Whether to complete a Roth conversion this year is a frequent conversation topic with clients, especially in the fourth quarter. I recently added a new software tool that provides more insights into the specifics around completing a Roth conversion than traditional financial planning software. Initially, I was surprised by some of its recommendations. That made me dig deeper to understand the thought process better.

Traditionally, we think of a Roth conversion as adding value when current tax rates are lower than projected future tax rates. When current and expected future tax rates are the same, a Roth conversion’s impact is minimal to non-existent. If you anticipate lower tax rates in the future, a Roth conversion can hurt rather than help.

Please note that as far as taxes and elections are concerned, whoever gets elected can impact the eventual tax policies. However, we do not try to pontificate on or bemoan things we cannot control. We need to do the best planning and make the best recommendations we can based on the information available at the time. The tax code is written in pencil. It can and will change over time. We cannot dramatically change our tax planning every time we read a new headline.

Completing a Roth Conversion at Different Tax Rates

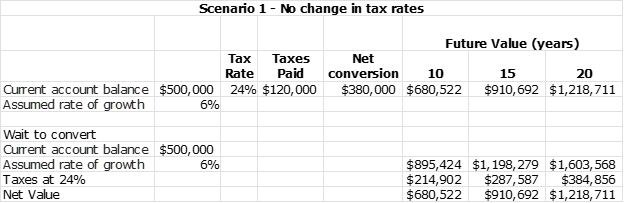

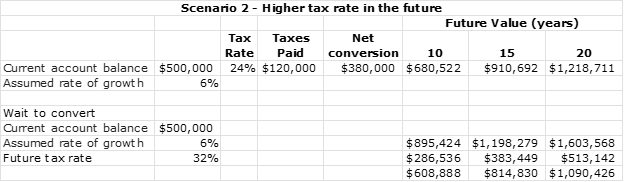

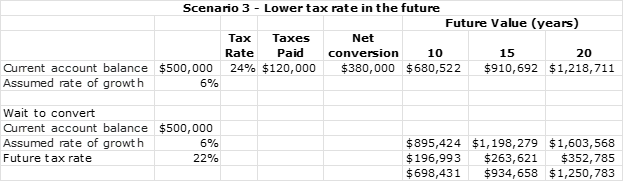

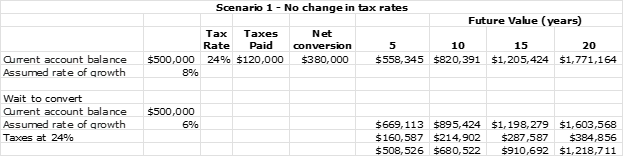

Changing tax rates can affect the value of a Roth conversion. Let’s look at why. In the first scenario, the current income tax rate equals the expected future tax rate. As you can see, the net value of the account remains the same.

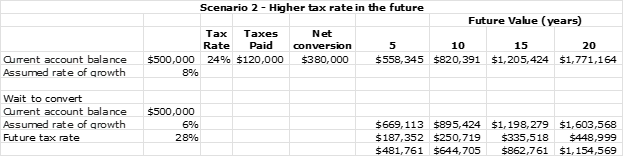

In the second scenario, we expect an increase in future tax rates. A Roth conversion leads to a higher after-tax account value.

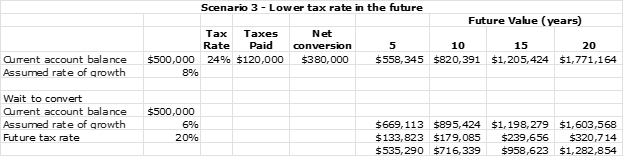

The third scenario assumes tax rates will decline in the future. As a result, completing a Roth conversion and paying taxes today reduces the account’s after-tax value. Based on these figures, you would not complete a Roth conversion in this case.

Summary of Examples 1-3

These results are not surprising. The traditional view suggests Roth conversions add the most value when we expect future tax rates to be higher than current rates.

