Based at least partly on the results of a recent reader survey, I am making some changes to Apprise’s blog content. I know many of you enjoy “My Five Favorite Reads of the Week.” I will continue to provide that content, but a little less often. Starting this week, I am going to write more original content. If you have any thoughts about this decision, I would be happy to discuss them. You can send an email to philweiss@apprisewealth.com or schedule a free 15-minute call.

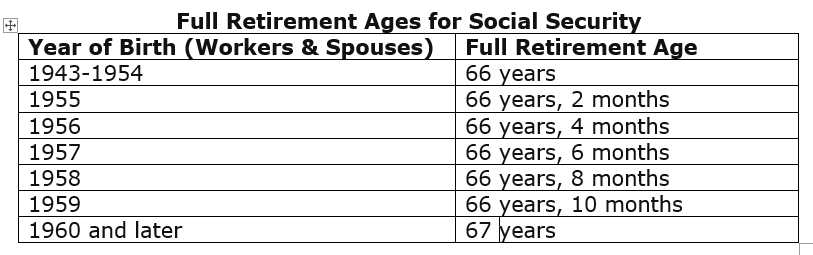

Social Security benefits are an important part of any financial plan. Yes, there are concerns that the system could run out of cash. According to the program’s trustees, the Social Security Trust Funds are projected to become insolvent in 2035. That could lead to benefit cuts or an increase in the retirement age – full retirement age is 67 for those born in 1960 or later.

At the same time, I do not think Social Security benefits will go away completely. I believe the political backlash would be too great.

My experience working on financial plans with clients indicates that there is a considerable amount of misunderstanding related to Social Security benefits. What follows is not meant to be an extensive list of all the questions that come up. I hope it gives you a better understanding of the basics along with a few planning ideas.

1. How do I apply for Social Security benefits?

You can apply for your benefits online at www.ssa.gov. You cannot apply online more than four months before your 62nd birthday. It usually takes three-to-four months to begin receiving benefits once an application is made.

2. When can I claim Social Security benefits?

You can claim benefits as early as age 62. Full retirement age (FRA) was 65 for many years. In 1983, Congress passed a law gradually increasing this age. People are living longer and are generally healthier in old age than they were in the past. You are not entitled to full benefits until you reach your full retirement age.

If you delay taking your benefits from your FRA until age 70, your benefit amount will increase. Your benefit increases by 8% per year (not compounded) from FRA until age 70. If you begin receiving benefits from age 62 up until FRA, your benefit will be reduced. The chart at this link provides examples of how much lower your benefits will be if you start claiming them early.

If you begin claiming Social Security benefits at age 62, you will receive only 75% of your projected benefit at FRA. This difference in benefits is permanent. The breakeven point, when the total dollars received by waiting until age 66 begin to exceed the total dollars received by starting at age 62, is approximately age 77. Life expectancy tables show that a person who reaches age 62 will live to be 85.5, and a person who reaches age 66 will live to be 86.2. It is also important to remember that the difference in benefits is also compounded because future benefits grow by the annual cost of living adjustment (COLA).

The breakeven point for those that wait until age 70 to begin claiming benefits rather than starting at age 66 is approximately age 81. Life expectancy tables show that a 66-year-old will live to be age 86.2, and a 70-year old will live to be 87.

Note that waiting until age 70 takes on added significance for married couples. In this case, if either member of the couple lives long enough to achieve the breakeven age realized by delaying their retirement benefit, then it will be more worthwhile to wait until age 70 to start claiming benefits. Statistically, if both members of a couple are 65 and in good health, there is a 50% chance that one of them will live to the age of 95.

3. What happens if I work after I start taking benefits?

If you take benefits early but continue to work, you may forfeit some of your benefits. If you have not reached FRA, the Social Security Administration (SSA) deducts $1 from your benefit payments for every $2 you earn above the annual limit. For 2020, that limit is $18,240.

In the year you reach FRA, the SSA deducts $1 in benefits for every $3 you earn above a different limit. For 2020, this limit on your earnings is $48,600. You should note that your earnings are only counted up to the month before you reach full retirement age and not the entire year.

Beginning with the month you reach FRA, your earnings no longer reduce your benefits, regardless of how much you earn.

4. Are Social Security benefits always taxable? Are there any exceptions?

Retirees are often surprised to hear that they must pay taxes on up to 85% of their Social Security benefits. That also means that no matter how much you earn, 15 percent of your Social Security benefits are tax-free.

Beyond that, the taxability of your Social Security benefits depends on how much income you earn. According to Social Security Administration estimates, about 40% of people who receive Social Security benefits must pay income taxes on their benefits.

For example:

· For taxpayers who file a federal tax return as individual or single:

o If your combined income* is between $25,000 and $34,000, you may have to pay tax on as much as 50% of your Social Security benefits.

o If your combined income* exceeds $34,000, up to 85% of your Social Security benefits are subject to tax.

