Note: This blog was updated in August 2024. You can find the most up-to-date version here.

Do you know if Social Security income is taxable? This question does not have an easy answer. It might be. But then again, it might not be. In short, the answer depends on your overall tax situation.

To determine the tax paid on your Social Security benefits, you must calculate your provisional income first. You can’t find provisional income on the face of your tax return. There you will see terms such as taxable income and adjusted gross income. Provisional income isn’t either one of those. It includes:

- All income that would normally be taxed (wages, pension benefits, interest, dividends, business income, capital gains, etc.)

- Some non-taxable income (tax-free municipal bond interest)

- One-half of your Social Security benefits

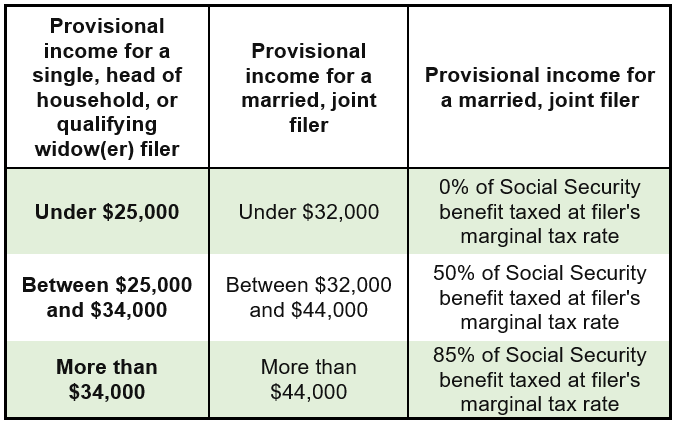

After calculating your provisional income, you will know how much of your Social Security benefits are taxable. The table can help you determine how much of your benefits may be subject to tax.

Even if you exceed the highest threshold in the above table, you won’t pay tax on at least some of your Social Security benefits. Under current tax law, you do not pay income taxes on at least 15% of your Social Security benefits.

In certain situations, increasing your income can have unintended tax consequences. The following example can help you understand what can happen. This handy calculator from the IRS can help you determine if your benefits are taxable. This IRS worksheet can help you calculate your taxable benefits as well.

Don’t forget about the state tax implications as well. Most states do not tax Social Security benefits. Beware. If you live in any of the 13 states identified in this article, you will have to pay state taxes on your benefits.

A SAMPLE CALCULATION:

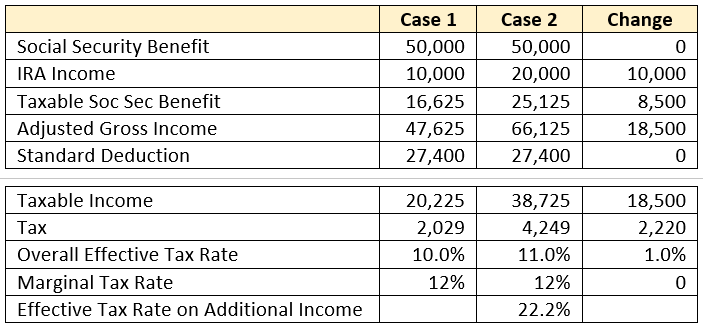

Sally and Bob are 68 and 70 years old. In 2021, they expect to earn the following amounts of combined income: $20,000 in pension benefits, $1,000 in interest and dividend income, and $500 in tax-free municipal bond income. They also plan to withdraw $10,000 from their IRAs. They will receive another $50,000 in Social Security benefits. They have provisional income of $56,500 ($20,000 + $1,000 + $10,000 + $500 + $50,000/2). Based on the provisional income table above, up to 85% of their Social Security benefits will be taxable. According to this IRS worksheet, they have a taxable Social Security benefit of $16,625. They also claim a standard deduction of $27,400. Their marginal tax rate – the rate of tax paid on their last dollar of income – is 12%. They have a total tax bill of $2,029.

Suppose the couple has an unexpected expense of $10,000. They decide to withdraw another $10,000 from their IRA to pay this bill. This increases their provisional income to $66,500. Their taxable Social Security benefit increases by $8,500 to $25,125. This means their taxable income is now $18,500 higher! They still have a marginal tax rate of 12%, but the effective marginal tax rate on the extra income is 22.2%. The decision to take more money from their IRA has some hidden costs. Why? Every additional dollar of pre-tax income increases taxable income by $1.85 because it makes more of their Social Security benefit taxable.

The following table summarizes this example:

The 22.2% effective tax rate paid on the additional income stands out. We refer to this as the “Tax Torpedo.” Recognizing extra income can disproportionally increase your tax bill. It comes into play when your income falls between the lowest provisional income threshold levels (below which you don’t pay any taxes on Social Security benefits) and the point where 85% of all Social Security benefits are taxed. In our example, this would occur when provisional income reaches about $94,500.

Can you avoid the Social Security tax torpedo?

Yes, you can. It takes planning though. If you have other sources of funds, you can potentially pay the additional expenses without increasing your provisional income. You could improve the result if you can take the money from any of the following account types:

- Taxable savings

- Roth IRAs

- Health Savings Accounts (HSA)

- Taxable brokerage account

Withdrawals from your Roth IRA do not impact your provisional income. They also do not affect the taxability of Social Security benefits.

