In this week’s Tuesday Tip video, learn how to set a 30-minute weekly money check-in routine: Bills → Balances → Calendar → One small improvement. A calm, repeatable ritual to steady cash flow and stress. Please watch the video below, or read the transcript that follows, to learn more.

Book a weekly 30-minute money appointment—same day, same time, every week. One ritual beats five apps. If you’re starting fresh after a big life change, this becomes your weekly money check-in routine.

In plain English, here’s what’s going on—and why it matters: transitions create decision fatigue. Bills, new accounts, and shifting income make everything feel noisy. A standing appointment provides you with a consistent, calm place to look, act, and move forward. A gentle truth: if you don’t do this, no one will—your money won’t manage itself.

Here’s how I think about it—keep it tight and repeatable:

1. Bills & Autopay (5–7 min)

Confirm due dates/amounts, and verify that autopay details are correct. If something looks off, note it—don’t spiral. Email yourself one quick task; g., “Call cable company re: increase.”

2. Balances & Cash-Flow Sweep (7–8 min)

Glance at checking, savings, and cards. Make a small transfer if needed to keep checking from running low. Doing so can help you avoid overdraft fees. Gently watch for “pebble leaks”—tiny charges that pile up.

3. Calendar Upcoming Expenses (5–7 min)

Scan the next 2–4 weeks—travel, medical, home/auto, school, legal. Write down rough amounts. If a big bill is coming, set a reminder now.

4. One Small Improvement (5–7 min)

This week, consider canceling or resizing one of your subscriptions. Pick a low-joy, low-use item and either cancel or drop a tier. Small wins compound, and they build momentum.

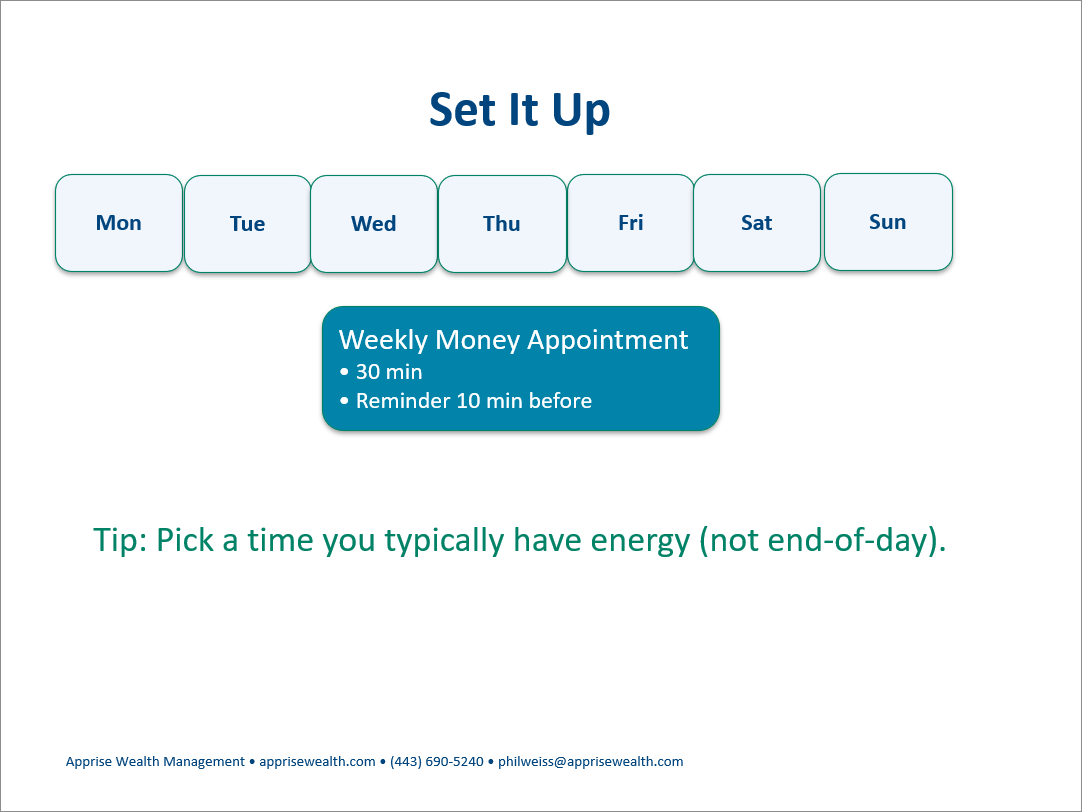

Create a recurring calendar block labeled “Money Appointment.” Set it to weekly, 30 minutes, with a 10-minute reminder. This is the habit container for your weekly money check-in routine.

- Don’t skip two weeks in a row. If life is heavy, shrink to 15 minutes—just do steps 1–2.

- Don’t do it when you’re tired. Pick a time you reliably have energy.

This ritual helps you protect your Time (fixed block), respects your Energy (timed well), focus Attention on the few things that matter, and use Money as a tool. For a deeper dive, here’s a link to our blog “Time vs. Money Trade-Off: A 5-Minute Framework to Make Values-Aligned Decisions.”

If uncertainty is making everything feel urgent, my blog “Overcoming ‘What’s Next?’ Anxiety—Financial Planning for Life Changes” can help you slow the noise and focus.

FAQ: Weekly Money Check-In (30 Minutes)

1) What exactly do I do each week?

Bills → Balances → Calendar → One small improvement. Set a 30-minute recurring “Money Appointment.”

2) What day/time works best?

Any slot when you reliably have energy. Same day, same time, every week. If life is heavy, do 15 minutes and just Steps 1–2.

3) Do I need budgeting software?

No. A bank app + your calendar is enough. One ritual beats five apps.

4) What counts as “one small improvement”?

Cancel/resize a low-joy subscription, set one autopay, move a due date, or email yourself one follow-up task.

5) How does this help if I’m starting fresh after a big life change?

It cuts decision fatigue and steadies cash flow—protecting your Time, respecting Energy, focusing Attention, and using Money as a tool (TEAM).

Want help installing this? Schedule a quick call; if you’re not ready, subscribe for weekly plain-English tips.

Summary

Your weekly money check-in routine is simple: Bills → Balances → Calendar → One small improvement. Keep it gentle. Note issues, take one action, and move on.

If you’d like a calm, clear plan for your next chapter—or help setting up this weekly routine—schedule a call using this link. If you’re not ready yet, subscribe to our weekly blog for more steady, plain-English guidance each week.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above post valuable. If you would like to talk to us about financial topics, including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us: Facebook LinkedIn Instagram YouTube

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/