This week’s Tuesday Tip addresses the Cycle of Market Emotions and how the market’s performance can affect us. It also addresses the impact this can have on us as investors. Please watch the video below to learn more. If you would like a free review of your current financial situation, please use this link to schedule a free call. You can find an edited transcript below the video.

When we invest, our emotions can often get in the way. This is something that we should keep in mind when we see the market go down.

In 2023, the market started off strong, but then August and September came and things turned in the other direction. In fact, the S&P 500 fell by 3.6% in the third quarter and October has been even worse. As of Friday’s close, the S&P 500 was down 4% month-to-date. It was also down more than 10% year-to-date, signifying a correction.

We never know for sure what’s causing the market to fall, but most would attribute the decline to the wars that we have ongoing in Ukraine and the Middle East and the rising interest rate environment. There are also concerns about the economy.

War in the Middle East can also lead to higher oil prices. Higher oil prices can lead to recession.

It’s important to keep our emotions in check.

The Cycle of Market Emotions

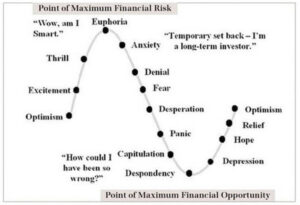

Pictured here you also see the cycle of market emotions (pictured below and sourced from here) which shows how as the market starts to go up, we start feeling optimistic, we get excited, and we get thrilled when the market is at its peak. We think about how smart we are as investors. We may even get kind of euphoric. Then the market starts to change direction and we get anxious. We deny that it’s happening. We feel fear. Next come feelings of desperation and panic. Then we capitulate and we sell.

When we are most despondent, or most worried, we sell out of fear. But the market bottom represents the point of maximum financial opportunity. From there, the market starts to go back up, our optimism starts to come back. But this timing can really hurt. That’s why it’s important to try to keep our emotions in check.

The Internet Bubble

Let’s go to an example of what can happen. When we were in 1999, the market was up. It was a really strong year. Going into 2000, we had just seen the Nasdaq go up 80%. That was tech stocks. That was the dot com boom. And the market soared. As I said, the Nasdaq was up 80%.

In January of 2000, investors added close to $44 billion in stock mutual funds. According to the Investment Company Institute, the previous record was 28 and a half billion. February and March shattered even more records. The market lost half of its value by October 2002. That was the low point.

What did investors do? They sold stocks. They bought bond funds, which were near record highs — at tops.

We can’t buy enough. Our emotions come into play. We get greedy. At market bottoms, the opposite happens. We can’t sell fast enough, and this happens again and again. That’s what we see on this graph that we have here. The cycle of market emotions.

Would You Do This?

Think about it. Would you let your emotions do this to you in other settings? Say you go into your car dealership to buy a new car, and the salesperson says to you you’re in luck, we just raised the price. Would you respond by saying that’s great, so I’ll take two? That’s kind of what we do with the stock market. But we wouldn’t do that with a car.

It’s okay to feel scared when the market falls. But you want to be careful about acting on it. That can cause financial harm. You want to try doing whatever you can to avoid acting out of fear and greed. You want to try and keep your emotions at bay. That could mean not watching as much financial TV, because when the markets fall and people are scared, what happens? They get louder. Why? Because that makes people watch and pay attention. You want to try and remain calm.

Closing Thoughts

Remind yourself that you’re investing for the long term. But remember that the most important thing isn’t to build the biggest portfolio. It’s to be able to live your desired lifestyle now and in the future. It’s to live your most fulfilled life. So, try and keep your emotions at bay.

Try to remain calm. If you have questions, or you’d like to talk about this, please feel free to schedule a call. Thanks for listening and have a great day.

I hope you find this helpful. I’ll be back again next week with Apprise’s “Five Favorite Reads of the Week.” Have a great day.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

If you would like to talk to us about financial topics including your investments, creating your life plan, saving for college, or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/