· For taxpayers who file joint tax returns:

o If you and your spouse have combined income* between $32,000 and $44,000, you may have to pay tax on 50% of your benefits.

o If your combined income exceeds $44,000, as much as 85% of your Social Security benefit is subject to tax.

· For taxpayers who file with married, filing separate status:

o You will probably pay taxes on your benefits.

5. Is Social Security taxed at the same as other income?

No. As noted above, 15% of your Social Security income is not subject to tax. Depending on your combined income*, even more can be excluded.

Beyond that, some types of income receive preferential tax rates. For example, dividends and long-term capital gains are generally taxed at a lower rate than other sources of income. The taxable portion of your Social Security benefits is taxed at the same rate as the following types of income:

· Wages

· Pension benefits

· Distributions from tax-deferred retirement accounts such as Individual Retirement Accounts (IRAs), 401(k)’s, and 403(b)’s

· Short-term capital gains

· Interest income

One other note: Earnings on tax-exempt investments must be included in the calculation to determine the taxability of Social security benefits. Since that could make them effectively taxable (to the extent they cause tax on Social Security benefits), you may need to reconsider whether or not to hold such securities in your portfolio. If they are part of your investment allocation, they may need to be recharacterized as taxable rather than tax-free in your allocation. You may even consider not holding such investments.

6. What are some strategies people can use to save on Social Security taxes?

Here are some ways you can reduce or avoid paying taxes on your Social Security benefit:

- Keep your income below the taxable thresholds.

- Manage your other retirement income sources.

- Consider taking IRA withdrawals before signing up for Social Security.

- Save in a Roth IRA.

- Factor in state taxes.

- Set up Social Security tax withholding.

- Wait to start receiving benefits until age 70 and begin drawing from your taxable IRA accounts or taxable annuities before then. (Delayed Benefit)

- Convert taxable IRAs, 401(k)’s, or 403(b)’s to Roth IRAs before beginning to collect Social Security benefits. (Roth Conversion)

- As part of your asset allocation strategy, consider investing a portion of your taxable IRAs in fixed-income instruments and a portion of your after-tax investments or Roth IRAs in equities. (Asset Location)

Let’s expand on the last three items:

a) Delayed Benefit: If you wait until age 70 to receive Social Security benefits you receive an additional 8% per year in projected benefits (not compounded). Drawing from your taxable retirement assets during this period can potentially help average out distributions to lower tax brackets before age 70. It will also reduce the amount of any taxable required minimum distributions (RMDs) from your retirement accounts. RMDs start at age 72.

b) Roth Conversion: RMDs reduce potential Social Security taxation. The conversion of taxable IRAs to Roth IRAs is allowed by anyone regardless of income. Converting to a Roth IRA will eliminate or lower the amount of any RMDs from taxable IRAs since Roth IRAs have no RMD requirement. Roth IRAs are also not taxable in any way.

c) Asset Location: Deciding to hold certain assets in certain types of accounts based on taxation is also referred to as asset location. (See this blog for further information.) If dividend yields are less than the interest rates earned on fixed-income investments, holding equities in your taxable or Roth IRA accounts will reduce current taxes due on portfolio income. Gains on equity investments held for the long-term (more than one year) are taxable when the investment is sold. The tax rate on such gains is lower than the rate paid on ordinary income. Equity investments can also qualify for a step-up in basis on death, which can mean avoiding capital gains taxes.

7. Do states also tax Social Security benefits, in addition to federal taxes?

It depends on where you live. 37 states don’t tax Social Security benefits. The District of Columbia does not tax them either. The states that currently collect income tax on Social Security to at least some beneficiaries include

· Colorado

· Connecticut

· Kansas

· Minnesota

· Missouri

· Montana

· Nebraska

· New Mexico

· North Dakota

· Rhode Island

· Utah Vermont

· West Virginia

How these states tax Social Security benefits varies based on adjusted gross income or other criteria, so check with the relevant state tax agency for more information.

8. Do children’s Social Security benefits (survivor and dependent care) also get taxed as income?

Yes, Social Security survivor benefits paid to children are taxable for the child. But most children don’t make enough income to be taxed. In other words, if half of a child’s benefits plus her other income equals $25,000 or more, the benefits are taxable.

If a child’s only taxable income is survivor benefits, that income is not taxable.

One other thing to keep in mind: If parents or guardians receive benefits on a child’s behalf, then they are not responsible for taxes.

9. Do you recommend that people pay taxes on their Social Security benefits as a lump sum in April, or do you recommend they make quarterly tax payments? Why?

