A Lifetime Perspective Can Help Lower Your Tax Bill

Keep in mind that instead of reactively planning for taxes, if you want to implement good tax-planning practices, you want your analysis to reflect more than the current year’s numbers. Consider your lifetime tax liability instead. Why? You can realize the greatest benefit if you develop long-term strategies that can reduce your lifetime tax liability. This represents one of the reasons I frequently write about Roth conversions. (See, for example, here, here, and here.)

The importance of a lifetime perspective could be even more important this year. Why? The current tax system became effective in 2018. Without further legislation, we will revert to prior law beginning in 2026. Based on the current consensus, we will likely see higher rates in a couple of years. It could also result in lower standard deduction amounts. Based on my experience working as a tax professional for Deloitte & Touche, I don’t like to speculate much about tax legislation. I’ve seen much more legislation proposed than passed. In this case, if no legislation gets passed, we revert to a system with higher rates and lower standard deductions. I’ll talk more about this in a little bit.

It’s time to discuss some tax tips and planning ideas that can lower your tax bill.

Lower Your Tax Bill – Tip 1: Review Contributions to Tax-Advantaged Retirement Accounts

If you are still working and would like to maximize your retirement contributions, you still have time to make changes. Review your last pay stub and your regular contribution. Based on the number of remaining pay periods, determine if you will have enough withheld between now and year-end to equal $22,500 (or $30,000 if you are 50 or older). If possible financially, adjust your remaining withholdings to maximize this year’s contribution.

If you participate in a Health Savings Account (HSA), consider maximizing your contributions as well. You can contribute $3,850 for yourself or $7,750 for families. Those 55 and over can contribute another $1,000. Don’t forget that the spouse who isn’t the primary plan holder must make that contribution to their own HSA. Employers can only facilitate the catch-up contribution for their employees. Remember that HSAs are triple-tax-free, meaning you get a tax deduction for contributions, you can invest your contributions and won’t pay tax on any earnings, and withdrawals for qualified medical expenses are also tax-free.

If you are eligible to contribute to an IRA or Roth IRA, you can contribute up to $6,500 ($7,500 if you are 50 or older) this year. You have until April 15, 2024, to make an IRA or Roth IRA contribution for 2023.

Tip 2: Consider Roth Conversions

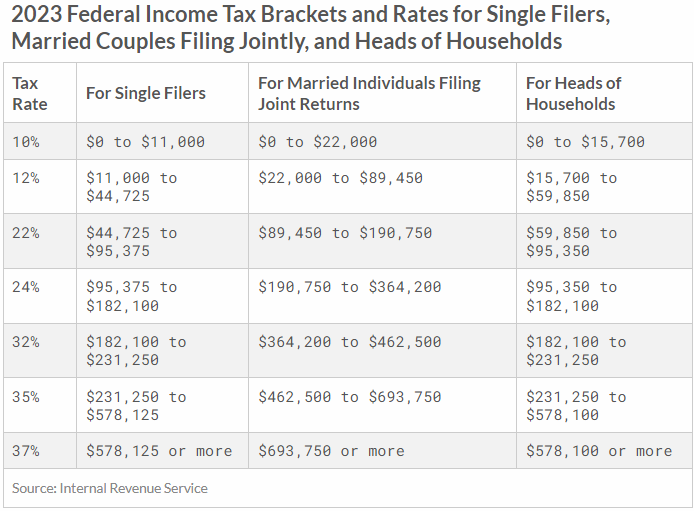

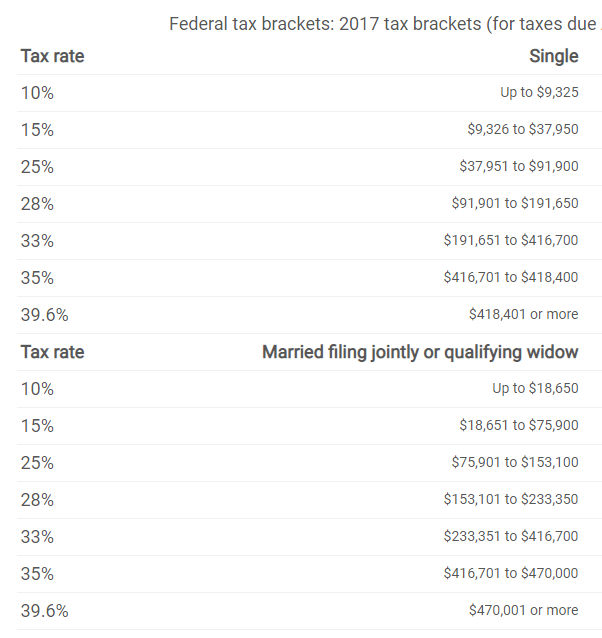

Unlike contributions, Roth conversions count in the year they occur. Unfortunately, as noted above, there are only a few years left to take advantage of the lower rates created by the Tax Cuts and Jobs Act that passed in 2017. The current rates – see the table below for 2023 – sunset at 2025’s end. As a result, beginning in 2026, we will revert to the 2017 rates (see the second table) adjusted for inflation. Those tax rates were higher. They also have a narrower income range within each bracket. They also contain a more severe marriage penalty.

