In this week’s Tuesday Tip video, we discuss when to claim Social Security at 62 vs. 70, a 62–Full Retirement Age–70 timeline, break-even basics, survivor considerations, and a quick checklist to help you decide confidently. Please watch the video below, or read the transcript that follows, to learn more.

Deciding when to claim Social Security at 62 vs 70 is a timing tradeoff: smaller checks sooner or larger checks later. The decision can also affect survivor benefits. I’m Phil Weiss—CPA, CFA, and Registered Life Planner®. I help women facing new beginnings—divorce, widowhood, empty nest—make calm, confident money choices.

Have you ever wondered when to claim Social Security at 62 vs 70? If so, today I’ll explain break-even thinking without jargon, share a simple 62–FRA–70 timeline, and outline the survivor lens that often gets missed.

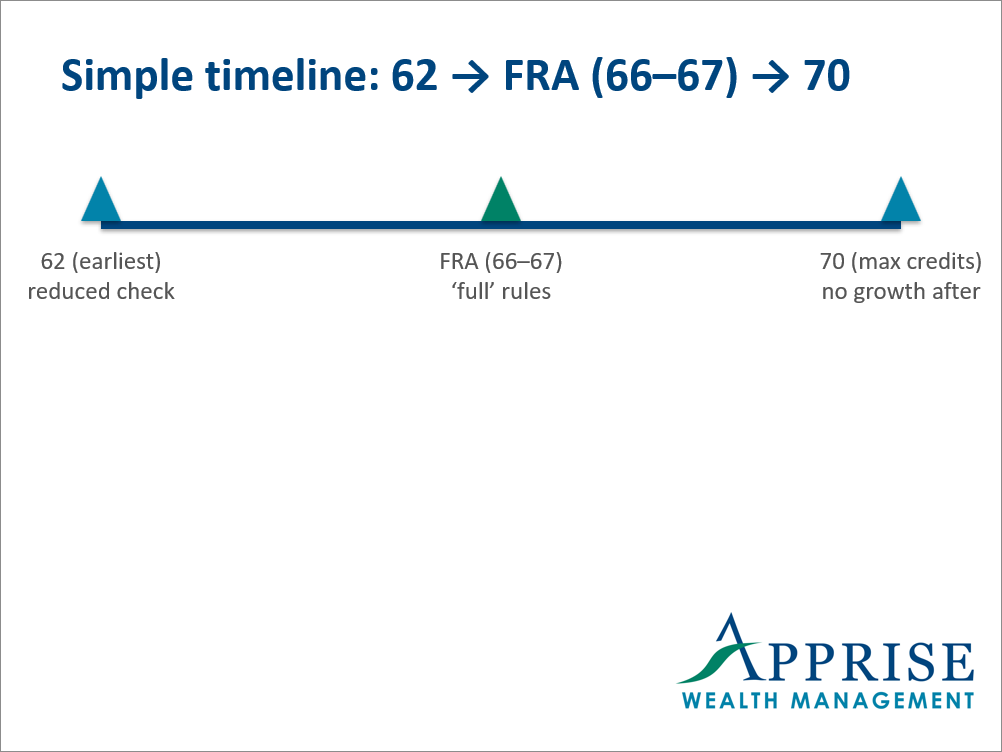

Here’s the simple timeline most people need: Age 62 is the earliest age at which you can claim retirement benefits; your check is reduced if you start early. Your Full Retirement Age (FRA) is generally 66–67, depending on when you were born.