I recommend quarterly payments rather than paying a lump sum in April. It makes it easier to come up with the money to pay the taxes. It also makes budgeting easier. If you don’t want to mail quarterly estimated tax payments to the IRS, you can have federal taxes withheld from your payments as received. You should do this when you first apply for benefits, you can have 7, 10, 12, or 22 percent withheld from your monthly benefit. Those are the only percentages you can choose.

10. Do you have any other advice for handling Social Security taxes and preparing for taxes in retirement?

I always recommend planning ahead. If you do, you can lower your tax bill. For some suggestions as to what type of planning you can do, please see this blog.

Wait until age 70 to start receiving Social Security retirement benefits and begin drawing from taxable IRA accounts, workplace retirement accounts, or taxable annuities after age 59 ½.

Why? Waiting past FRA – 67 for those born in 1960 or later – until age 70 to start receiving Social Security benefits causes your projected benefit to increase by 8% per year. Drawing from other retirement savings as soon as possible will lower your taxable required minimum distributions (RMD) – these begin at age 72. This can potentially reduce taxes paid on future Social Security benefits.

Convert taxable IRAs to Roth IRAs before you start collecting Social Security benefits.

Why? This will lower the amount of your future RMDs and reduce potential Social Security taxation. Conversion of taxable IRAs to Roth IRAs is allowed for anyone at any income level. Converting to a Roth IRA will eliminate or reduce the RMD from taxable IRAs in the future. Roth IRAs have no RMD requirement (such distributions are not taxable anyway). One warning. Be careful of the impact the change in your income can have if you are Medicare eligible. The cost of Medicare is impacted by the amount of income you earn.

As part of your asset allocation strategy consider investing a portion of taxable IRAs in fixed-income securities and a portion of after-tax investments or Roth IRAs in equities. The gains on equity investments held for the long term (more than one year) are only taxable when the investment is sold. In addition, equity investments qualify for a step-up in basis on death, which can lead to avoiding capital gains taxes altogether.

Why? This can lower your taxable income (and thereby reduce the potential taxation of Social Security benefits). Social Security survivor benefits paid to children are taxable for the child, although most children don’t make enough to be taxed.

If you have any questions related to Social Security beyond those I have addressed above, or would like help with your financial plan, please schedule a free Strategy Session.

* Combined income:

Your adjusted gross income + Nontaxable interest + ½ of your Social Security benefits = Your “combined income”

FAQs: Social Security Basics — What to Know, When to Claim, and How to Plan

1) Should I include Social Security in my retirement plan?

Yes. While lawmakers debate changes, benefits aren’t likely to disappear. Sensible planning assumptions: if you’re 50+, model 100% of your estimate; if you’re under 50, use ~75% for prudence. Likely levers include raising the full retirement age and/or the wage cap.

2) How do I qualify for a benefit?

Earn 40 credits (up to 4 per year). In 2022, one credit equals $1,470 in earnings. Credits don’t need to be consecutive.

3) How is my monthly benefit calculated?

The Social Security Administration (SSA) indexes your earnings, then averages your highest 35 years. Fewer than 35 years? Missing years count as zeros. Create a My Social Security account to see your record and projections.

4) When should I claim?

You may file at 62; your Full Retirement Age (FRA) is 66–67 (67 if born 1960+). Benefits grow ~8% per year (simple) from FRA to 70. Rule of thumb: if health and cash flow allow, delay—the breakeven vs. claiming at FRA is around age 82, and longevity favors waiting.

5) What does claiming early or late look like in dollars?

If your FRA benefit is $2,000 (at 67):

- Claim at 62 → about $1,400

- Claim at 70 → about $2,480

That’s a 77% higher check at 70 vs. 62.

6) How should couples decide?

Coordinate. At a minimum, the higher earner should aim to file at 70, as it boosts lifetime income and the survivor’s benefit. Remember: the surviving spouse keeps the higher of the two benefits.

7) How do spousal benefits work?

A spouse can receive up to 50% of the worker’s FRA benefit (not the age-70 amount). You can’t collect a spousal benefit until the worker has filed for benefits. Special “restricted application” rules applied only to those born in 1953 or earlier.

8) What about survivor (widow/er) benefits?

You can claim as early as 60 (reduced) up to 100% of the deceased spouse’s benefit at your FRA. Unique to survivor benefits: you can switch later, e.g., take a survivor benefit now and your own higher benefit at 70. Remarriage after 60 preserves eligibility.

9) If I wait, how do I cover the income gap?

Use planned withdrawals from IRAs/401(k)s to “bridge” to 70. This buys a larger, inflation-adjusted Social Security check, may reduce future RMDs and taxes, and can help lower future Medicare IRMAA exposure.

Bottom line

Most people claim too early and leave money on the table. Run the numbers, plan as a couple, and, when possible, delay—especially for the higher earner. If you’d like, I can model your optimal filing ages and a bridge strategy tailored to your plan.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above information valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or virtual meeting via Zoom.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/