If you find yourself in the 22% or 24% marginal tax bracket (the tax rate that applies to your last dollar of income), now represents a great time to evaluate a potential Roth conversion. Those in today’s 22% tax bracket could easily be in the 25% bracket in 2026. If you’re in the 24% tax bracket, you could easily find yourself in the 28% or even 32% tax bracket in 2026.

Importantly, Roth conversions don’t make sense for everyone. Factors to consider include your IRA balance and its related growth, estimated future income, your available cash balance, and how much you want to hedge against future tax rate increases.

In general, those with more than $750,000 in IRAs and/or 401(k)’s/403(b)’s who are 73 or younger may want to consider Roth conversions. If you would like to discuss them with us, please schedule a call. A Roth conversion can help you pay a lower tax rate today than you might pay in the future.

Lower Your Tax Bill – Tip 3: Take Required Minimum Distributions (RMDs)

Remember that RMDs for those born in 1951 through 1959 now start at age 73. For those born in 1960 or later, they start at age 75. If you are already subject to RMDs, you should continue taking them. The law did not change for those born in 1950 or earlier.

While the penalty for failing to take an RMD was reduced to 25%, that’s still a significant amount. If you are supposed to take a $60,000 RMD, you would owe $15,000 in penalties if you don’t distribute it by December 31. The penalty can be reduced to 10% of the calculated amount if you take it within a correction window – typically before the end of the second year following the year the RMD should have been distributed. That would still result in a $6,000 penalty on a $60,000 RMD.

Qualified Charitable Contributions (QCDs)

Those fortunate enough to not need the cash can reinvest their RMD into a taxable brokerage account. Those who are charitably inclined and who are at least 70 ½ years old should consider making qualified charitable contributions (QCDs) instead of regular donations. QCDs reduce the amount of your RMD. Plus, QCDs don’t represent taxable income. If your RMD this year is $50,000, and you want to donate $10,000 to charity, you can distribute that $10,000 as a QCD, That reduces your taxable RMD to $40,000. Please note that the maximum annual amount that can qualify for a QCD is $100,000 in both 2023 and 2024. Beginning next year, indexing will allow the annual QCD amount to increase.

Inherited IRAs

The rules for Inherited IRAs are complicated and confusing. They can also give rise to considerable uncertainty. Before 2020, it wasn’t that complicated. You took an RMD based on your age and the IRS’s single-life expectancy table. But the rules changed in 2020. Now you only have 10 years to empty an inherited IRA. Initially, it seemed you didn’t need to take RMDs from post-2019 Inherited IRAs. Then the IRS issued somewhat controversial proposed regulations stating that RMDs were required for years 1-9. The IRS has failed to issue final regulations. They have also waived the requirement for RMDs from these Inherited IRAs in 2021, 2022, and 2023.

Beneficiaries may still want to consider taking a distribution from an Inherited IRA this year. This applies especially if you think you will be in a higher tax bracket in the future. Taking distributions annually can help you avoid the big one-time tax hit that would result if you took the full distribution in year 10. Some of Apprise’s clients with post-2019 Inherited IRAs have taken distributions this year for these reasons.

Please note that these distribution rules can be complicated. Each of you also has your own, unique situation. Please schedule a call if you have any questions.

Tip 4: Tax-Loss and Tax-Gain Harvesting

Tax-Loss Harvesting

While you may strive to lower your taxes this year, paying no taxes today could mean you pay more in the future.

Remember that you can deduct up to $3,000 of capital losses each year. A capital loss results when you sell a stock for less than you bought it for. If you have more than $3,000 in capital losses, you can carry the excess forward until you use it. Each year you can deduct up to $3,000.

Keep in mind that the wash sale rule also applies. If you sell a security at a loss and repurchase it (in any of your accounts) less than 31 days after selling it, you can’t recognize the loss. Instead, your cost basis in your shares gets reduced by the amount of the loss.

Tax-Gain Harvesting

I want to discuss the other side of the coin as well. Some may benefit from harvesting capital gains as well. Capital gains get stacked on top of ordinary income. What does that mean? In short, your capital gains rate can go up or down, depending on your ordinary income. Despite this, gains still get taxed at the applicable capital gains rate – not the ordinary income tax rates shared in the tables earlier.

2023 Capital Gains Rate Table

| Capital Gains Tax Rate | Married Filing Jointly Taxable Income | Single Taxable Income |

| 0% | $0 – $89,250 | $0 – $44,625 |

| 15% | $89,251 – $553,850 | $44,626 – $492,300 |

| 20% | $553,851 or more | $492,301 or more |

Consider a retired, married couple under the age of 65. They get a $27,700 standard deduction. If they do nothing else, they won’t pay any taxes. They could have earned $27,700 in income and still paid no taxes. They would have also missed out on filling the 10% or 12% tax bracket. In the end, they will likely pay taxes at a much higher rate in the future. In other words, they lost an opportunity to lower their lifetime tax bill.

