This week’s Tuesday Tip was inspired by a conference I recently attended. Please watch the video below to learn more. If you would like a free review of your current financial situation, please use this link to schedule a free call. You can find an edited transcript below the video.

For this week’s Tuesday Tip, I’d like to talk about “Wonder and Awe.” For a financial advisor, the topic may seem a bit unusual. Believe it or not, this was the subject of a presentation I heard at a conference I recently attended. I met the speaker (Howard) at another conference last March. That meeting itself inspired some wonder and awe. While the two of us had never met before, we immediately felt like the proverbial brothers of a different mother. Both of us grew up in New Jersey. We both attended Duke – he graduated a couple of years before I arrived. We also both focus our financial planning practices on working with women. Howard has already earned the Registered Life Planner (RLP®) designation. At that time, I was only about halfway through that journey. Since we first met, when we can, Howard and I also both attend the same weekly meditation class.

The conference itself was held in a place that inspires wonder and awe as well. We stayed at the Estes Park YMCA. Rocky Mountain National Park is close by. You can see some pictures and videos on my Facebook page, You can find a link in the online transcript on Apprise’s website.

To set the stage for his presentation, Howard started with some wonder- and awe-inspiring magic tricks. Until the night before, I did not know that Howard was once a professional magician. His tricks brought great joy as well as wonder and awe to all who attended.

We often associate wonder and awe with places like the Grand Canyon or our national parks. But as discussed in this article (check the transcript for a link) “the number-one way people experience awe isn’t nature; it’s other people.” Wonder and awe can help us build better relationships and social connections. They can help us feel closer to others.

Wonder and awe can be powerful emotions. Their effects can leave us feeling more connected to something bigger than ourselves.

You might ask, “What do wonder and awe mean,” or “How do these two feelings differ? Being curious, I looked for an explanation. Think of awe as a powerful feeling that leaves a mark. Awe can move, inspire, and motivate us. Wonder can be considered a more lasting state – akin to curiosity. It can follow a burst of, “What just happened?!”

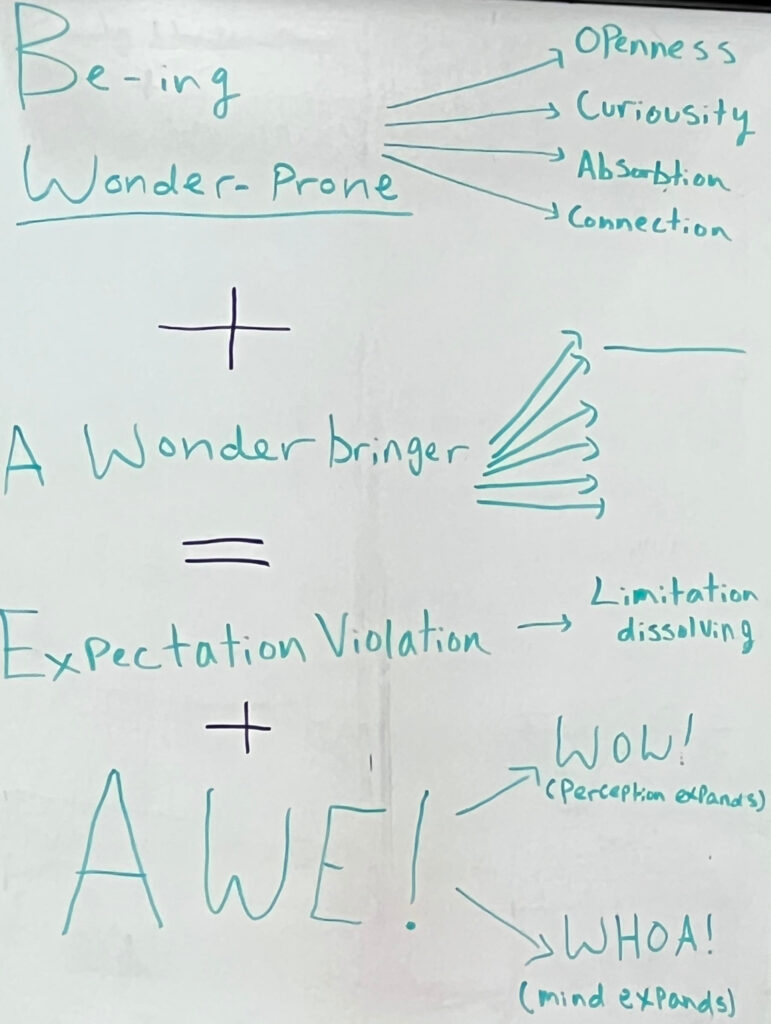

The main message from Howard’s presentation centered on bringing wonder and awe to financial planning. He spoke of being “wonder-prone” and a “wonder-bringer.” He said that the combination of the two could lead to an expectation violation and ultimately AWE! He further described AWE as creating the “WHOA!” (Your perception expands) and the “WOW!” (Your mind expands) (You can find a photo of the outline he created in the online version of this Tuesday Tip.

Let’s explore the connection between wonder and awe and life planning.

Imagine a world where your financial future is not a source of stress, but a wellspring of wonder and awe.

For many, financial planning can be intimidating and overwhelming, resulting in us feeling lost and anxious. But what if we told you that within the realm of financial planning, there lies a realm of wonder waiting to be discovered?

Financial wonder is the feeling you get when you realize that your dreams are within reach.

Awe comes from understanding the power of living your most fulfilled life by having a well-thought-out financial strategy that better aligns your money with what matters most to you.

Achieving your financial dreams can be an incredible journey, filled with excitement and satisfaction.

It’s about celebrating milestones along the way. Identifying your priorities and doing those things that are most important to you.

So, how can you connect wonder and awe to your financial planning?

Step 1: Set Clear Goals – Define your dreams and priorities, both short-term and long-term.

Step 2: Create a Plan – Work with a financial advisor to create a tailored life plan.

Step 3: Save, Invest, and spend Wisely – Discover the magic of compound interest and smart investing.

Step 4: Stay Informed – Continuously educate yourself about financial strategies.

Step 5: Celebrate Milestones – Revel in your achievements, no matter how big or small.

When you follow these steps, you’ll embark on a journey that transforms financial planning into an adventure of wonder and awe.

Picture a life where you have the freedom to pursue your passions, knowing that your financial future is secure.

Financial wonder and awe are within your reach. Begin your journey today and unlock the true potential of your financial future.

During the session asked that we share times when our clients did things that filled us with wonder and awe. As an advisor, seeing a client achieve success can easily bring a smile to my face. We can revel in and celebrate their successes. One of my favorites relates to one of the first couples I worked with. They had significant credit card and student loan debt. We put in a plan to address the credit card debt. They did a wonderful job of paying it off. Seeing that brought me great joy as well as wonder and awe. I also feel wonder and awe when I see the change that a life plan can have on a client’s attitude and outlook. The change can be quite noticeable.

For women facing new beginnings, a life plan that leads to wonder and awe can be quite impactful. Please click here if you would like to start working on your life plan and see if it brings more wonder and awe to your life.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

If you would like to talk to us about financial topics including your investments, creating your life plan, saving for college, or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/