Tuesday Tips: Spending Plan vs. Budget: Forget Budgets—Try This Instead

Spending plan vs budget. Learn how a Lifestyle Spending Plan aligns your money with your values using three categories. Joy, Essentials, and Future Self.

Spending plan vs budget. Learn how a Lifestyle Spending Plan aligns your money with your values using three categories. Joy, Essentials, and Future Self.

Discover my three words for 2026: Simplify, Yutori, and Flourish, plus a simple checklist to help you choose your own three words for the year.

A gentle year-end note for women navigating divorce, widowhood, or an empty nest. Plus, three simple prompts to start 2026 with clarity.

Teach kids about money during the holidays with a simple Spend, Save, Give bucket framework. Plus, this week’s five favorite reads on money, life, and planning.

Holiday scams are surging. Learn 4 red flags, a simple verify-first habit, and how to protect your money and identity during the busy season.

2025 year-end tax planning is not just about filing your return. Learn 9 strategies, from Roth conversions to QCDs and OBBBA changes, to lower your tax bill.

Small habits to improve your life in health, career, and relationships. Plus, how they compound over time to boost your Return on Your Life (ROL).

Not sure what to do with an old 401k when in your 50s. Learn your main options, what to avoid, and make your retirement accounts easier to manage.

A caring for aging parents checklist: first 48 hours, documents to gather, costs, fraud guard, and lesser-known care options.

Should you downsize your home in retirement? Compare costs, taxes, and lifestyle trade-offs—plus a Quick TEAM check to help you decide.

When to claim Social Security at 62 vs 70—a 62–FRA–70 timeline, break-even basics, survivor considerations, and a quick checklist to decide confidently.

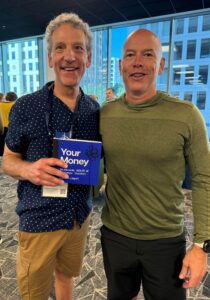

Tax planning not reporting—look forward, not back. In Ep. 5 with Carl Richards, time income/deductions, coordinate accounts, and avoid avoidable taxes.

"*" indicates required fields

Alleviate stress and see where you are and what you need to do next for a comprehensive financial plan tailored for you.