What type of retirement tax bill will you have? When you stop working, you don’t stop paying taxes. When you save money in your 401(k), 403(b), IRA, or other similar tax-deferred retirement account, you don’t pay tax on the amount contributed. Unfortunately, you will owe taxes when you withdraw the money from these retirement accounts.

As you approach retirement, you should ask yourself what the potential size of your retirement tax bill will be. It’s important to remember that for most of your life, you accumulate assets. This means you operate under one set of tax rules. When you retire, the rules change. Different considerations apply when you spend down or decumulate the assets you have saved for retirement.

As a result, managing your tax bill is an important part of managing your finances effectively. When doing so, adopting a long-term perspective is crucial. This includes taking a proactive approach to tax planning throughout your lifetime. Focusing on reducing taxes over your life rather than just the current year or the next couple of years, or macro tax planning can significantly lower your tax burden over time. Macro tax planning lies in distinct opposition to micro tax planning, which typically focuses on lowering this year’s tax bill – or perhaps your tax bill over the next couple of years.

Sources of Income in Retirement

Gaining a better understanding of your retirement tax bill starts with understanding the various sources of retirement income. The following represent some common sources of retirement income.

-

Social Security

Depending on your total income, you may pay tax on a portion of your Social Security benefits. If you have little in the way of taxable income, you could pay no taxes on your Social Security income. At most, you will owe taxes on 85% of your Social Security benefits. This blog discusses the taxation of Social Security benefits in greater detail.

-

Pension and Retirement Accounts

Withdrawals from tax-deferred retirement accounts, such as 401(k)s, 403(b)s, or traditional IRAs are typically taxed as ordinary income. The same applies to payments you receive from traditional pension plans.

-

Roth Accounts

Qualified withdrawals from Roth IRAs or Roth 401(k)s are tax-free since taxes were paid on the contributions before they were deposited in the accounts.

-

Health Savings Accounts (HSAs)

As long as you have unreimbursed qualified medical expenses that were incurred any time after you first funded your HSA, you can make tax-free withdrawals of such funds. For more on HSAs, please see this blog.

-

Investment Income

Interest, dividends, and capital gains generated from investments held outside your retirement accounts may also be subject to taxes. You should note that the tax rate paid on dividends and capital gains may be lower than the rate paid on interest income.

Lowering Your Retirement Tax Bill

What, if anything, can you do to lower your retirement tax bill? Tax planning can help. But what kind of tax planning? When it comes to saving taxes, most of us think about micro tax planning. This often happens when you wait until it’s time to prepare your tax return to even think about taxes. What would happen if you took a broader approach and focused on macro tax planning? Since macro tax planning takes a long-term view, the dollars – and tax savings – associated with macro tax planning can be much more significant.

Six Steps You Can Take to Reduce Your Retirement Tax Bill

-

Start Early and Establish a Tax Planning Strategy:

Effective tax planning starts well before you retire. As a first step, you should understand the tax implications of various financial decisions, such as investing, saving, asset allocation, and asset location. In general, asset location involves placing investments strategically in taxable, tax-deferred, and tax-free accounts to help optimize your tax efficiency. For example, holding bonds in tax-deferred accounts and equities in taxable accounts may be beneficial. A qualified tax advisor or financial planner, such as Apprise, can help you establish a tax planning strategy tailored to your specific goals and circumstances. If you start early and stay proactive, you can maximize tax-saving opportunities as they arise.

-

Optimize Retirement Savings Vehicles:

Take full advantage of retirement savings vehicles, such as employer-sponsored 401(k)/403(b) plans, traditional IRAs, Roth 401(k)/403(b) plans, Roth IRAs, and health savings accounts (HSAs). These accounts provide tax advantages that can help you reduce your tax liability over time. Start by contributing enough to earn any employer match. Beyond that, contribute as close to the maximum allowable amounts to these accounts as you can. When deciding how much to contribute, consider factors like tax deductions, tax-free growth, and tax-free withdrawals in retirement.

-

Utilize Tax-Advantaged Investments:

Consider adding tax-advantaged investments to your portfolio. Municipal bonds, for example, offer tax-free interest income at the federal level and, in some cases, at the state level. Similarly, if held in a taxable portfolio, exchange-traded funds (ETFs) can benefit tax efficiency by minimizing capital gains distributions. Holding individual stocks can also aid tax efficiency. By strategically selecting investments with tax advantages, you can potentially reduce your taxable income and minimize your tax liability.

