As previously published by Home Action News on February 5, 2019

If you are saving for retirement, your time horizon should be long-term, especially when you are early in your career. In fact, since the typical average life expectancy for a new retiree is at least 10-15 years, one could argue that even when we first retire, we have a long time horizon. As a result, one would think the average investor would hold onto their stocks or mutual funds for years. However, this is far from the case. According to the most recent available data, on average, today’s investor holds an individual stock for about four months. This is a substantial decline from the 1960s when the average holding period exceeded eight years.

Short holding periods also lead to increased costs:

- Commissions are higher

- You can potentially pay higher taxes

- Each stock has a “bid” and an “ask” price. This spread increases your costs.

A Google search for the phrase “long-term investing is dead,” yields about 23.3 million results. While not every narrative on the subject answers that question with “yes,” many do. Here are two of my favorite headlines from this search:

- “27 Reasons Why Long-Term Investing is a Bad Idea”

- “Investing for the next 10 years? Are you nuts?”

In today’s information age, apparently actionable information is readily available. It is so easy to trade stocks that some investors are willing to dump a stock at the slightest hint of bad news. Many also chase short-term performance. In fact, short-termism is unequivocally one of the most serious behavioral biases investors must overcome in their attempts to achieve positive returns. Psychologists view our innate preference for short-term rewards – or instant gratification – over long-term gains as an element of the human condition that extends to many elements of our behavior.

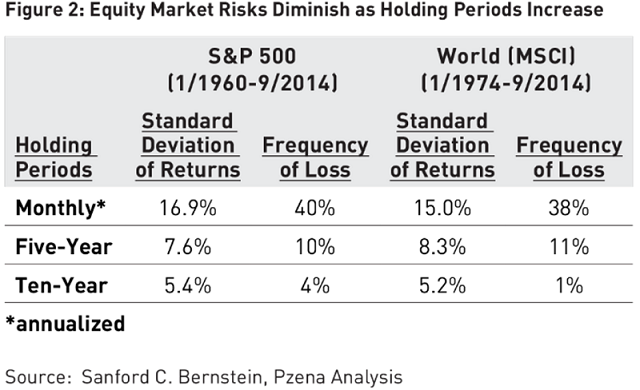

Market volatility also contributes to investor tendencies to favor a short-term approach. Standard deviation is a common means of measuring volatility. If you are not familiar with this term, think of it this way: Assume you are given a group of numbers and are asked to calculate the average value (mean) of those numbers. Standard deviation measures the difference between each data point and the mean – or how spread out the numbers are. The standard deviation of the returns on stocks held in a portfolio is a common measure of risk or volatility.

We can also think of risk in terms of what is the chance an investor will suffer a loss when investing in a particular security. By holding stocks for longer periods, investors can reduce both types of risk.

As shown above, a longer holding period reduces the volatility of returns and lowers the frequency of loss. In addition, today’s stock price only represents the market’s best guess of a company’s long-term value. When investor’s place too much emphasis on short-term rather than long-term news, a company’s share price can fluctuate much more than it should.

Online stock quotes include both 52-week high and 52-week low prices. This range can be quite wide. For example, shares of Amazon (Nasdaq: AMZN) closed as low as $1,265.93 on February 9, 2018, and as high as $2,050.50 on September 4, 2018. The high price is more than 60% above the low price. While no one can expect to buy every (or even any) stock at its low, the size of this disparity is indicative of the opportunity the general market’s short-term thinking can present to investors with a long-term approach.

It is also unlikely that the intrinsic value of Amazon increased so dramatically over a seven-month period. Stock prices tend to overreact on the way down as well as the way up. Long-term investors can benefit from this volatility, as short-term dislocations may provide an opportunity to buy quality stocks at discounted prices.

It can often help to turn to the advice of some of history’s most successful investors when trying to answer philosophical investing questions. That can certainly apply in this case. For example,

- Warren Buffett, Chairman of Berkshire Hathaway: “If you are not willing to own a stock for 10 years, do not even think about owning it for 10 minutes.”

- Philip Fisher, Author of Common Stocks and Uncommon Profits: “If the job has been correctly done when a common stock is purchased, the time to sell it is – almost never.”

- Seth Klarman, President and CEO of Baupost Group: “The single greatest edge an investor can have is a long-term orientation.”

If you invest, ignore the naysayers. Take a long-term approach. If done properly – seek help if you are not comfortable investing on your own – it can increase your chances of success.

Follow us:

Please note that we post information about articles we think can help you make better decisions about money on LinkedIn and Facebook.

Phil Weiss founded Apprise Wealth Management. He started his financial services career in 1987 working as a tax professional for Deloitte & Touche. For the past 25+ years, he has worked extensively in the areas of financial planning and investment management. Phil is both a CFA charterholder and a CPA.

Located just north of Baltimore, Apprise works with clients face-to-face locally and can also work virtually regardless of location.