Have you ever thought about bucket list planning? We all have bucket list goals we imagine pursuing someday. They could include traveling the world, learning a new skill, or taking up an exciting hobby. However, treating these goals as indefinite plans we’ll eventually get to can result in missing out on key experiences. Our physical abilities, energy, and time are not unlimited resources. Without setting a timeline, we risk missing out on them simply because we wait too long.

I recently read Bill Perkins’ book Die With Zero. In it, he introduces the idea of the “health line,” or how our physical and mental abilities naturally decline as we age. No matter how much money we save, we won’t be able to fully enjoy life’s most demanding experiences if we no longer have the health or energy for them.

Perkins highlights how certain activities – like adventure travel or physically demanding experiences – become more difficult with age. As a result, timing your spending to align with your health and life stages is critical. This approach helps keep you from saving all your money for a time when you may no longer be able to fully enjoy it.

This aligns with his broader “Die With Zero” philosophy, which encourages maximizing life’s fulfillment through timely and intentional spending, particularly focusing on what he calls “memory dividends” – the long-term joy gained from experiences.

The Illusion of “Someday”

The concept of “someday” is deceptively comforting. It allows us to postpone experiences indefinitely, thinking we’ll always have time in the future. But this is a dangerous mindset. Life is governed by finite resources – particularly health, energy, and time. Delaying our bucket list items can cause us to miss out on them as we age.

We often want to travel the world in retirement. We assume we will have the time and money to do so. Unfortunately, retirement often arrives just as health begins to decline. This can limit our ability to take long-haul flights, physically demanding trips, or even go on simple walking tours in new cities. These activities may be far more difficult or exhausting than they would have been at a younger age.

An Example

A client shared a story about her trip to the Great Pyramids with her husband. They were lucky to visit when they could still climb the many steps and navigate the tight spaces. Many older tourists could not go inside due to physical limitations. If my client had waited as long as some of the other tourists, she might have been in the same boat.

The message is clear. Our ability to enjoy physically demanding or high-energy experiences diminishes as we age. Money cannot reverse aging’s effects.

This real-life example shows why aligning your bucket list with your health is important.

Putting This Into Practice

This June, my wife and I will be married for 30 years. Our 25th anniversary was during COVID, so we couldn’t go anywhere special to celebrate. She asked if I wanted to go on a cruise to Alaska to celebrate our 30th. I said, “I would love to go on a cruise to Alaska, but not yet.” The cruise she had in mind would not be physically demanding. I said I would rather go when we had less physical capacity.

None of us knows when we’re going to die. Not going now could mean we never go. However, we still have the opportunity for a special experience. Yes, you might never get to do what you put off. But at least doing the more physically demanding things sooner lessens your chances of reaching a point where you can’t do things you want to do that you haven’t done yet.

Why Timing Matters

To live a fulfilling life, setting goals is essential. Adding bucket list planning to the equation can help. Map bucket list items to the periods when you’ll have the physical and mental energy to enjoy them. Waiting until your 60s or 70s to start tackling physically demanding activities could mean missing out on the full experience.

If hiking Machu Picchu or backpacking through Europe is on your list, aim to do it in your 30s, 40s, or early 50s when your body is still at its peak. Save less physically demanding goals, like writing a book, for later in life when your energy may not be as high, but your creative or intellectual capacity is still thriving.

The Psychological Cost of Delayed Goals

Delaying your goals doesn’t just mean missing out physically – it can also take a toll mentally. Constant postponement can lead to decision paralysis, a psychological state where we avoid acting due to fear or uncertainty. Many people end up feeling regret later in life, not just for what they didn’t do, but for how much time they spent worrying about when they’d eventually do it.

Once we understand time is finite, putting our dreams off can generate long-term dissatisfaction. That’s a cost no amount of wealth can recover.

FOMO vs. JOMO

One of the reasons people delay their bucket list items is the fear of missing out (FOMO) on financial or career milestones. Many prioritize career success or building a large savings account over personal fulfillment. But there’s an emerging mindset known as the “Joy of Missing Out” (JOMO), which focuses on taking satisfaction in the present rather than deferring life’s pleasures for an uncertain future.

