Talk to Your Spouse About Finances

I’d like to offer belated Happy Mother’s Day wishes to all the incredible moms out there. I hope you had a wonderful holiday. You deserve it.

In the traditional model, the husband takes care of the family’s finances, and the wife takes care of the home and has primary caregiving responsibilities for the kids. Fortunately, that’s changing as more women become their family’s primary breadwinners. According to this article in Barron’s, the percentage of women who say they take the lead on financial decisions climbed from 21% in 2018 to 26% in 2022. Plus, the number of women who still defer to their spouse on financial decisions also declined by 5% over the same period.

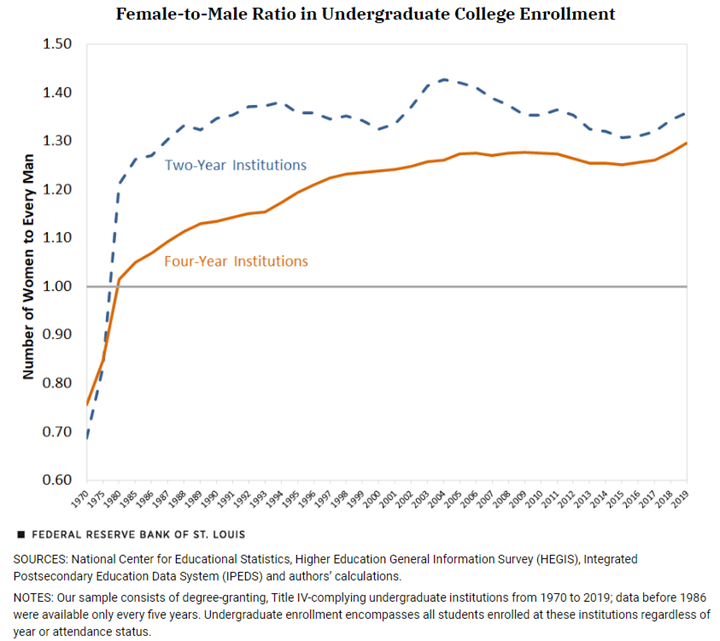

According to some sources, for every man, there are now almost two women attending college. This represents the highest recorded gender imbalance favoring women seen in U.S. college enrollment. (See the following chart from the same source as well.) This trend also supports the idea of women taking a more active role in family finances.

Why Both Spouses Should Be Informed

At a minimum, both spouses should understand the full range of the family’s assets. This includes investments, real property, and personal property. They should also be informed about the family’s debts including mortgages, student loans, personal loans, and credit cards. Knowledge about the family’s income matters, too.

But it goes beyond knowing about these items. It also includes knowing how to access the accounts. Apprise gives new clients a password book to record the username, password, and security hints for all such websites. You can also use an online password manager to maintain this information. If something happens to either one of you, the other needs to know how to access the information. Otherwise, they could be in trouble if one of you passes away or becomes incapacitated.

You should also know the location of your wills and the name(s) of the attorney who prepared them. Plus, you should know about any insurance policies including the name of the agent who sold them. You don’t want to forget about knowing where any documents detailing advanced healthcare directives are stored as well. You should ensure that you both know the name of the family attorneys and accountant, too.

It’s not Always an Easy Conversation

Many people struggle when it comes to discussing finances. As discussed in these articles (see here and here) many couples find it easier to talk about sex than money. Don’t forget how important it is to have discussions about money. You should both know what’s going on. If you work with an advisor, make sure that he or she pays attention to both of you, too. If you’d like some questions that can help you get the conversation started, you can also click here.

This Week’s Five Favorite Reads

This week’s articles address topics such as the fear of missing out (FOMO) and its impact on your finances. I highly recommend this week’s second article. It includes some great questions that can help make you a better parent and person. I recommend you check out the bonus video at the end as well.

Here are the links to this week’s articles as well as a brief description of each:

1. FOMO: The Worst Financial Trait.

As far as ambition is concerned, money works differently. We can ask how we can get smarter or find new skills. With money, the opposite often applies. Our chances of accumulating more money can increase if we get rid of bad traits rather than worry about acquiring good ones. In this article, Morgan Housel, one of the best writers on personal finance, addresses FOMO and money. He provides his take on the benefits that could result if we remove FOMO from the equation.

2. 15 Questions That Will Make You a Better Parent (and Person).

As parents, should we focus on having the right answers or on asking the right questions? In this article, Ryan Holliday, who also hosts the Daily Stoic podcast, shares 15 questions that have challenged and helped him the most as both a parent and as a writer. These questions come from some of the “wisest philosophers, most incisive thinkers, and greatest parents that have ever lived.” We may not know the answers to all these questions. We can still find value in letting them challenge us.

Questions such as, “Am I making deposits or debts?” and “Am I doing what I want to do?” can make you think hard about the way you act. I also want to do all I can always answer yes to, “Will I have a crowded table?”, especially at times like Thanksgiving and birthdays. Finally, wouldn’t the world be a better place if we could all provide an answer to “What did you do that was kind today?”

3. The Motherhood Penalty vs. the Fatherhood Bonus.

I’ve blogged about the motherhood penalty in the past. But I admit that I haven’t given as much to the other side of that equation. I recently came across this article from several years ago. It makes the situation sound even worse. Having a child can hurt a woman’s career. But this article discusses how it could benefit a man’s career. This doesn’t seem fair, does it? I’m writing this blog on Friday afternoon, but it won’t be published until after Mother’s Day has passed. As many of you know my mother passed away many years ago. But she still provides inspiration for the business I’m building and the type of clients I want to work with. You may want to take a couple of minutes to watch this video, too. Our mothers do an awful lot for us.

4. We Hope Your iPhone Never Gets Stolen. But Just in Case….

A few weeks ago, my favorite reads included an article talking about how to protect your iPhone data from thieves. I hope that this doesn’t happen to anyone, but if it does it helps to know what to do. This article shares some thoughts to help you protect the assets you store on your phone.

5. Subscription Price Creep Is Real. Our Guide to Pushing Back.

Do you have subscriptions for services you no longer want or use? Have the prices for some of your subscriptions increased so much that you no longer consider them affordable? Do you even know how many subscription services you’re paying for? If you can answer yes to one or more of these questions, I suggest you check out this article. It offers tips to help you audit your subscriptions and cancel unused services. It provides some suggestions that could help you lower the price of subscriptions you want to keep, too. You will find some free alternatives as well.

Bonus Content: I don’t spend a lot of time on social media sites. I don’t recall any time that I went to TikTok to watch videos except for the rare occasion when somebody shared content with me. (For example, one of my sons shared a TikTok video that has made cutting bell peppers so much easier.) This week I attended a Zoom meeting for members of Purse Strings as I recently became one of the site’s approved professionals. During the meeting, this TikTok video was shared. It provides a great explanation as to why men must be women’s allies. The reasons for this go well beyond the motherhood penalty that was mentioned above.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics including your investments, creating your life plan, working on your financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/