An HSA can also be a source of funds to cover these expenses. People often don’t realize that you do not have to use your HSA for current medical expenses. As long as you have documented your unreimbursed healthcare expenses during the period when you had a high deductible healthcare plan (HDHP), you can withdraw funds from your HSA tax-free. (For more on HSAs you can also see this blog.)

In the case of a taxable brokerage account, you could pay capital gains taxes, but in our example, Sally and Bob’s income falls in the 0% capital gains tax bracket. They would still see a bump in their taxable Social Security benefits, but the overall rate would be lower than the effect the tax torpedo has in our example. They would also have some cost basis in whatever asset they sold, which would lower the taxable amount.

You should also consider the advantage of diversifying the types of accounts you have for your retirement savings. It can provide benefits in situations such as this. If you have not diversified your account types – or even if you have – you may also want to consider Roth conversions at the right time. A proactive Roth conversion strategy can reduce your overall tax bill. In particular, you want to consider Roth conversions when you have a lower marginal tax rate.

What About High-Income Taxpayers?

If you are a high-income taxpayer, your other income levels, especially after your required minimum distributions (RMDs) begin, will result in 85% of your Social Security benefits being taxed. But you should still be concerned with how you withdraw funds from your savings in retirement. Your withdrawal strategy can affect your future Medicare premiums.

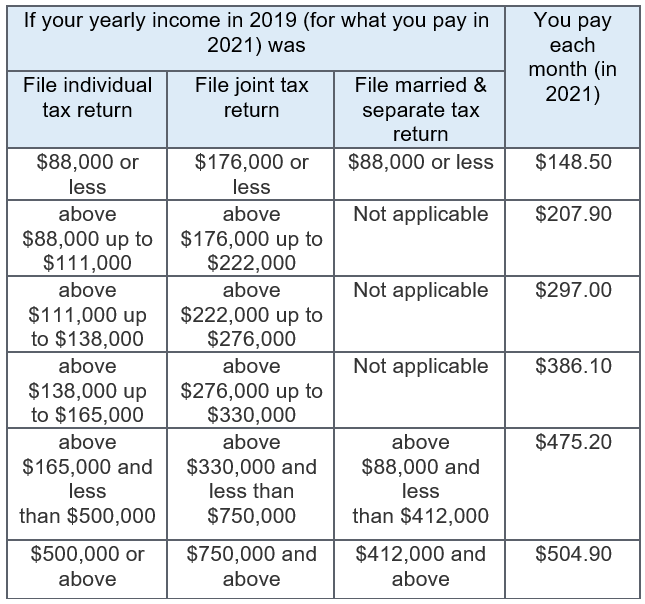

Since the passage of the Affordable Care Act, retirees must pay higher Medicare premiums as their income level rises. Medicare premiums for the current calendar year are based on modified adjusted gross income (MAGI) from two calendar years previously. (For example, your premiums in 2021 are based on 2019’s MAGI. For Medicare premiums, MAGI equals your adjusted gross income plus your tax-exempt interest.

The following table shows how Medicare premiums increase as your MAGI surpasses certain income threshold levels. The amount in the right-hand column is referred to as the Income Related Monthly Adjusted Amount (IRMAA).

For married couples filing joint returns with income of $176,000 or less, the standard premium for Part B applies. If your MAGI exceeds $176,000 by a single dollar, your monthly premium increases by $59.40 for each spouse covered by Medicare. This equates to higher premiums of $1,425.60 for a couple once their MAGI surpasses $176,000. It is equivalent to a $1,425.60 tax increase, as you must pay this additional amount to the federal government or face penalties. Exceeding each of the $222,000, $276,000, and $330,000 thresholds increases a couple’s Part B premiums by $2,138.40. Your premium increases another $712.80 if your MAGI exceeds $749,999.

These rules are akin to another “Tax Torpedo.” These income-based jumps in Medicare premiums can push your marginal tax rate above 100%. For example, if your MAGI was $175,000 and you withdrew another $2,500 from your IRA in December, you would pay $2,138.40 in additional Medicare premiums plus the tax due on the distribution.

Roth Conversions Count, too

As noted above, Medicare uses the MAGI reported on your IRS tax return from 2 years ago to calculate your premium. (This is the most recent tax return information provided to Social Security by the IRS.) When you retire, you can file Form SSA-44 with the Social Security Administration (SSA) to note this specific life-changing event. The SSA will adjust your income to reflect your work stoppage and retirement. Some other examples of life-changing events include divorce/annulment, death of a spouse, and loss of pension income.

A Roth conversion is not a life-changing event. Thus, if you decide to pursue a Roth conversion strategy, you should pay attention to potential IRMAA as well. Roth conversions increase your MAGI for the current year. They also can lower your MAGI in future years, so you want to consider the full impact.

Closing Thoughts and What’s Next

Social Security benefits and the related tax implications can be complicated. I hope this blog as well as these: Social Security: Some Key Benefit-Related Concepts and Social Security: Some Questions and Answers About Benefits have helped shed some light on this topic.

Social Security will also be the lead topic of this month’s “Ask Me Anything” webinar session. We plan to hold these sessions on the last Thursday of the month going forward. If you have any Social Security- related questions, please join us for this month’s webinar. We will share provide registration details in next week’s blog. We will host the event on Thursday, April 29th at 5 pm.

In the meantime, if you have any questions, please send an email to philweiss@apprisewealth.com or schedule a free call.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above information valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or virtual meeting via Zoom.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/