By embracing JOMO, you prioritize what brings you joy now – without sacrificing your long-term financial health. You can focus on having meaningful experiences now instead of constantly postponing them for a better financial moment.

Other Reasons We Delay

Several other factors contribute to why we delay pursuing our bucket list items:

- Financial concerns: Many of us think, “I can’t afford this right now,” and defer our dreams until we reach a point of financial security. But waiting for the “perfect” financial moment may mean we miss out on the ideal window health-wise.

- Comfort and routine: Life gets busy, and we fall into routines that make it easier to delay big plans. A small postponement often turns into years of waiting. Suddenly the opportunity has passed.

- The myth of endless time: Many underestimate how quickly time passes and overestimate how long they’ll remain physically capable. This leads to a dangerous illusion that we can always do it “later.”

How This Meshes With Life Planning

Many say the three Kinder life planning questions are about regret. They’re not. They are about avoiding regret. The idea is to identify things you can do now so you don’t regret things you haven’t done at life’s end. Creating a timeline for the activities or goals you want to achieve can help you create context around when you want to accomplish different things.

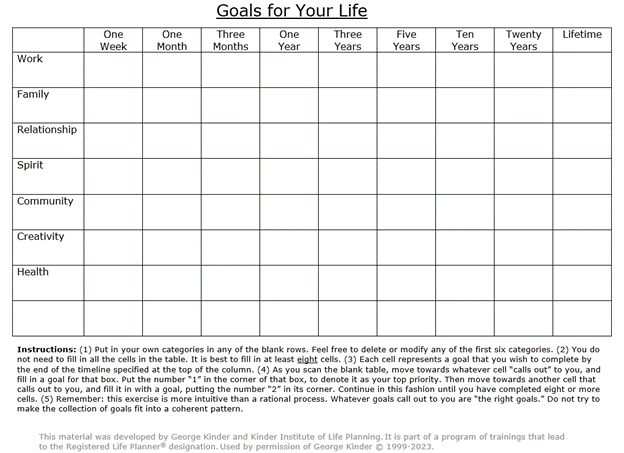

When using the EVOKE® process while working with clients on their life plans, we ask them to complete several inspirational exercises, including the “Goals for Your Life” (GFYL).

The GYFL represents a form of bucket list planning. It helps you put your goals on a timeline.

Bucket List Planning: Mapping Your Health Line to Your Bucket List

How do you decide when to tackle certain goals? Bucket list planning involves creating a prioritization framework based on physical demand and health. Here’s a simple way to think about it:

- Physically demanding activities: Tackle these in your prime, ideally in your 30s, 40s, or 50s.

- Less physically demanding, more intellectual goals: Save these for your later years, when your mental capacity may still be strong but physical ability may have declined.

- Relaxing or passive experiences: These can be enjoyed at any age and don’t need to be rushed.

- Adjust your financial planning: Instead of saving everything for retirement, allocate funds now to experience key life moments during your prime health years.

- Reassess regularly: Life changes, and so do your goals and health. Every few years, reassess your priorities and your health. Always keep your health line in mind when planning what’s next.

The Importance of Health in Achieving Life Goals

Your health is the foundation of your ability to achieve your dreams. No financial planning strategy is complete without addressing health. Prioritizing exercise, mental well-being, and healthy habits now will enable you to enjoy those bucket list items later.

In Peter Attia’s book, Outlive: The Science & Art of Longevity, he says part of being in good shape when you’re in your 60s, 70s, and beyond is taking good care of yourself when you’re younger. For example, to be in good shape in your 60s, you must be in good shape before you’re 60. I often remind my kids that one of the main reasons I work hard to keep in shape is because I want to continue to go places and participate in physically demanding activities with them in the future.

The Ripple Effect of Acting Now

One unexpected benefit of acting on your goals is the ripple effect. Pursuing one dream can often lead to new opportunities and connections you didn’t foresee. One travel experience could open the door to new relationships, new perspectives, or even career shifts.