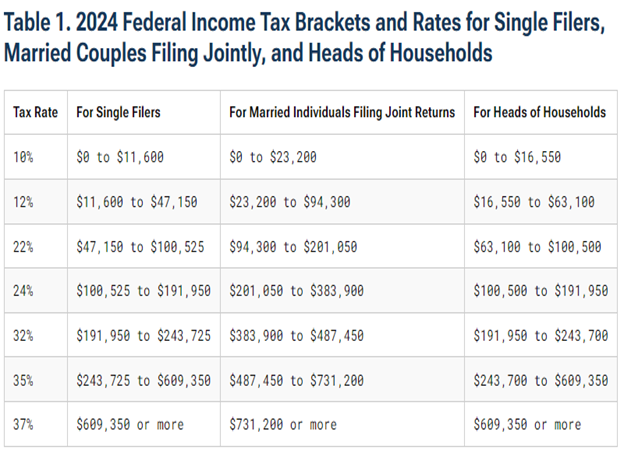

I typically recommend stuffing (or filling) tax brackets using this logic when considering Roth conversions. If a client is currently in the 24% tax bracket or lower, and their future tax rates are projected to be higher than 24%, I recommend a Roth conversion that fills the 24% tax bracket. For example, If a single filer’s taxable income is $150,000, she has $41,950 of room to fill the 24% bracket. In 2024, the 24% tax bracket ranges from $201,050 to $383,900 of taxable income for married individuals filing a joint return. It ranges from $100,525 to $191,950 for single filers.

While these examples do not distinguish between married couples, singles, widows, or divorcees, keep in mind that, as shown in the table below, the tax brackets for women facing new beginnings who are single filers are one-half as large as those for married couples through the 32% tax bracket. As discussed in this blog, this can make Roth conversions even more valuable to surviving spouses and their heirs.

Source: Tax Foundation.org

Client-specific circumstances could lead to a recommendation to convert in other situations that could differ from the general rule. For example, I have a client who intends to move from Illinois to Michigan. Illinois does not tax Roth conversions. Michigan imposes a 5% tax on such amounts. Since future income could potentially surpass the 24% tax bracket, saving state taxes can justify completing a Roth conversion and paying up to 32% federal tax on it.

The new software I started using often recommends completing Roth conversions and paying tax at the 32% marginal rate in cases where I would typically have only previously recommended filling the 24% marginal bracket. Since this didn’t make intuitive sense, I decided to see if I could better understand why.

The Importance of Asset Location

I have discussed asset location before. Asset location focuses on placing different asset types in different account types based on their growth potential and how they are taxed.

From a tax perspective, you can place your assets in three different types of accounts:

- Taxable accounts such as brokerage or savings accounts.

- Tax-deferred accounts such as 401(k)s, 403(b)s, or Individual Retirement Accounts (IRAs).

- Tax-exempt accounts such as Roth IRAs, Roth 401(k)s, or Health Savings Accounts (HSAs).

Where to Hold Equities (including ETFs)

In general, assets (typically growth stocks) with high growth potential are best suited for tax-exempt accounts as you won’t pay taxes on future gains. If possible, you want to keep growth stocks out of your tax-deferred accounts. Here’s why: If you hold growth stocks in your Roth IRA, you won’t pay any taxes on gains. If you hold them in a taxable account for longer than a year, any gains are taxed at the lower capital gains rate. If you hold them in a tax-deferred account, you will pay taxes at your higher ordinary income tax rate on any future withdrawals.

You should note that the above assumes the overall value of your equity allocation will deliver long-term growth. While growth cannot be guaranteed, when we invest, we implicitly assume that our investments’ future value will grow. Otherwise, we would have no reason to invest.

Historically, based on the S&P 500 Index, equities have delivered long-term growth averaging about 10% – 11% annually since the 1920s, including reinvested dividends, versus approximately 4% – 6% for high-quality bonds with interest reinvested.

