In today’s Tuesday Tips video, I address the question, “Will My Retirement Tax Bill Be Too Big?” I also provide an example of how long-term tax planning through Roth conversions can meaningfully reduce your long-term tax bill. I go through how current and future tax rates could inform the decision-making process and how Roth conversions can help. Please watch the video below to learn more. If you would like a free review to help determine if long-term tax planning could help lower your retirement tax bill, please use this link to schedule a free call.

An edited transcript follows:

Hi. Phil Weiss of Apprise Wealth Management here. Welcome to this week’s edition of Tuesday Tips.

In last week’s blog, which is called Will Your Retirement Tax Bill Be TOO BIG?, I talked about the idea that we could lower our lifetime tax bill by thinking about macro tax planning, or planning while taking more than one year into consideration instead of what we usually do, which is: just thinking about taxes when it’s time to file a return.

We can lower our overall tax bill. This could make us pay less taxes during our lifetime, or during our spouse’s lifetime if we pre-decease them. If there’s money left over, we can also make it easier on our kids. Those are all benefits of Roth conversions. I’ve written a blog on this topic in the past.

Last week, I also promised that I would go through an example to show what I’m talking about in terms of how Roth conversions can help. So first, I’m going to share my screen and we’re going to take a look at tax rates.

What we can learn from the current tax rates

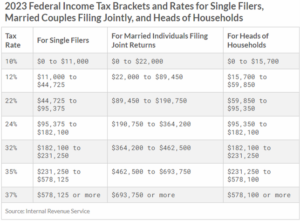

Here we have tables showing the current tax rates. You’ll see that rates range from 10% to 37%. These are federal rates, not state rates. (While state rates are a consideration, we’re not talking about those today). Let’s look at where we have some big breaks in rates. We have 10% and 12%. Then there’s a big jump up to 22%. Then we have 24%, and there’s a big jump up to 32%. There are also smaller jumps to 35% and 37%.

A lot of times when I’m talking about the idea of doing Roth conversions, I talk about the concept of bracket stuffing. What that really means is we look at this table in 2023 if I’m already in the 22% bracket, I might want to think about going up into the 24% bracket. If I look at what my future income might be – I might not. But I definitely want to stay out of that 32% bracket. So, I’m going to figure out how much tax I’m comfortable paying. Or how much income I’m recognizing, keeping the brackets in mind. If I’m in the 12% bracket, I’m probably not going to do a Roth conversion to take me to the 22% bracket. If I’m in the 24% bracket I’m probably not going to do a Roth conversion that takes me up into the 32% bracket.

There’s a reason I have these other brackets on the right. The other thing that I want to consider is that at the end of 2017, they passed new tax legislation, which became effective beginning in 2018. That’s when the rates that we have for 2023 came into play. Before that, we had the rates on the right. If no legislation is passed between now and the end of 2025 on tax rates, we’re going to go back to the old system in 2026 because that 2017 tax bill was only for eight years.

You can see if we look at that 24% rate you see it goes up to $364,200. Well, under the old rates, if you have over $233,350 of taxable income, you’re in the 33% bracket.

That’s another reason that doing a Roth conversion now could make a lot of sense because it could keep money out of that 33% bracket.

A look at your retirement tax bill without Roth conversions

Let’s go ahead and go into my planning software. If we do that, we can get a look at some of the basic facts that I laid out for this couple.

Let’s assume they’re three years apart in age. They have $50,000 in the bank. They have $1,250,000 in investments. Of that, $250,000 is in a taxable account, the other million dollars is in their IRAs. They have no Roth savings. They do not have a health savings account. I limited the types of accounts they have for the purposes of this example.

Instead of using the information in the software in Right Capital, I extracted it into Excel so I can show you what happens to tax rates more easily.

What we’re going to do is we’re going to share a different screen that’s going to show information about their income. Give me one second and I’ll bring that up on the screen for you.

This example assumes that there’s no Roth conversion. You’ll see that there are no plan distributions here until line 18, the year 2038 when he turns 75 because that’s when his RMDs (Required Minimum Distributions) start.

