Retirement Planning

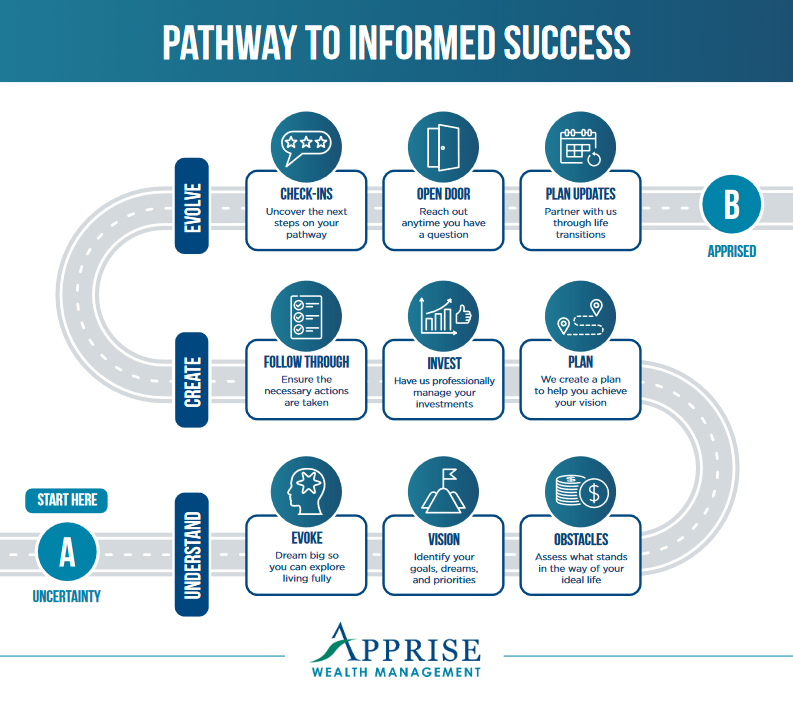

We created Apprise’s “Pathway to an Informed Retirement” to explain how we help you move from retirement uncertainty to an informed retirement. This process can help you answer the following questions:

- When can you retire?

- How much you should save for retirement?

- Which of your goals can you achieve during retirement?

- In which type of account(s) should you hold your retirement savings?

- When should you start claiming Social Security benefits?

- How should you allocate your retirement savings to different asset classes?

- What can you spend your money on during retirement?

- How can you create a retirement paycheck?

- How do you decide which account(s) to withdraw funds from during retirement?

At Apprise Wealth Management, we take pride in being a trusted financial partner, especially for female-led households. Our mission is to enhance our clients’ financial lives as well as their understanding of financial concepts. We strive to deliver you with the holistic, customized guidance you deserve based on a foundation of trust and transparency. We strive to align people’s capital with what’s truly important.

Why Choose Us

INTEGRATED APPROACH

Our approach to wealth management helps clients align their capital with what matters most to them.

It is through detailed financial conversations encompassing all aspects of our clients’ lives that we empower people to make informed decisions.

It is through detailed financial conversations encompassing all aspects of our clients’ lives that we empower people to make informed decisions.

ACCOUNTABILITY

As fiduciaries, we give you guidance you can trust, and we care about your financial life. We provide advice that uses simple language to explain complex topics, helping to foster financial literacy.

Our feeling is that the quality of our advice is based on the depth of the relationships we build with each client. We are committed to helping you meet your financial goals.

PEACE OF MIND

We do our best to avoid elevating stress levels. Therefore, you will never see a market barometer or breaking news on this site – that is simply more noise.

At Apprise, we understand that short-term tactics can be important but they must be executed based upon wise strategic decisions rather than best-guess predictions.

At Apprise, we understand that short-term tactics can be important but they must be executed based upon wise strategic decisions rather than best-guess predictions.

Pathway to Informed Success