-

Plan for Roth Conversions:

Roth conversions can be a powerful tool for reducing taxes over your lifetime and your retirement tax bill. By opportunistically converting funds from traditional retirement accounts to Roth accounts, you can create a tax-free income source in retirement.

Focus on timing your conversions so that they take place during years when you anticipate being in a lower tax bracket. This helps to minimize the immediate tax impact. Typically, if you want to optimize the effects of Roth conversions on your retirement tax bill, you should focus on completing them when your income declines.

Roth conversions can also help lower the long-term tax cost of withdrawing the amounts held in your traditional retirement accounts. Roth conversions provide flexibility in managing taxable income. They can also help optimize your tax situation over time.

-

Consider Capital Gains and Losses:

Capital gains and losses play a significant role in tax planning. Consider tax-loss harvesting to offset capital gains and potentially reduce your tax liability. Additionally, long-term capital gains are typically taxed at a lower rate than ordinary income and short-term capital gains. (For this purpose, long-term means holding an asset for at least a year and a day before selling it. By understanding the tax implications of investment sales and timing your transactions strategically, you can minimize your capital gains tax and lower your tax bill.

-

Charitable Giving and Legacy Planning:

Charitable giving offers tax advantages while supporting causes close to your heart. By donating appreciated assets, such as stocks or mutual funds, you can potentially avoid capital gains taxes on the appreciation and receive a tax deduction for the fair market value of the donation. You can incorporate charitable giving into your financial plan to reduce taxes while making a positive impact. Once you reach the age of 70 ½, you can also consider making qualified charitable distributions or QCDs from your traditional retirement accounts. QCDs represent a more tax-efficient way to make donations.

The Role of Roth Conversions in Lowering Your Retirement Tax Bill

Planning for a financially secure retirement and optimizing your tax situation involves considering each of the above strategies – and possibly others. Let’s focus on Roth conversions as they can have an outsized impact, especially as you approach – and enter – retirement.

-

What Is a Roth Conversion:

A Roth conversion involves transferring funds from a traditional retirement account (such as a traditional IRA or 401(k)) into a Roth IRA. Unlike traditional accounts, Roth IRAs offer tax-free withdrawals in retirement, provided that certain criteria are met. By completing a Roth conversion, you effectively prepay the taxes on those funds at the time of conversion, potentially reducing your tax liability in retirement.

-

Tax Diversification and Flexibility:

Converting a portion of your traditional retirement savings to a Roth IRA can provide tax diversification in retirement. Having both traditional and Roth IRAs provides the flexibility to withdraw from either account, allowing you to strategically manage your taxable income each year. This flexibility can help optimize your tax situation and potentially reduce the impact of RMDs on your taxable income.

-

Timing and Tax Bracket Considerations:

When considering Roth conversions, it’s essential to evaluate your current and projected tax brackets. Converting funds to a Roth IRA can be most advantageous when you anticipate being in a lower tax bracket during the conversion year compared to your expected tax bracket in retirement. By paying taxes at a lower rate now, you can potentially minimize your tax burden when you start withdrawing funds from your Roth IRA tax-free during retirement.

Key times to consider when thinking about Roth conversions include:

-

- Retirement.

- The years before you start claiming Social Security benefits.

- The years before your required minimum distributions (RMDs) start.

The above periods often represent the times when you have the most control over how much taxable income you report on your tax return.

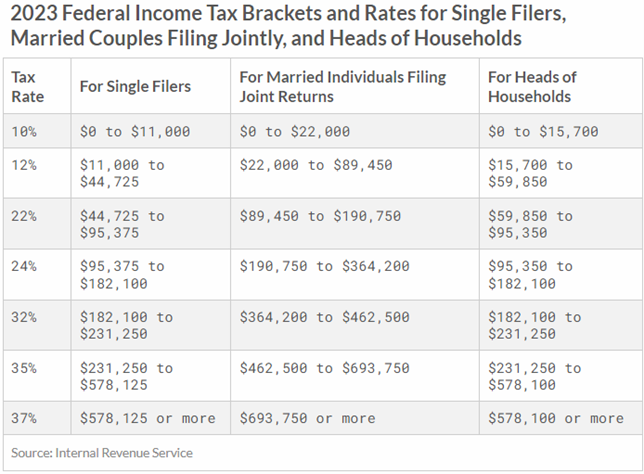

For example, take a look at the current tax brackets:

When deciding how much to potentially convert in a particular year, I think of bracket stuffing. Bracket stuffing refers to the idea of deciding the maximum rate of tax you’re comfortable paying in a given year and completing a large enough Roth conversion to essentially stuff that bracket. In the above table, you will note that the tax rate takes a sharp jump two times. The first is from 12% to 22%; the second happens when it goes from 24% to 32%.

