This week’s Tuesday Tip addresses how Roth conversion strategies can be helpful for Tax Planning 2025. Please watch the video below to learn more. If you would like a free review of your current financial situation, please use this link to schedule a free call. You can find an edited transcript below the video.

Hi! When considering Tax Planning 2025, Roth Conversion Strategies play a key role. When I review client tax returns or work on client financial plans, the potential to complete future Roth conversions is always a consideration. Apprise strives to help clients lower the amount of taxes paid during their lifetime.

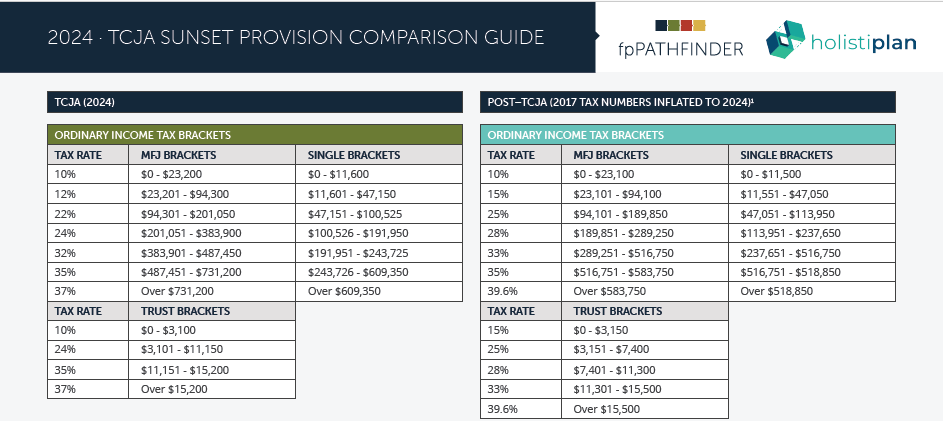

Let’s talk about why. Today’s tax rates are at historical lows. They were implemented by the Tax Cut and Jobs Act (TCJA), which passed in 2017. Due to the associated costs, the TCJA rates expire at the end of 2025. I cannot forecast future tax rates with any degree of certainty. However, it seems unlikely that future tax rates will be lower than current tax rates. Absent future legislation, we will revert to the 2017 tax system (adjusted for inflation). You can see current rates along with 2017 rates adjusted for inflation in the table that appears with this week’s Tuesday Tip.

2024 – TCJA Sunset Provision Comparison Guide

With income taxes, we should focus on how much we pay in taxes over our lifetimes rather than in a particular year. In some years, you could pay zero or almost no tax depending on how your accounts are structured. For example, you could fund everything with capital gains taxed at 0%. You could raise money by selling stocks in your taxable account for which you had a net loss. But it’s important to remember that different items of income get taxed differently. That could also lead to a higher tax bill in future years if you use up all your low-taxed income.

Roth Conversion Strategies – An Example

Let’s discuss a real-life example. I work with a couple who came to Apprise from another advisor. They only had a trust account and IRAs. Meaning they held no Roth IRA assets. They were funding their living expenses from the Trust and the required minimum distributions from their IRAs. Since the trust is taxable at the individual level, the related income primarily consists of interest, dividends, and capital gains. Some dividends and long-term capital gains can get taxed at lower rates.

But, if they lived a normal lifespan, the trust assets would run out. Then everything would come from the IRAs. Based on their income, they had room in the 22% and 24% tax brackets and could avoid paying additional Medicare premiums by staying within the related Income Related Monthly Adjustment Amount.

The Strategy

Since we started working together, they have implemented Roth Conversion Strategies. First, we opened a Roth IRA account and have been completing annual Roth conversions. If the taxable Trust runs out of money, they won’t have to use their IRA to meet all their cash needs. Based on the table, if we revert to the 2017 tax system, they would likely have been in at least the 28% tax bracket in the future.

With our Roth Conversion Strategies, they only pay taxes at a 22% or 24% rate on this income. They also won’t pay taxes on any future growth of the Roth assets. Plus, we can assume that one will outlive the other. The survivor could find him or herself – more likely to be her – in the 33% bracket. Any money left to their children and grandchildren also won’t be subject to income taxes. They will have 10 years to withdraw the funds and annual distributions won’t be required. This provides the potential for even more tax-free growth. If you want to know more about this, read How Roth Conversions Can Help You, Your Surviving Spouse, and Your Heirs.

Is There a Downside?

What’s the downside of this approach? While it seems unlikely, if future tax rates fall, they will pay less in taxes than they are paying for the Roth conversions. If future tax rates rise, the strategy will work as desired. They will pay less in taxes to withdraw the funds from their IRAs. If tax rates remain the same, there should be no discernible difference between current and future taxes. Why? They will pay taxes today and the future growth will be tax-free. If they waited, the growth should be the same, and the amount withdrawn would be greater. On a net basis, they would be in the same place.

Closing Thoughts on Roth Conversion Strategies

As noted last week, we place significant importance on this topic. Proactive Tax Planning can add significant value to your portfolio and your assets. Changes to the tax law are likely coming. We will continue discussing this topic. We will also make you aware of any formal changes. Remember, the key is to start planning early to make the most of the current tax landscape. This can help ensure a smoother transition when any changes take effect.

If you have any questions or need personalized advice, please don’t hesitate to reach out. Your financial well-being is our priority, and we’re here to help you every step of the way. Schedule a free consultation today to create a personalized tax plan for 2025. Let us help you navigate these changes with confidence and help improve your financial stability. Contact us here.

Thanks for listening. We’ll return next week with Apprise’s Five Favorite Reads of the Week. Have a great day!

If you would like to talk to us about creating your life plan as well as other financial topics including your investments, saving for college, and/or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on Facebook and LinkedIn.

For firm disclosures, see here: https://apprisewealth.com/disclosures/