

- Lower spending on some leisure activities as we age.

Phase 2 of the Retirement Smile: The Dip

The second phase of retirement spending is also referred to as the slow-go years. You have done many of the things you always dreamed about. Your bucket list has probably gotten shorter. You might have less energy, too. This causes you to spend less. Leisure still represents a big part of life, but spending may decrease during this period.

As retirees settle into their new lifestyle, their spending tends to dip. The initial excitement of retirement may subside, leading to a more stable and predictable financial routine. During this phase, individuals often find contentment in the familiarity of their chosen activities, leading to a temporary decrease in discretionary spending.

Phase 3 of the Retirement Smile: The Rise

Not surprisingly, some call retirement’s third phase the no-go phase. You rarely travel. You consume less. While you still enjoy leisure and time with loved ones, healthcare expenses play a significant role in household spending.

The latter part of the retirement smile sees an upward trend in spending. This rise is often associated with increased healthcare expenses as individuals age and require more medical attention. As healthcare costs tend to escalate with age, this phase highlights the importance of planning for potential medical needs and long-term care.

Understanding the Retirement Smile

The retirement smile can have implications on your financial life. You want to consider it when preparing your financial plan. It impacts your investment strategy as well. It also requires that exhibit both flexibility and adaptability in your financial plan. Let’s take a closer look at each.

-

Financial Planning Implications

Recognizing the stages of the retirement smile plays a crucial in effective financial planning. During the early years, retirees may need to allocate additional funds for travel, leisure, and new experiences. As the dip phase approaches, budgeting grows increasingly important, as you want to ensure financial stability during the transition to a more settled lifestyle. In the rising phase, having a robust healthcare plan and addressing potential long-term care needs become paramount.

- Investment Strategy

Tailoring your investment strategy to accommodate the retirement smile is essential. Throughout retirement, you don’t want to have too conservative a portfolio. When thinking about the risks you can face in retirement, not having enough money leads the way. Beyond that, consider sequence of returns risk and longevity risk.

Sequence of returns risk refers to the risk of negative returns occurring late in your working years and/or early in retirement. Longevity risk refers to the risk that you outlive your money. Either can result in significant financial setbacks. This blog discusses a bucket strategy that can help address sequence of returns risk.

Many suggest simply lowering your allocation to stocks as you age. (For example, subtract your age from 100 or 110 to determine what percentage of your portfolio to allocate to stocks.) But a better option could involve building a bond position as retirement approaches and then spending down that bond reserve in the early years of retirement. This approach allows equity exposure to return to normal.

-

Flexibility and Adaptability

The retirement smile underscores the importance of flexibility in your financial plan. Life is unpredictable, and unexpected expenses may arise. While you may have good intentions when you plan, everything won’t go exactly as expected. Having the flexibility to adjust your budget, revisit investment strategies, and adapt to changing circumstances is crucial for maintaining financial security throughout retirement.

Conclusion:

Understanding the retirement smile offers valuable insights into the dynamic nature of financial needs during different stages of retirement. By acknowledging the anticipated shifts in spending patterns, you can proactively plan for a comfortable and fulfilling retirement. Whether you’re savoring the adventures of early retirement, enjoying the settled routine of the dip, or addressing healthcare needs in the rising phase, strategic financial planning can help you navigate the retirement smile with confidence and peace of mind.

Remember the importance of being tax-aware, too. Deciding when to start spending retirement savings strategically choose which account to take the funds from. This can help you lower your lifetime tax burden and avoid complications later in life.

Constant inflation-adjusted spending represents a simplifying and conservative assumption. Conservative assumptions are often preferred to aggressive ones. But you don’t want to unduly penalize yourself. Keeping the retirement spending smile in mind when working on your financial plan can help address this issue.

Please schedule a call if you have any questions or would like some help with your financial plan or understanding the retirement smile’s impact.

A Tribute to Charlie Munger

The world lost a brilliant investor last week. I would like to pay tribute to one of my investing heroes, Charlie Munger, who passed away on November 28th. The first time I added shares of Berkshire Hathaway to my account was September 25, 1998, after the company issued its first “B” shares. I continue to own those shares and frequently purchase shares for those client accounts that hold individual stocks. The size of my position has grown over time as well.

When I first bought shares of Berkshire, I knew much more about Warren Buffett than Charlie. Over time, I grew to appreciate Charlie’s wit and wisdom. I have attended several Berkshire Hathaway annual meetings, which increased my respect and admiration for Charlie even more. Countless times Warren would spend a few minutes answering a question before turning the mike over to Charlie. Charlie often showed that he was a man of few words when he would respond, “I have nothing to add.”

Some Examples

When I look at Apprise and the overall business philosophy, I find more elements of Munger than Buffett:

- I favor recurring revenues over one-time revenues.

- In my “5 Favorite Reads” blogs, two of the articles I share relate to non-financial topics. Charlie believed that integrating insights from different fields helped individuals make more informed and nuanced decisions. Charlie was well-versed in psychology (e.g., see here for one of his most famous talks), economics, mathematics, and other disciplines. He attributed much of his success to this broad-based approach.

- From the time I first started Apprise, I considered the Berkshire philosophy that a share of stock represents ownership in a business not a piece of paper. When looking for potential investments, I take a long-term approach. I always try to make decisions for the long term when it comes to managing Apprise as well. I want to manage a business that I would want to invest in.

- I read all the time. I’m often reminded of Charlie saying, “In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time – none, zero. You’d be amazed at how much Warren reads, and at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.”

Recent Appearances.

Charlie will be missed. His was certainly a life well-lived. Recently he appeared on his first podcast, which you can find here. CNBC also aired a special on Charlie that was originally going to be in honor of his 100th birthday on January 1st. You can find the transcript here. listen to the podcast version here (Part 1 and Part 2). We should all be as lucid and clear at 70 or 80 – or maybe even younger – as Charlie was at nearly 100.

I would like to close with a few of Charlie’s more memorable quotes:

- “I think you would understand any presentation using the word EBITDA, if every time you saw that word you just substituted the phrase, ’bull—- earnings.” When writing for the Motley Fool, I took Charlie’s words to heart when I wrote an article titled “Ignore EBITDA.”

- “All I want to know is where I’m going to die so I’ll never go there.”

- “Go to bed smarter than when you woke up.”

- “Remember that reputation and integrity are your most valuable assets—and can be lost in a heartbeat.”

- “To get what you want, you have to deserve what you want. The world is not yet a crazy enough place to reward a whole bunch of undeserving people.”

We’ll miss you, Charlie.

***************************************************************************************************************************

If you would like to talk to us about financial topics including your investments, creating your life plan, saving for college, saving for retirement, or the retirement smile, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Next week, please look for our Tuesday Tips video blog.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on Facebook and LinkedIn.

For firm disclosures, see here: https://apprisewealth.com/disclosures/