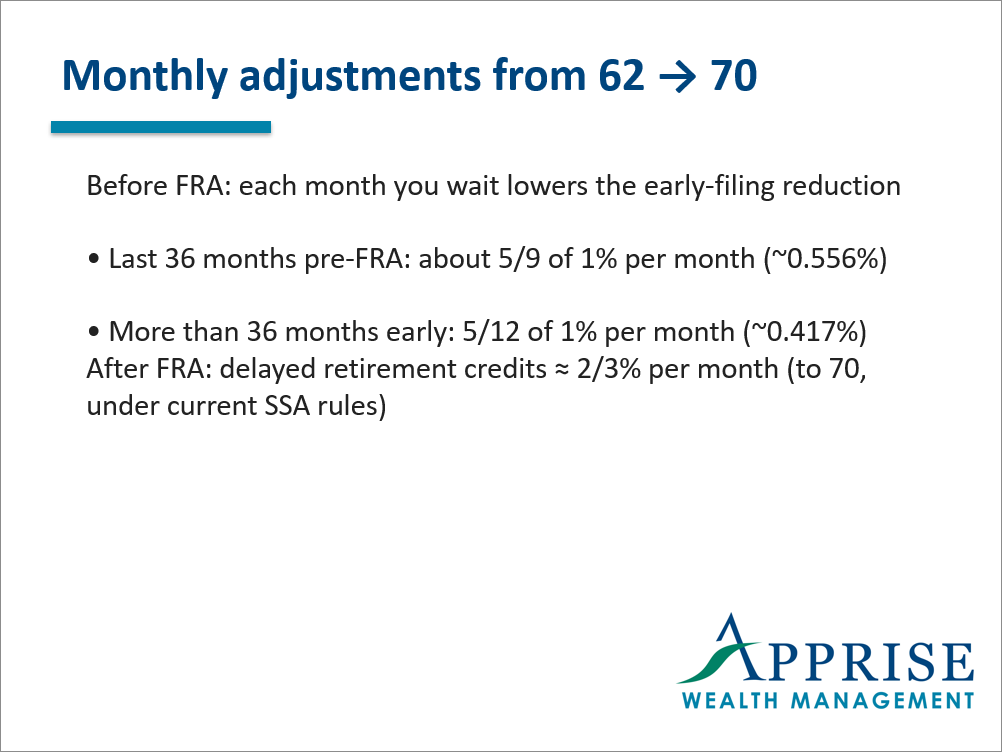

Benefits adjust monthly, the whole way from 62 to 70—before FRA, each month you wait reduces the early-filing reduction; after FRA, you earn delayed retirement credits that add roughly 2/3% per month under current SSA rules until age 70, when these increases stop.

Before FRA, your benefit rises each month you wait by the same amounts the early-filing reduction would have taken away:

- For the last 36 months before FRA, about 5/9 of 1% per month ≈ , 0.556%.

- For months earlier than that (i.e., more than 36 months before FRA): 5/12 of 1% per month ≈ , 0.417%.

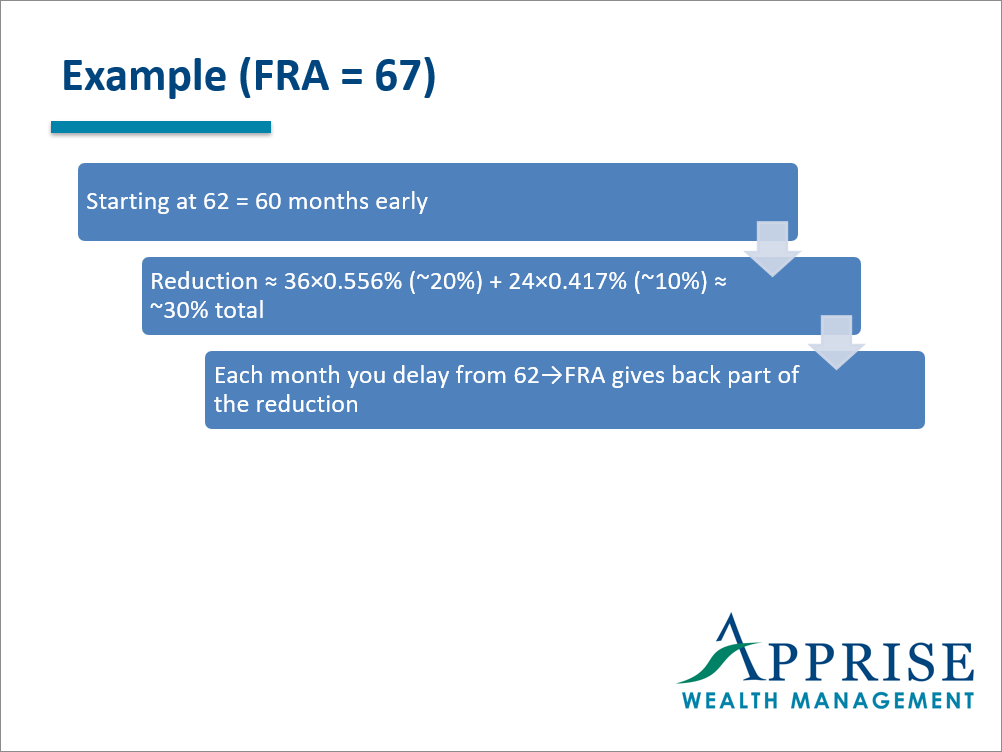

Here’s a quick example (FRA = 67): Starting at 62 is 60 months early → 36 months × 0.556% (~20%) plus 24 months × 0.417% (~10%) ≈ 30% total reduction vs. waiting to FRA. Each month you delay from 62 to FRA “gives back” those percentages.

What this means for you: delaying often means a higher monthly check for as long as you live. For many viewers asking when to claim Social Security at 62 vs 70, this 62 → FRA → 70 frame keeps the decision clear.

Break-even simply compares two paths—start earlier (more checks, smaller amount) vs. start later (fewer checks, larger amount)—and asks, “Around what age do the totals tie?” If you live past that age, delaying often pays more in total; if not, earlier can pay more.

But life isn’t a spreadsheet. Break-even doesn’t account for taxes, working before FRA (the earnings test can temporarily reduce checks), or how your timing affects a spouse or ex-spouse.