Living Without Regrets

Life is not just about accumulating wealth for the future. It’s about balancing enjoying experiences now while also securing your financial future. Our physical abilities are as finite as our financial resources. By taking control of both, you can create a life rich in experiences, meaning, and memories—not just savings.

Integrating the Health Line into Financial Planning

To align your financial planning with the concept of the health line, consider the following steps:

- Assess Your Health Timeline: Reflect on your current health and project where you may be in the coming decades.

- Time Your Experiences: Identify key life experiences you want to have, and strategically plan when to do them.

- Reevaluate Retirement Goals: Rather than saving everything for a distant future, consider adjusting your bucket list planning to allocate resources toward meaningful near-term experiences. This might mean taking more vacations, spending more time with loved ones, or pursuing hobbies you’re passionate about.

- Consider Your Legacy: The health line is also about leaving behind more than just money. Investing in experiences that create lasting memories for you and your loved ones often has more value than simply leaving a financial inheritance.

FAQs:

1) What do you mean by “bucket list planning”?

It’s intentionally timing your big experiences so you do the right things at the right life stage. Instead of “someday,” you map each item to a window when you’ll actually have the health, energy, and time to enjoy it; then you fund it on purpose.

2) What’s the “health line,” and why does it matter?

Our physical and mental capacity declines over time. Money can’t buy back cardio fitness, healthy joints, or energy. That’s why physically demanding trips (think: Machu Picchu, long walking tours, adventure travel) belong earlier, while lower-effort goals (writing a book, slow travel, classes) can come later. Align the experience with the body you’ll have.

3) How do I decide what to do when?

Use a simple framework:

- Do first: High-effort/active items (30s–50s).

- Do later: Lower-effort, more creative/reflective pursuits.

- Anytime: Relaxing/passive experiences.

Then budget to the timeline: don’t push every “do first” item into retirement and expect the same experience.

4) I’m worried about the money—how do I balance today’s memories with tomorrow’s security?

Create a “memory fund” inside your plan: automate savings toward specific experiences, right alongside retirement and emergency funds. Pair that with sensible trade-offs (one upgrade you skip = one experience you move forward). The goal isn’t to spend recklessly. It’s to spend intentionally while you’re able.

5) What keeps people stuck in “someday,” and how do I get unstuck?

Common blockers: waiting for the “perfect” financial moment, comfortable routines, and the myth of endless time. Get moving with tiny commitments: put the trip on the calendar, book a refundable hold, start a monthly transfer to the memory fund, or take a local “trial” version now. Action creates clarity.

6) How often should I revisit the list?

Every 12–24 months, or after significant life changes. Health, priorities, and cash flow shift. Re-sort the list by effort level, update timing, and re-aim the dollars. In our life-planning work (As part of our EVOKE® life planning process), we also use a “Goals for Your Life” timeline to keep the plan current and regret-proof.

7) What’s one step I can take this week?

Write your Top 3 “do-while-able” experiences, pick target years for each, and start saving $X per month toward #1. If it’s physically demanding, add a health habit that supports it (training walks, strength work). Put a date on the calendar—even a placeholder—so “someday” becomes a plan.

If you want help mapping your bucket list to your health line—and funding it without derailing your long-term goals—let’s talk.

Conclusion: Bucket List Planning for a More Dynamic Life Plan

Life isn’t just about accumulating wealth—it’s about maximizing experiences while you have the health and energy to enjoy them. Aligning your bucket list planning with your physical health and financial resources, helps you live with fewer regrets and more fulfillment.

Putting your bucket list on a timeline ensures you make the most of your prime years. Your health, like your wealth, is finite. Plan wisely to create a life filled with rich memories and meaningful experiences – not just savings.

Ready to work on your bucket list planning and consider when to achieve your goals rather than simply listing them? Break free from the conventional thinking about financial planning and start building a plan that aligns with your goals and life plan. Schedule a free call to get started today!

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above information valuable. If you would like to talk to us about financial topics including your life plan, your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or virtual meeting via Zoom.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/