In this week’s Tuesday Tip video, learn how to use the 1% auto-increase savings strategy to capture your 401(k) match, pay down high-interest debt, and pay your future self first—without feeling it. Please watch the video below, or read the transcript that follows, to learn more.

This week, I’d like to address the 1% auto-increase savings strategy.

If you do just one thing today: raise one savings line by 1%. It’s a tiny change your future self will thank you for.

I’m Phil Weiss from Apprise Wealth Management.

In my practice, I see this pattern: after divorce, widowhood, or an empty nest, big money decisions feel heavy. So, we start small—with the 1% auto-increase savings strategy. It’s simple, automatic, and respects your energy as life shifts.

Let’s Take a Closer Look at the 1% auto-increase savings Strategy:

1) Choose where the 1% goes, in order.

- Your first priority is to capture your full 401(k) match. If you’re not contributing enough to get the full match, direct the 1% there first. Two reasons: (1) employers set compensation assuming you’ll take the match—skip it and you’re leaving pay on the table; (2) a typical structure is receiving a 50% match on the first 6%—that’s effectively a 50% boost to your contribution. It’s equivalent to an automatic 50% return on your investment, which nobody can consistently beat.

- If you’re already getting the full match, aim the 1% at high-interest debt (like credit cards). Paying off 18–20% interest is a strong, risk-free win for both your current and future selves compared with uncertain market returns.

- Next steps: increase retirement savings toward the 2025 401(k) limits (elective deferral and catch-up if you’re 50+), and, if you have a Health Savings Account (HSA)-eligible plan, work toward 2025 HSA limits (with catch-up at 55+). After that, consider a backdoor Roth IRA (if eligible) or a taxable brokerage account to diversify by tax treatment.

2) Do it now—an example of how to make this change.

- On your company intranet, open Payroll or your plan/custodian portal.

- Find “Contribution” or “Auto-transfer.” Change 10% → 11%, or $300 → $303. Save.

- Add a calendar reminder for +1% in 90 days.

- If the target is debt, schedule an automatic extra payment equal to that 1%.

3) Make it invisible.

This change represents an example of the benefits you can realize when you Pay Yourself First—money moves before you see it. Keeping the 1% auto-increase savings strategy running makes progress painless and automatic.

Smart Timing

A great moment to do this is when you get a raise. Increase your savings by 1% (or more) at the same time. You’ll still bring home a bit more, and you’ll lock in higher savings without really feeling it—the ultimate Pay Yourself First move for your future self.

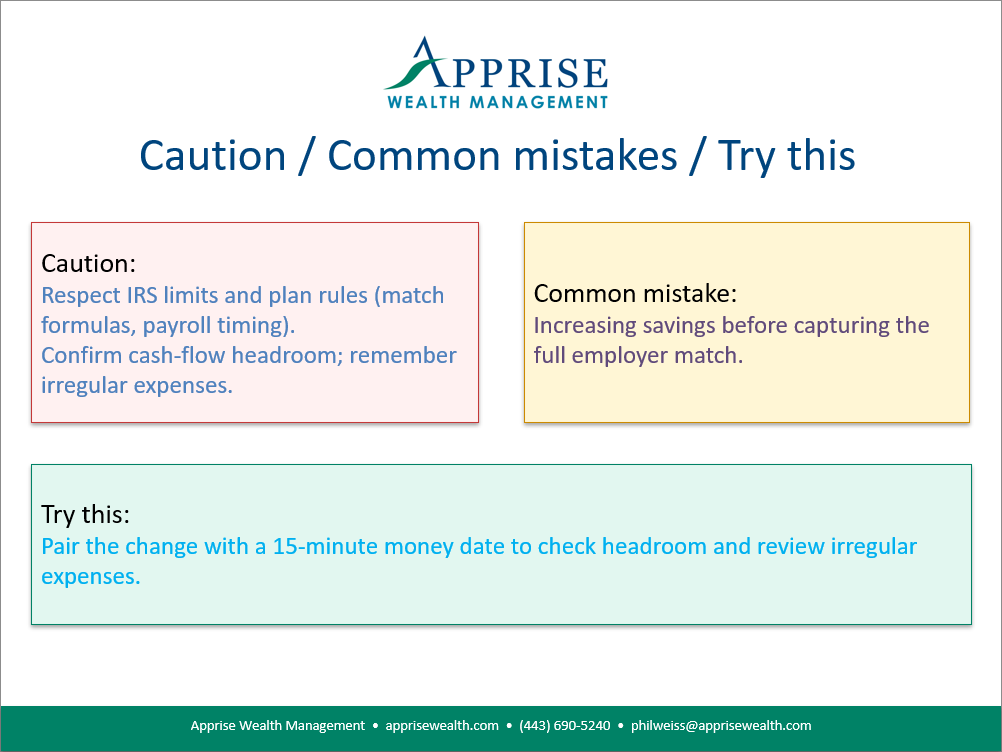

Caution. Don’t Forget to Consider the Following When Applying the 1% Auto Increase Savings Strategy:

- Plan rules & IRS limits: confirm match formulas, payroll timing, and annual contribution limits before increasing.

- Cash-flow headroom: ensure bills clear comfortably, and remember to account for irregular expenses.

- Debt priority: if you already capture the entire company match, directing the 1% to high-interest balances is often the best next move.

One note before we finish: If you’re watching this video, please refer to the transcript on our website: www.apprisewealth.com to review the blogs discussing some of the key points in more detail.

Final Thoughts

One account, with a 1% increase today, followed by another 1% increase to either the same or a different account in 90 days. Small, automatic moves compound into meaningful change for your future self. If you’d like help prioritizing where your next 1% should go, schedule a call—and subscribe for weekly tips.

FAQs

Q1: Where should my 1% go first?

A: Capture the full 401(k) match. Then target high-interest debt, then increase retirement/HSA, and consider a Backdoor Roth or taxable.

Q2: Will I feel a 1% increase in my paycheck?

A: Usually not much. That’s the point—small, automatic steps that your future self will appreciate.

Q3: When’s the best time to start?

A: Raise day is ideal—boost savings by 1% as your pay increases.

Q4: What if cash flow is tight?

A: Start with 1% and reassess in 90 days. Ensure bills clear comfortably and review irregular expenses.

Q5: What about HSAs and Backdoor Roths?

A: If eligible, HSAs can be powerful; Backdoor Roths or taxable accounts can add tax-diversified flexibility.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics, including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us: Facebook LinkedIn Instagram YouTube

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/