They could have also recognized up to $116,950 ($27,700 + $89,250) of capital gains without paying taxes. In this case, they could have sold securities in their taxable account, recognized gains, and immediately repurchased the securities. How? The wash sale rule described above does not apply to gains.

Lower Your Tax Bill – Tip 5: Review Tax Withholdings and Estimated Tax Payments

You can easily get snagged by this one when you stop working. Why? When you work, have taxes withheld from your pay. When you retire, you must either make estimated quarterly payments or have taxes withheld from income such as Social Security, pensions, and distributions from retirement accounts.

To avoid underpayment penalties, you must pay 90% of your current year tax liabilities or 100% of your prior year tax liabilities if your adjusted gross income is $150,000 or less (110% of your prior year tax liabilities if your adjusted gross income is more than $150,000).

Withholding Tax vs. Quarterly Estimated Payments

Keep in mind that the IRS treats amounts withheld from your income as paid ratably throughout the year. This means that if you under-withhold taxes during the year, you can make up for it by withholding any shortfall from a distribution you receive late in the year.

If you make quarterly estimated payments, you may still pay an estimated tax underpayment penalty if more should have been paid throughout the year.

Self-employed individuals also must make estimated quarterly tax payments. Remember to include the Social Security and Medicare taxes due on your income when estimating your liability.

Tip 6: Decide on Family Gifts

In 2023, every individual can give up to $17,000 to as many individuals as they want without worrying about filing a gift tax return. In 2024, this amount increases to $18,000. You can give this amount to your child or grandchild. If you’re married, you and your spouse can give up to $34,000 to your child or grandchild without filing a gift tax return. (This amount increases to $36,000 in 2024.)

If you give more than $17,000 this year, you must file a gift tax return. You won’t owe any gift tax, but your lifetime exemption amount will be reduced. This amount currently sits at $12.92 million. Note that it could fall in 2026 if we revert to the old tax system as well. In 2017, this amount was $5.49 million.

You can also take advantage of the gift tax provisions to superfund a 529 plan for a child’s education. You can fund up to five years – $85,000 in 2023 and retain eligibility for a gift-tax exclusion in 2023. Any excess gets applied against your lifetime estate and gift tax exemption.

You could also make a gift to fund the Roth IRA contribution for a working child. Remember that if that child makes less than this year’s maximum contribution of $6,500, you can only fund the Roth IRA up to the amount of that child’s earned income.

Lower Your Tax Bill – Tip 7: Watch for Mutual Fund Distributions

If you plan to consider investing significant amounts in a taxable account in a mutual fund before year-end, you may want to do some research first. Many funds distribute their net capital gains to investors in mid-to-late December. These payouts are typically taxable regardless of when you invested in the fund.

Before investing, see if you can find out whether a fund you’re considering is planning a big distribution. If it is, you want to know when and how much. You can often find this information on the fund company’s website. You can also consider purchasing an ETF rather than a mutual fund. ETFs generally do not distribute net capital gains to shareholders.

Tip 8: Consider Ways to Donate

As you start considering your year-end charitable giving, think about other ways to donate besides writing a check. As noted above, if you are at least 70 ½ years old, you can make a QCD from your IRA. Doing so can help lower your tax bill.

You can also donate appreciated stock and other securities you’ve owned for more than a year. Those who itemize your deductions can typically deduct the fair market value of the shares. Plus, you won’t pay any capital gains tax on the increased value of the shares over the years.

Lower Your Tax Bill – Tip 9: Consider Asset Location

When you hold investments in different types of accounts from a tax perspective, you want to keep in mind the tax implications associated with each investment type. There are three types of accounts in terms of tax treatment: taxable (personal accounts held in a brokerage or a bank), tax-deferred (IRAs, retirement accounts, annuities), and tax-free (Roth IRAs, Roth 401(k)’s, HSAs).

Investments have different types of tax implications, too. Bonds and savings accounts generate ordinary interest income. Tax-exempt bonds pay lower interest rates but are exempt from federal income tax. Low-dividend paying stocks are held primarily for their appreciation potential, which is taxed at long-term capital gains rates when sold or receive a basis step-up at death. Finally, high dividend-paying stocks produce ongoing taxable income (the tax rate on such income is often less than on interest income). Asset location attempts to place investments according to the most appropriate tax treatment. This blog discusses asset location in more detail.

Conclusion

Women embarking on new beginnings should strive to make tax planning a year-round activity.

Oftentimes, you only think of taxes when gathering the documents to prepare your return. Unfortunately, other than funding contributions to an IRA, Roth IRA, or HSA, you can’t do much to lower your tax bill after year-end. You still have seven weeks to act this year. Doing so can help you lower your lifetime tax liability.

Failing to act could result in your paying than your fair share of taxes. Do you want to pay more than you need to?

Which steps do you plan to take to lower your tax lifetime tax burden?

Please schedule a call if you have any questions or would like some help implementing any of these tips.

If you would like to talk to us about financial topics including your investments, creating your life plan, saving for college, or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Next week, please look for our Tuesday Tips video blog.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on Facebook and LinkedIn.

For firm disclosures, see here: https://apprisewealth.com/disclosures/