If we go a couple of years further, then her RMDs start. That’s in 2041, line 21 on the Excel spreadsheet, they’ve got $240,000 worth of planned distributions. This other income inflow, that’s going to be Social Security income. That’s all I really gave them. They’ve got $380,000 in total inflows and they’re paying $89,000 in taxes.

If we keep going out when he’s 83 and she’s 80, if they both live that long they’re going to have almost $327,000 of planned distributions. That’s their required minimum distribution. They’re going to have $480,000 plus of total inflows. According to the current rates they’re going to pay $127,000 in tax. Again, this is making no Roth conversions at all.

If we look down here, you’ll see (I’ll make the columns freeze so it’s a little easier for you). You’ll see that their total taxes paid are $4,466,769 if we don’t do Roth conversions.

The other thing you don’t see here is that this couple is going to start claiming Medicare benefits. They’re going to need them for their health insurance.

There’s an adjustment for Medicare premiums called the Income Related Monthly Adjustment Amount (or IRMAA). That’s based on income. Your premiums increase based on your income. With these big income numbers and these big distributions, they’re going to pay pretty significant IRMAA adjustments over time.

How Roth conversions can change your retirement tax bill.

Now I’m going to stop this share, and I’m going to show you what happens if we start to do Roth conversions.

What I did for this is I did $25,000 a year in the current year. Because of what their current marginal tax bracket is, that still made it easy for them to stay where they were – the 24% bracket. Then I did $75,000 in the future instead. I increased it as time went on.

You can see that the plan distributions are less than they were before. I didn’t make a comparison here, but you can see that they never get to the big $400,000 plus distribution that we had in the first example. Again I’m going to freeze this I’m going to freeze the panes. That way you can see how much they paid in taxes.

You’ll see this time the total tax bill is $3,373,464. By doing these Roth conversions, this is assuming that both members of the couple live to 95, they would pay about $1.1 million less in taxes over their lifetimes by doing these Roth conversions.

As I said in the first example, this would also reduce their IRMAA adjustments, which means that the total savings are even greater.

I’m going to do one more thing. I’m going to go back to that first file that I shared which has the tax rates on it.

If we look at that one, we’ll also see at some point it’s likely that one of them pre-deceases the other. When that happens, the survivor is going to be single, instead of married, for tax purposes.

The lower amount of Social Security income that’s the lower of the two is going to go away, but those IRAs are most likely going to go to the surviving spouse. After that, they’re left at the end for their children, their heirs, or whatever they want to do with the money. If they don’t have any children, the money could go to charity.

The key thing here is to look at what happens to their tax rates. If you look at the current rates remember I said that the 24% bracket went up to $364,200? If you’re single it only goes up to $182,100.

But let’s go over here and look and see what happens in the future if they don’t change tax rates. Now that 33% bracket starts at $191,650.

The Survivor is easily going to be in the 33% bracket if we don’t do Roth conversions. They can even end up in the 35% bracket because they’re paying single rates.

The other thing to consider is that if there’s money left at the end, under the current rules if you have an inherited IRA, you have 10 years to pull the money out. If it’s in a taxable inherited IRA, you have to pull out a required minimum distribution each year.

Those big numbers are going to be added to whatever other income they have. They’re big distributions because they only have 10 years to clear the money out.

That could make them pay even higher taxes.

If you pass on Roth funds, they still have 10 years to pull the money out, but they can let it sit for 10 years because there are no required minimum distributions with inherited Roth IRAs, and they’re not going to pay taxes.

Closing Thoughts

This example should help you better understand how you can lower your retirement income tax bill in three different ways. It could lower the amount of taxes paid by you while you and your spouse are alive. The amount of taxes paid by your surviving spouse could be lowered, too. It could lower the amount of taxes paid by your heirs, too.

In short, these Roth conversions could benefit you, your surviving spouse, and your heirs and if you want to read more about that I’ve written another blog on that.

I hope you find this helpful. I’ll be back again next week with Apprise’s five favorite reads of the week. Thanks for listening and have a great day.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. If you do, we would be happy to have a conversation. You can also schedule a call or a virtual meeting via Zoom.

Follow us: Twitter Facebook LinkedIn

For firm disclosures, see here: https://apprisewealth.com/disclosures/