For many, Social Security benefits represent a key element of retirement income. Understanding the key concepts involved in calculating your Social Security benefits can enhance your retirement planning. If you haven’t saved along the way and created a more expansive retirement paycheck, Social Security benefits may be your only source of retirement income. Either way, you should understand how your benefits are determined. You also want to know when to claim them.

Should I even include Social Security in my retirement planning?

Politicians and regulators continue to discuss the long-term viability of the Social Security program. We do not know for sure what changes, if any, they could make to the system. It seems like it would be political suicide to eliminate Social Security benefits. Politicians who voted to end Social Security benefits could struggle to get votes.

What could happen?

· Full retirement age could increase as it did in 1983.

· The maximum amount of earnings subject to Social Security tax – currently $142,800 – could increase.

Over the last three decades, the average retirement age has increased by roughly three years – to about 65 for men and 63 for women.

Recently, there have been suggestions that Social Security taxes could be reinstated once annual earnings surpass $400,000. The government-appointed Social Security Board of Trustees reports on the financial outlook for the Social Security and Medicare Trust Funds annually. In last year’s report, it estimated the combined trust funds will run out in 2035. At that time, tax revenue will pay about 79% of benefits. The program’s costs are expected to surpass its income beginning in 2021. Increasing the wage base could help ease this concern.

The likelihood of benefit cuts seems greatest for younger workers. One could consider including 100% of the projected benefit for workers 50 and over. For those under 50, using 75% of the projected benefit would be more conservative.

How do I qualify for benefits?

You must work for 40 quarters to fully qualify for Social Security retirement benefits. (You can qualify when working less if death or disability benefits are involved.) You must earn $1,470 for a quarter to qualify (QQ). In other words, you must earn at least $5,880 ($1,470 x 4) for 10 years to fully qualify for benefits. You cannot earn more than four QQs in any one calendar year regardless of how much you earn that year. The dollar amount of a QQ gets recalculated each October based on a set formula.

How are my benefits calculated?

The Social Security Administration (SSA) calculates your benefit. They index your earnings each year to bring them to near-current wage levels (like an inflation adjustment). The index for age 60 and beyond is 1.0. Your highest 35 years of indexed earnings are used to determine your benefit. If you work for more than 35 years, your low-earning years are excluded from the calculation. If you work fewer than 35 years, the years in which you did not work are calculated as zeros in the calculation.

The SSA can provide you with an estimate of your retirement benefit at different ages and dates. You can sign up for your personal my Social Security account here.

When should I start claiming benefits?

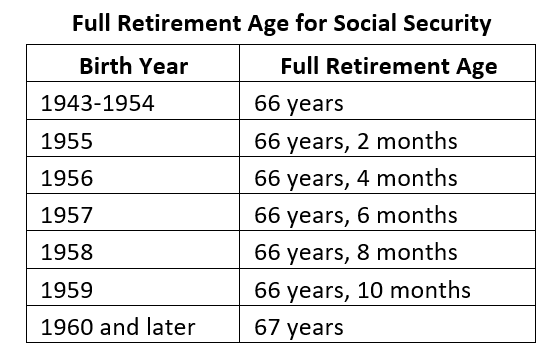

You can start claiming benefits as soon as age 62. Until 1983, the full retirement age (FRA) was 65. That year, Congress passed a law gradually increasing the age. Those born in 1960 and beyond reach FRA at 67. The latest you can wait to start claiming benefits is age 70.

Full Retirement Age for Social Security

As a general rule, you should wait as long as possible to start claiming benefits. Your benefit increases 8% annually (not compounded) from FRA until age 70. If you were born in 1960 or later, your benefit increases by 24% from age 67 to age 70. That’s a guaranteed return you can’t get anywhere else. On the other hand, your monthly benefits are 6% lower benefits for each year you begin receiving benefits before full retirement age.

If your FRA is 67 and you start claiming benefits at age 62, you will receive only 70% of your projected benefit at FRA. The breakeven point for those that wait until age 70 to begin claiming benefits rather than starting to claim them at age FRA is approximately age 82. According to life expectancy tables, a 66-year-old woman will live to 86.7; a man to 84.3. If both members of a couple are 66, the joint life expectancy is 92.2.

An example

Assume that your benefit at FRA (age 67) is $2,000. Waiting until age 70 to start claiming increases your monthly benefit to $2,480. That’s 24% more than you would receive at age 67. If you start collecting your benefit at age 62, you will only receive $1,400 per month. Your monthly benefit increases by $1,080 from 62 to 70 – a 77% increase.

Maximizing Social Security benefits

While benefits are available as early as age 62, claiming later permanently raises monthly benefits. As noted above, waiting until age 70 provides the maximum benefit. Delaying claiming is equivalent to purchasing an inflation-adjusted annuity. An annuity benefit that will be received for as long as the beneficiary lives. Most people, however, do not claim Social Security at their optimal age. They usually claim too early.