Where to Invest Fixed-Income Assets

On the other hand, fixed-income assets primarily provide interest income. Such income gets taxed the same as ordinary income. That means the ultimate tax rate we pay on that income is the same regardless of whether it’s in a taxable portfolio or a tax-deferred account.

When managing client accounts, wherever possible, Apprise endeavors to only hold stocks in tax-exempt accounts. This approach typically causes the allocation in tax-deferred accounts to be more conservative (own more bonds). We strive to keep the overall allocation aligned with the client’s risk tolerance and financial plan. This results in tax-deferred accounts holding less than the overall equity target, while tax-exempt assets hold more than the overall equity target.

Why This Matters for a Roth Conversion

I started thinking about why the new software recommends Roth conversions at higher rates than expected. Historically, stocks provide better overall returns than bonds. If we follow asset location principles, we have higher allocations to stocks in tax-exempt accounts. That means the tax-exempt accounts will potentially provide greater returns.

A Second Look at Completing a Roth Conversion

For these examples, assume the growth rate for the tax-exempt accounts is 2% higher than the growth rate for the tax-deferred accounts. Here’s what happens if the current and future tax rates match:

In this scenario, tax rates remain unchanged. Even after only five years, completing a Roth conversion today leads to a higher net account value than if you waited to withdraw the funds.

In the second scenario, the increase in tax rates is lower than in the first set of examples. However, completing a Roth conversion now results in a much lower future balance.

In the third scenario, the estimated future tax rate is again lower than in the first set of examples. Despite this, completing a Roth conversion today provides more after-tax funds in as few as five years.

What This Means

For many reasons, I am a long-term proponent of Roth conversions – and Roth IRAs. You can check out the following blogs for more information:

- How Roth Conversions Can Help You, Your Surviving Spouse, and Your Heirs

- The Value of Roth Conversions at Today’s Low Rates

- Wealth Unlocked: Navigating the Benefits of Backdoor Roth IRAs

- 7 Benefits of a Roth IRA

- Roth IRA Benefits for Kids

For many of us, tax-exempt accounts like Roth IRAs were not even available early in our careers, and we do not have much money in them. Without fully understanding the benefits of Roth IRAs, we focused on saving in our IRAs or 401(k)s because they provide a current tax benefit. In retirement, it helps to have different account types from which to withdraw funds.

Ideally, we want to pay as little in taxes as possible during our lifetimes. Roth conversions allow us to make amends for not having enough in our tax-exempt accounts. A properly timed Roth conversion can help you lower your lifetime tax bill. That should be your focus rather than trying to have some individual years where your tax rate is low. Not filling your lower tax brackets with income is a lost opportunity.

The analysis in this blog indicates that you can be even more aggressive than conventional thinking suggests when considering Roth conversions.

Moving Forward – Consider Roth Conversions Every Year

While working, we must navigate one set of tax rules. Those rules focus on saving for the future, and the benefits of current tax deferral get drilled into our heads.

When you retire, the rules change as you withdraw the funds you saved for retirement. Focusing on how to lower your lifetime tax bill can benefit the amount of money you have to spend during your retirement.

For women facing new beginnings, financial independence is about security and the freedom to live fully and flourish. Focusing on lowering your lifetime tax bill can enhance your chances of living your most fulfilling life now and in the future. It can provide you with more funds. As part of your financial plan, it can help to consider a Roth conversion of some amount every year.

Roth conversions can also provide peace of mind and financial security. You can potentially pay less in taxes leaving women navigating life transitions like widowhood or divorce with more money to spend in retirement.

Closing Thoughts

Regardless of where you are on your path, remember that each step brings you closer to a life of confidence and financial empowerment. Do you know your projected or future tax rate? Have you evaluated your current taxable, tax-deferred, and tax-exempt accounts? If you haven’t, we can help.

You can shape your financial future—why not start now? Schedule a call to discuss how Roth conversions can help you achieve your financial goals throughout your life.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

If you would like to speak with us about financial topics, including facing new beginnings, managing your investments, creating your life plan, or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Follow us:

Please note. We post information about articles that can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/