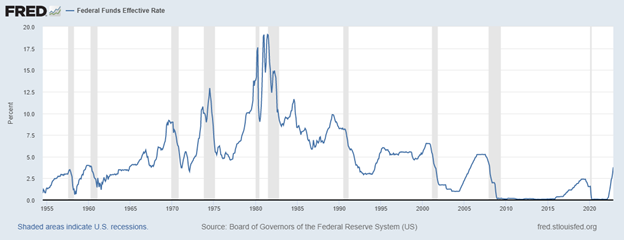

Individual bonds or bond funds, which should you choose when investing in fixed-income securities? If asked this question today, you might answer differently than you did at other times over the last few years. Why? The environment for fixed-income investing has changed. The Fed Funds rate (see below) is at its highest level since the 2008 financial crisis. According to The Wall Street Journal, the spread between investment-grade and high-yield corporate bonds has widened from about 2% to a little more than 3% since the year began.

Recently, more clients and prospects I speak to ask about investing in fixed income and owning individual bonds. Until recently, the fixed-income allocation in Apprise’s client portfolios did not include any individual bonds. With the increase in short-term rates, I am now shifting at least the short-term treasury bond allocation to Treasuries. The risk associated with Treasuries is low. Transaction costs are also low. You can come close to locking in a return for a Treasury bond’s term. This can also reduce volatility.

Investing at Apprise

When it comes to investing, at Apprise, we favor the simple over the complex. We want to avoid financial catastrophes as best as possible. That means avoiding manias and questionable investments. For example, in this blog post, I shared some perspectives related to some recent “hot” investments. I said the following:

Any of these assets can make good investments if the purchase – and sale – are well-timed. They also add more of a trading or speculative element to your portfolio. Is that what you want from the money you save for your future? Probably not. None of them are held in any Apprise client’s portfolio.

Individual Bonds or Bond Funds in A Low-Rate Environment

With interest rates at such low levels for so long, the most difficult question for most fixed-income allocation within most investor portfolios revolved around how much to allocate to fixed-income investments. Did the decision to use individual bonds or bond funds have a significant impact on returns? Fixed-income portfolio managers would likely argue it did.

But that’s not the case for most investors. Either way, you couldn’t earn much income. In either case, the associated interest rate was low. The spread between investment grade and low-quality (junk) bonds was narrow. That left investors with little compensation for assuming more risk.

Some investors argued that you should increase your stock allocation to compensate for low bond yields. But that can change the risk profile of your portfolio. Most investors don’t want to do that.

Bond Prices and Interest Rates

Bond prices or values move in the opposite direction of interest rates. When interest rates fall, bond prices rise. When interest rates increase, bond prices fall. Why? Consider this. Assume you hold a one-year bond paying 4% annual interest (the coupon rate). If rates increase to 5%, you will want to earn that higher rate. If rates fell to 3%, a bond paying 4% would have more value.

Assume you own a bond with a face value of $1,000. If rates increased from 4% to 5%, all else being equal, the value of a bond paying 4% interest would fall to $990. That way someone who purchased it would still earn $50. $40 in interest plus the additional $10 you would receive when the bond matured.

Similarly, if rates fell to 3% the value of a bond paying 4% would increase. All else being equal, you would receive $1,010 for this bond. In this case, you would earn $30. In other words, $40 in interest less the additional $10 paid to buy the bond.

Individual Bonds or Bond Funds – Other Factors

Higher interest rates do not directly correlate to higher yields for bond funds. Bond funds may hold their current basket of low-coupon bonds until they mature. They may only be replaced over time. That means it can take longer for the fund’s overall yield to increase to market levels.

Individual Bonds or Bond Funds – Bond Funds

Bond funds – primarily exchange-traded funds (ETFs) for Apprise – can provide broad diversification. Due to their larger size, bond funds can hold more bonds than an individual can own.

You can also find low-cost funds. Bond funds that invest based on an index have low manager risk as they typically invest based on that index. That also reduces the risk of significant underperformance relative to that index. Your return comes from the small interest or coupon payment paid by the bonds held in the fund. In a falling rate environment, the principal value can increase as well. That increase can lead to additional gains. When rates fall, the opposite happens. Higher rates lead to lower bond values. In this case, the losses may more than offset the current income earned.