For many clients, the objective centers on filling either the 22% or the 24% tax bracket. An understanding of what future RMDs could look like also helps. The projections for future income, including RMDs, provided in financial planning software can help as well. These can be used to give some insights into what future tax rates could look like. Next week I will walk through this in more detail.

-

Reducing Future RMDs and Taxable Income:

Traditional retirement accounts are subject to RMDs once you reach a certain age (currently 73 years old for those born from 1951-1959; 75 for those born in 1960 or later). RMDs can increase your taxable income, potentially pushing you into a higher tax bracket and increasing your tax liability. By strategically converting funds to a Roth IRA before RMDs start, you can effectively reduce the size of your future RMDs. This can lead to lower taxable income and potentially reduce your overall retirement tax bill. You may also lower future Medicare premiums. Smoothing out your income can help minimize the impact of the Income Related Monthly Adjustment Amount (IRMAA) on your Medicare premiums. (See this blog for more details.)

-

Legacy Planning and Tax-Free Growth:

Roth conversions can offer significant benefits for legacy planning. Roth IRAs do not have RMD requirements. This allows the funds to continue growing tax-free for as long as you wish. (See this blog for additional thoughts on how Roth conversions can help both your surviving spouse and your heirs.)

Beginning in 2020, when a non-spouse inherits your IRA or Roth IRA, the balance must be withdrawn within 10 years. But there are no RMDs associated with an inherited Roth IRA, so you can wait until the end of year 10 to withdraw funds from a Roth IRA. This potentially provides for more tax-free growth. It also means that inherited Roth IRAs can potentially provide a tax-efficient wealth transfer strategy.

In next week’s video blog, I will walk through an example showing how Roth conversions can lower your overall retirement tax bill. If you would like a complimentary review of your situation and a better understanding of whether or not a Roth conversion strategy could be beneficial in your situation, please click here to schedule a complimentary review.

-

Considerations and Consultation:

It’s important to note that Roth conversions involve paying taxes upfront, which can impact your current cash flow. Additionally, every individual’s tax situation is unique, and the optimal Roth conversion strategy will depend on various factors, such as age, income, and retirement goals. Consulting with a qualified tax advisor or financial planner is crucial to determine the best approach for your specific circumstances.

Closing Thoughts:

When it comes to tax planning, taking a long-term, or macro approach represents a more comprehensive approach to reducing your retirement tax bill. It can lower the total amount of taxes you pay during your lifetime. By starting early, optimizing retirement savings vehicles, utilizing tax-advantaged investments, strategically planning for Roth conversions, considering capital gains and losses, and incorporating charitable giving into your financial plan, you can proactively manage your tax liability and maximize your wealth accumulation.

Of the strategies discussed in this blog, Roth conversions often represent the most meaningful way that retirees can reduce their retirement tax bill and enhance their financial flexibility. By strategically converting funds from traditional retirement accounts to Roth accounts, you can take advantage of tax diversification, manage taxable income, minimize future RMDs, and benefit from tax-free growth for yourself and future generations. Remember to consult with a qualified tax advisor or financial planner to develop a personalized tax planning strategy that aligns with your goals.

Macro tax planning can help you navigate the complexities of the tax system. It can also help you and/or your heirs keep more of the money you worked hard to earn throughout your lifetime. Start exploring the potential tax benefits of Roth conversions today and pave the way for a tax-efficient retirement. If you would like a complimentary review of your situation and a better understanding of whether or not a Roth conversion strategy could be beneficial, please click here to schedule a complimentary review.

Don’t forget to look for our video blog next week. It will walk you through an example of the potential benefits that Roth conversions can provide.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics including your investments, creating your life plan, working on your financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn, Facebook, and Twitter.

Phil Weiss founded Apprise Wealth Management. He started his financial services career in 1987 working as a tax professional for Deloitte & Touche. For the past 25+ years, he has worked extensively in the areas of financial planning and investment management. Phil is both a CFA charterholder and a CPA.

Located just north of Baltimore, Apprise works with clients face-to-face locally and can also work virtually regardless of location.