Pay yourself first. When it comes to developing a regular plan for savings, remember those three words.

Retirement can be a scary proposition. Unfortunately, most people simply are not saving enough for retirement. As a result, they enter retirement unprepared.

Pay Yourself First

If you are not familiar with the term, “pay yourself first” means automatically routing a specified savings contribution from each paycheck to a specific savings or investment account upon receipt. Because your savings contributions come before you even see or touch the money, you are paying yourself first. You are paying yourself before you begin paying your monthly living expenses and making discretionary purchases.

Paying yourself first helps remove the temptation to skip a contribution and spend funds on expenses other than savings. Contributing to your savings account on a regular, consistent basis can play a significant role in helping you build a long-term nest egg. It can help you secure your future and create a cushion for financial emergencies, such as your car breaking down or unexpected medical expenses.

Build a Budget

Consider taking the 50/30/20 approach when allocating your income. This method allocates 20% of your income to savings and debt repayment, 50% to necessities, and 30% to wants. For example, if your monthly income is $5,000, reserve $1,000 for savings and debt repayment, $2,500 for necessities, and $1,500 for wants.

How do you pay yourself first? Consider automation. Set up contributions from your pre-tax salary to your 401(k), if you have one. Use an app or log into your bank’s website to schedule automatic transfers from your checking account to your savings account or IRA.

If you don’t think you can afford everything you want to do, take a closer look at your expenses and see where you can make some cuts. Maybe that means bringing your lunch to work or buying fewer expensive cups of coffee.

What Happens When You Finish School and Start Working?

One of the biggest keys to building wealth is saving adequately. Often, when we start working, we focus on paying down outstanding debt first. Later on, we start saving for long-term goals. However, if we wait, we are putting ourselves further and further behind. In order to get ahead, focus on both – reduce debt and save for long-term goals like retirement. The decision as to where your focus should be is not easy but waiting to start saving, especially when your employer matches at least a portion of your retirement savings is akin to turning down free money.

The Benefit of Starting Early

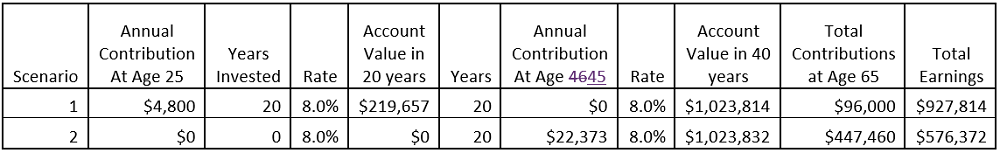

Especially when we are young, thinking about saving for a retirement that is many years away is hard. It may also cause us to delay saving for retirement. But, waiting can materially impact the size of our nest egg. Here’s an example: say you start saving at age 25 and contribute $4,800 a year for 20 years earning an annualized average rate of 8%. Then you stop adding to your account while it continues to compound at 8% annually. At age 65, you will have $1,023,814. In sum, you will have contributed $96,000 ($4,800 per year for 20 years) and earned $927,814 almost 10-times what you invested.

Instead, assume you delay saving, putting away nothing from the ages of 25-44. To have roughly the same amount at 65 as the early saver, you will have to invest about $22,373 per year using the same 8% annual return assumption. You will contribute a vastly larger sum of $447,460 over twenty years, almost five-fold the early saver’s total contribution. Your earnings will only be about 1.3-times your contributions as well.

This is also an example of the power of compound interest. Albert Einstein is credited with saying, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

How Much Should I Save for Retirement?

A simple rule of thumb is to save roughly 25-times your annual spending for retirement. If you anticipate living off $100,000/year in retirement, you will need to have $2.5 million set aside. This calculation does not consider inflation or spending more in retirement on other things such as healthcare and travel.

Write It Down

Don’t be too hard on yourself. If you are committed to saving or paying off debt, automate it so that money is moved without you ever having to take further action. Write your goal down. Experts across the board agree this helps cement your goal. When it comes to saving, remember how we started: Pay yourself first.

We hope you find the above posts valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for your retirement please complete our contact form, and we will be in touch. We can schedule a call, a virtual meeting via Zoom, or a meeting at Apprise Wealth Management’s office in Northern Baltimore County.

Follow us:

Please note that we post information about articles we think can help you make better decisions about money on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/