Many bond funds pay monthly rather than quarterly dividends, which can provide cash flow benefits. Trades in a bond fund are typically larger, which can benefit transaction costs. For example, the bid-ask spread can vary by trade size. (See here if you would like to better understand bid-ask spreads.) The size of the bid-ask spread is typically smaller for larger transactions.

Depending on position size, it’s easier to buy or sell a bond fund than an individual bond. That makes the shares more liquid – easier to turn into cash.

In summary, compared to individual bond holdings, bond funds offer investors the following advantages:

- Broader diversification

- Lower costs

- Better cash flow

- Greater liquidity

Individual Bonds or Bond Funds – Individual Bonds

I’ve highlighted several advantages of holding bond funds. But holding individual bonds can provide benefits, too.

In general, these advantages relate to having more control over which bonds you own and avoiding the fund’s operating expenses. Investors can also manage taxes at the individual security level. This makes it easier to harvest tax losses. But that may not matter if you hold your bonds to maturity.

Investors in individual bonds also get greater control over the credit quality and the term of the bonds they hold. The term matters because bonds long-term bonds are more sensitive to changes in interest rates than short-term bonds.

If you factor in maturity dates, holding individual bonds can also provide investors with greater control over portfolio-related cash flows. You can align maturity dates with future cash needs.

Holding individual bonds to maturity can also limit volatility. As with stocks, bond prices fluctuate daily. But if you hold the bond to maturity, these daily price changes don’t matter. Unless the bond defaults or gets called, you will receive the bond’s par value when it matures.

The disadvantages of holding individual bonds include higher transaction costs, less liquidity, and greater risk. It’s harder to rebalance a portfolio of individual bonds as well.

Individual Bonds – An Example

Assume you purchased XYZ Bond today at par ($1,000). The bond has a 5% coupon and a three-year term. When the bond matures in December 2025, you will get back your principal ($1,000). While you hold the bond, interest rates can go up or down and the bond’s value will change on a daily basis. But price movements only have an impact if you sell the bond before it matures. If you hold it to maturity, you get your money back. What may look like a gain or loss on your statement won’t matter when the bond matures. You get back what you paid.

What happens if the same hypothetical XYZ bond trades at $900 today? Assume the bond still pays the same 5% coupon. It may look as if the bond has fallen 10% in value. But that’s only true today. If you hold it until it matures in three years, you will still get $1,000 for it. You only suffer a loss if you sell it before it matures. When building individual bond portfolios, you should strive to hold all bonds until maturity.

Consider a bond ladder

When you own individual bonds, the time to maturity gets shorter for each bond while you hold it. This can impact your portfolio’s risk profile. It can also increase the impact of changing interest rates on your portfolio.

To combat this risk, you can implement a bond ladder. For example, you could buy similar amounts of bonds maturing in each of one, two, three, four, and five years. When the one-year bonds mature, you would then purchase new five-year bonds. You would repeat this process annually.

Individual Bonds or Bond Funds – Some Additional Risks to Consider

You should keep in mind that this plan still poses some risks. If inflation rises, you lose purchasing power. The bond issuer could have financial trouble and default. At the same time, knowing how much you will earn and when you will get your principal back has value – at least emotionally.

You may also face call risk. If a bond has a call provision, the issuer can repurchase and retire the bonds. The call provision may be triggered by a preset price. There may also only be a specified period in which the issuer can call the bond.

Individual Bonds or Bond Funds Summary

This question does not have a specific right or wrong answer. It depends on each investor’s unique situation and considers factors such as the preference for convenience or control. In most situations, it makes more sense for investors to own low-cost bond funds. But the current environment as well as individual circumstances can change that answer.

Owning individual bonds adds complexity and a level of understanding. Most investors no longer want to own individual stocks. Owning individual bonds can add even more complexity to your portfolio.

Your decision likely rests on how comfortable you are in buying individual fixed-income securities. Your emotions may matter here as well. Returns on fixed-income securities have not provided the buffer against the down market that we normally expect. Owning individual bonds could give you an emotional edge. As always, be careful about letting your emotions play too prominent a role in your investing. Letting your emotions dictate your portfolio decisions can damage returns.

I hope you find the above discussion helpful. If you have questions or would like some help determining what might be best for you, please schedule a free call. I’ll gladly answer any questions and assist in whatever way I can.

I’ll be back next week with “Apprise’s Five Favorite Reads of the Week.”

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us: Twitter Facebook LinkedIn

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/