Tax Planning 2025? It’s June 2024. Why talk about that now? At the end of 2025, the tax landscape could undergo significant changes. The Tax Cuts and Jobs Act (TCJA) of 2017 introduced various tax benefits. However, absent legislation, many of these provisions will sunset at the end of 2025. We could see higher tax rates and the return of previous tax regulations. For women facing new beginnings, understanding these changes and planning accordingly can play a crucial role in maintaining financial stability and peace of mind.

The TCJA was passed under a process known as reconciliation. One requirement was that a bill not increase the deficit beyond a 10-year budget window. Estimates showed that the TCJA would substantially reduce revenues and increase deficits over its first decade. Those estimates ranged from $1 to $2 trillion of additional federal debt. Changes to corporate tax rates – they fell from 35% to 21% – were permanent. But to stay within the guidelines, many changes to individual and estate taxes were limited to eight years – or the end of 2025. This week’s blog examines this question, “Should you act now, while you can still benefit from the current rules?”

Tax Planning 2025 –Tax Changes 2025

Let’s review the most meaningful changes implemented under TCJA.

1. Lower Tax Rates

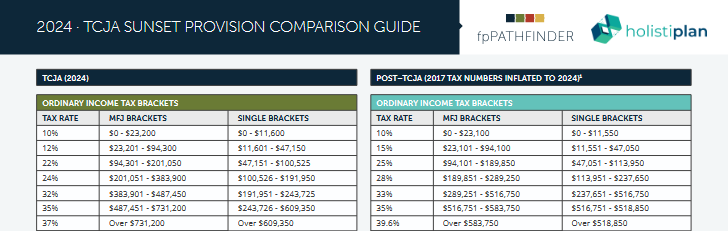

Tax rates fell under TCJA. The top tax rate declined from 39.6% to 37%. The top tax rate under TCJA also starts at a higher income level. Under pre-TCJA rules, tax rates went from 10% to 15% to 25% to 28%. TCJA added 12% and 22% brackets. It also eliminated the 28% bracket. Plus, the income cap on the 24% bracket is higher than on the old 25% and 28% brackets. You can see more details in the following tables.

2. Higher Standard Deduction, Elimination of Personal Exemptions, and Limits on the Deduction for State & Local Taxes

Many fewer filers itemize their taxes in the post-TCJA world. This year’s standard deduction is $29,200 for those with married filing jointly (MFJ) status. It would have been only $15,750 under the prior system.

Before the TCJA, MFJ filers could claim personal and dependent exemptions of $10,100. This exemption no longer applies under TCJA.

While the amount of deductible state and local taxes was unlimited in the pre-TCJA years, many taxpayers didn’t benefit. Why? Such taxes were a preference item under the Alternative Minimum Tax (AMT) rules. That means they were added back when calculating AMT.

Like state and local taxes, personal and dependent exemptions were also disallowed under the old AMT rules.

3. Elimination of Miscellaneous Itemized Deductions

Under prior tax law, taxpayers could deduct miscellaneous itemized deductions to the extent they exceeded 2% of adjusted gross income. Examples of such expenses included tax advice/tax preparation fees, investment fees and expenses, and unreimbursed employee expenses.

Other miscellaneous deductions such as casualty and theft losses from income-producing property and moving expenses were also eliminated by TCJA.

4. Qualified Business Income

Many small businesses are taxed on the filer’s tax return. To help compensate for the lower corporate tax rates, TCJA implemented the QBI deduction for businesses taxed on individual tax returns. This deduction can exclude up to 20% of QBI from taxable income. For some types of businesses, the QBI deduction is limited.

Tax Planning 2025 – Net Impact of TCJA Changes

According to an estimate from this podcast, 70%-80% of taxpayers pay less in taxes under TCJA than they would have under the pre-TCJA rules. In addition, about twice the number of taxpayers take the standard deduction rather than itemizing.

Of the income tax changes above, lower tax rates have had the biggest impact. They should also be the focus of any future planning.

Estate & Gift Tax Planning 2025

In 2024, the estate & gift tax lifetime exemption is $13,610,000 for singles and $27,220,000 for couples. If you inflate the allowed exemption in 2017 to 2024 levels, these amounts would be 50% lower.

Importantly, you can lock in the exemption now. Depending on the size of your estate, it can make sense to make tax-free gifts using your current exemption. The IRS has promised there will not be a clawback if the exemption amount falls in the future.

Those with large estates can consider a Single Lifetime Access Trust (SLAT). A SLAT allows individuals to transfer assets out of their estate while allowing their spouse to access the assets during their lifetime.

While estate & gift tax planning is important, this blog will not go deeper into this topic.

Tax Planning 2025 – What Should You Do?

Let’s make one thing clear. None of us know for sure what will happen. When asked for a forecast, I often respond, “My crystal ball is cracked and cloudy.” I started my career working for Deloitte as a tax professional. Every year there would be proposed tax legislation. Those in Deloitte’s “think tank” would publish papers on the implications of these proposed rules. More often than not, nothing would happen. This led me to plan based on what we know and make adjustments when changes occur.