According to a recent report published by the Bipartisan Policy Center, more than one-third of Americans start claiming benefits at age 62. Two-thirds claim before reaching their FRA. This decision can prove quite costly.

A wealth management software firm analyzed retiree’s actual claiming decisions. It found suboptimal claiming decisions cost households an average of $68,000 in lost income. For client financial plans, I assume clients live to age 90 as a base case assumption. Oftentimes, the optimal claiming strategy results in at least $200,000 in additional income.

The study also estimated that suboptimal claiming decisions could cause future retirees to lose an estimated $3.4 trillion in potential income. That money could improve your quality of life in retirement.

If both members of a couple are healthy, they should both try to delay to age 70. At a minimum, the higher earner should try and wait until age 70.

While you may plan to wait until age 70 to start collecting benefits, you can change your mind. If health or other circumstances mean you need to start collecting benefits early, you can.

Spousal benefits

A non-working spouse can collect a spousal benefit (one-half of the worker’s benefit) based on the working spouse’s earnings. But they can’t claim benefits until the worker applies for and collects his or her benefit.

A working spouse can also collect a spousal benefit when the benefit based on one spouse’s earnings history is more than two times greater than the other spouse’s benefit. As with the benefit for a non-working spouse, you must wait until the higher earning spouse applies for and collects benefits. The spousal benefit is one-half of the higher earner’s benefit.

In either case, spousal benefits do not reflect any increases in the higher-earning spouse’s benefit from FRA to age 70.

Special rules exist for those born in 1953 or earlier. These rules allow a spouse born in 1953 or earlier to collect a one-half spousal benefit while their own benefit continues to grow. Those who follow this strategy can more easily wait until age 70 to start collecting their own benefit. As is the case with all spousal benefits, this benefit cannot be received until the other spouse applies for and collects his or her benefit.

Important considerations for couples

A couple’s decision about when to start collecting benefits should consider both members of the couple. If possible, at least the higher-earning spouse should wait until age 70 to start collecting benefits. There are two reasons for this:

1. As noted above, your benefit grows 8% annually from FRA to age 70.

2. One spouse typically predeceases the other. The surviving spouse receives the higher of the couple’s two benefits.

The larger the age difference, the more important it is for the older spouse to wait until age 70. A surviving spouse receives the higher of either spouse’s benefit. A couple’s joint life expectancy is also longer than either spouse’s individual life expectancy. There is a greater chance the surviving spouse will benefit from the decision to wait.

Social Security is typically more valuable for women than men, too. Why? Their life expectancy is longer.

Surviving spouses

A widow(er) can begin claiming a survivor benefit at age 60. But starting to collect at age 60 means you will receive a reduced benefit. You can also claim the widower’s benefit and switch to your benefit at a later time. Widow(er) benefits are the only benefits that allow you to change between your benefit and survivor benefits. A widow(er)’s survivor benefit is only available if he or she does not remarry or remarries after the age of 60.

What do you do for income if you wait to start collecting benefits?

When you turn 72, you must start taking distributions from your Individual Retirement Account(s) or 401(k)’s (collectively IRAs) – required minimum distributions (RMDs). Instead of waiting until 72, you can use your IRAs to bridge the gap. You can withdraw amounts equal to the Social Security benefits you would have received.

This strategy allows your future Social Security check to grow at a guaranteed rate. It can also lower the amount of your future RMDs. The potential result – a lower tax bill in the future. It can also help you limit your future Medicare premiums. Medicare requires you to increase your premiums via an Income Related Monthly Adjustment Amount.

Using your IRAs to fund your income needs before you start collecting Social Security benefits allows you to buy guaranteed income for free. Not everybody can defer their benefits, but your first choice should be to use your IRAs to allow you to buy an inflation-adjusted annuity through Social Security. If you want to read more about this concept, you can read the white paper titled “How to Best Annuitize Defined-Contribution Assets?” from the Center for Retirement Research at Boston College.

Closing Thoughts and a Look Ahead

Social Security represents an important source of income for retirees. Many have misconceptions about how Social Security works. Poorly timed claiming decisions can be quite costly. The above is meant to give you some insights into the claiming process. If you have more questions, please send an email to philweiss@apprisewealth.com or schedule a free call. You can also attend the next session of Apprise’s “Ask Me Anything” webinar series later this month.

When it comes to content, April is Social Security month at Apprise. In two weeks, our blog will discuss some key Social Security-related tax issues – often referred to as the “tax torpedo.” The primary topic in this month’s “Ask Me Anything” webinar will be Social Security. Registration details will be provided in a future blog post.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above information valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or virtual meeting via Zoom.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/