If taxes or RMDs are part of your decision, I’ve linked a short read—‘Navigating Taxes After a Big Life Change’—in the description.

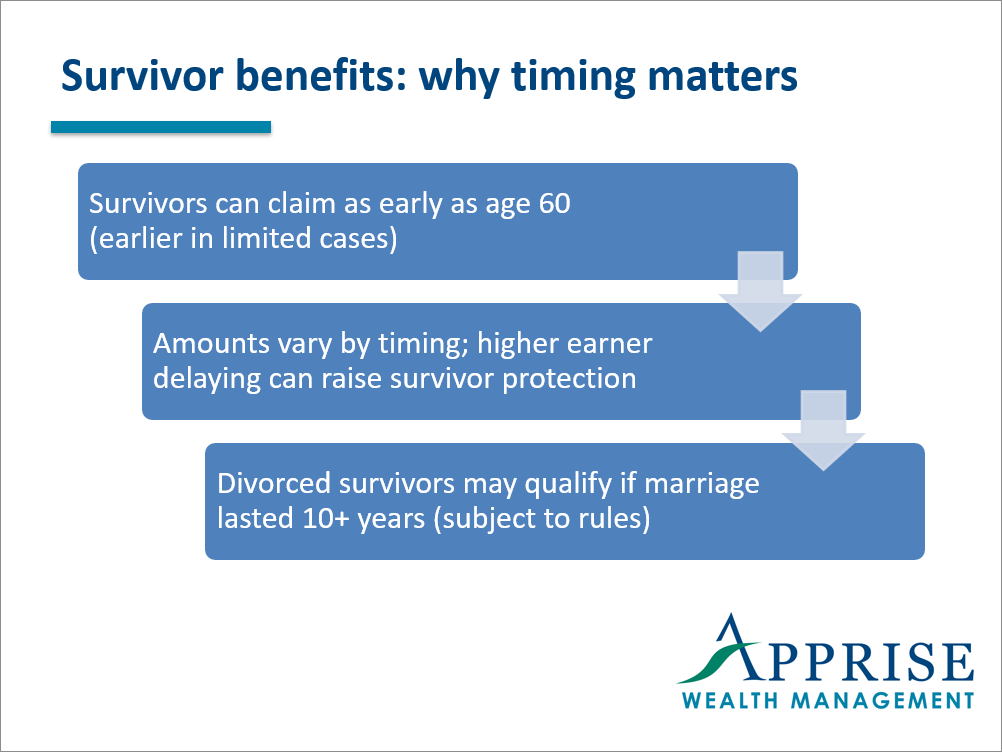

Survivor benefits pay a widow or widower based on their deceased spouse’s record. In plain English, your claiming age can influence what a survivor receives. Survivors can often claim as early as age 60 (earlier in limited cases) and receive amounts that vary by timing; divorced survivors may qualify if the marriage lasted 10+ years and other rules are met.

If you’re married—or were married—don’t miss ‘7 Social Security Claiming Mistakes Frequently Made by Couples’. It clarifies the distinction between spousal and survivor benefits in easy-to-understand terms. You can find a link in the description.

- Working before FRA can trigger the earnings test; reductions are temporary but can hamper cash flow.

- Rules evolve—double-check details on ssa.gov before filing.

- Don’t anchor on a single “8% per year” sound bite; increases are monthly after FRA up to 70, and your situation may differ.

- While you may intend to wait until 70, if conditions, such as your health, change, you can start earlier. Once past FRA, you can apply for up to six months of retroactive benefits, but not to a date before FRA, and you forfeit the delayed credits for those months.

FAQs

1) What’s the simple 62–FRA–70 timeline?

You can file at 62 (reduced check), reach FRA ~66–67, and benefits increase month-by-month from 62→70—via smaller early-filing reductions before FRA and delayed credits after FRA (credits stop at 70).

2) How do I decide when to claim Social Security at 62 vs 70?

Weigh three things: cash flow needs now vs. later, realistic longevity, and protecting your surviving spouse. Use the break-even point as a guide—not the decider—then layer in taxes and work plans.

3) Whether to claim Social Security benefits at 62 vs 70 if I’m still working?

If you file before FRA, the earnings test can temporarily reduce checks above annual limits (they’re recalculated at FRA). If work income comfortably covers expenses, waiting can keep things simpler—and may raise your future check.

4) How do survivor benefits factor into timing?

If you’re the higher earner, delaying can increase what your survivor receives. Divorced survivors may qualify if the marriage lasted 10+ years—worth checking before you file.

Here’s how I think about it: start with the 62–FRA–70 timeline, pressure-test the break-even point with real life, and weigh the impact on survivor benefits. If you want tailored help deciding when to claim Social Security at 62 vs 70, schedule a call—and subscribe for more calm, plain-English tips.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics, including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us: Facebook LinkedIn Instagram YouTube

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/