Tax Planning 2025 – What Do We Know?

Historically, today’s tax rates are the lowest seen in our lifetimes. If you consider the budget deficit, higher taxes seem likely. But a lot may hinge on this year’s elections. Higher taxes – at least for some – seem more likely if the Democrats fare well. If the Republicans do well, the current tax system could be extended. While the inflation rate may vary, inflation continues to expand the tax brackets, so we can expect the income-related caps to be higher in 2025 than in 2024, too.

We strive to pay taxes when rates are lowest. We know today’s rates, which are on sale historically. This approach helps you minimize your lifetime tax bill.

Tax Planning 2025 – 2025 Tax Strategies

1. Roth Conversions 2025

I discuss Roth conversions frequently:

- The Value of Roth Conversions at Today’s Low Rates.

- How Roth Conversions Can Help You, Your Surviving Spouse, and Your Heirs.

- 7 Benefits of a Roth IRA.

- Wealth Unlocked: Navigating the Benefits of Backdoor Roth IRAs.

- Tuesday Tips: Empowering New Beginnings: Navigating Roth Conversion Strategies And Tax Impact.

- Tuesday Tips – Will Your Retirement Tax Bill Be TOO BIG?

When reviewing client tax returns, assessing the potential for Roth conversions, especially in 2024 and 2025, is a must-do. For most clients, if there is room in up to the 24% tax bracket, I recommend Roth conversions to “stuff” that bracket. As shown in the table shared earlier, that means an estimated taxable income of $383,900 for couples and $191,950 for singles in 2024. Roth conversions in other situations can make sense, too, but taking advantage of the 24% bracket at least merits a discussion.

For many, when considering Tax Planning 2025, Roth conversions represent the easiest way to take advantage of today’s lower tax rates.

2. Consider Future Income

Do you think your future income will be higher than today’s? If you do, then to the extent you can, consider accelerating income into 2024 and 2025 when tax rates are known and historically low. For example, if you have stock options, you might want to exercise them sooner rather than later.

If you think your income will be relatively stable, you may not need to consider any special Tax Planning 2025 actions.

If you think your future income will be less than today’s, you probably don’t need to worry much about implementing tax planning strategies before the law changes. But review the above table to confirm that your income won’t potentially be subject to a higher tax rate in the future.

3. Consider Future Deductions

Unlike income, you want to claim deductions when tax rates are higher. If you defer deductions into the future, you could receive a greater tax benefit. Consider making charitable contributions or investing in energy-efficient home improvements now rather than further in the future.

Higher rates could also provide additional incentives to maximize your contributions to accounts like 401(k)s, IRAs, and Health Savings Accounts (HSAs). Doing so can reduce your current taxable income. It can also leverage the tax-deferred growth of these accounts.

4. Consider Future Required Minimum Distributions (RMDs)

Many people expect their income from their retirement savings to be lower than it was while they were working. But if you save diligently during your working years, your future income could be higher than your current income.

While past results do not necessarily have to be repeated, the stock market has provided investors with long-term gains. That means your IRA can continue to grow. Your RMDs may be higher than what you earned on your W-2. I have surprised clients when telling them their future RMDs could be a few hundred thousand dollars a year if we assume the market grows at its historical rate over the long term.

Roth conversions help you control the size of future RMDs and allow you to normalize your income in the future from a tax perspective. They can also help you minimize future Medicare premiums. Why? Higher earnings can lead to increased Medicare premiums.

5. Consult With a Financial Advisor

Given the complexity and potential impact of these changes, consulting with a financial advisor or tax professional is highly recommended. They can provide personalized strategies tailored to your unique financial situation.

Conclusion: Plan Ahead for a Smoother Transition

As the sunsetting of the TCJA provisions approaches, the idea of proactive Tax Planning 2025 becomes increasingly important. By considering these strategies and staying informed about potential changes, you can better position yourself to manage future tax liabilities. Remember, the key is to start planning early to make the most of the current tax landscape and ensure a smoother transition when the changes take effect.

For those facing new beginnings, especially women navigating life transitions, it’s crucial to stay ahead of these changes. Thoughtful tax planning can provide peace of mind and financial stability, It can also allow you to focus on your goals and aspirations without the added stress of unexpected tax burdens.

If you have any questions or need personalized advice, please don’t hesitate to reach out. Your financial well-being is our priority, and we’re here to help you every step of the way. Schedule a free consultation today to create a personalized tax plan for 2025. Let us help you navigate these changes with confidence and help improve your financial stability. Contact us here.

We place significant importance on this topic. You should expect more blogs, Tuesday Tips, and reminders about Tax Planning 2025 over the next 18 months.

If you would like to talk to us about Tax Planning 2025, your life plan, or other financial topics, including your investments, saving for college, and/or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on Facebook and LinkedIn.

For firm disclosures, see here: https://apprisewealth.com/disclosures/