Is Investor Optimism a Contrarian Signal?

The market seems indestructible. It has risen in the face of multiple record-breaking hurricanes, mass shootings, and political turmoil. The numbers show that investors are increasingly optimistic. In fact, investor confidence is at levels last seen in 2000. In my interview with Chuck Jaffe on the MoneyLife Show (October 4th, 2017 Episode). Chuck referred to the environment as a “Teflon” market.

So…Is there a reckoning coming?

It’s probably a combination of both economic strength and risk in areas where the market is overextended. However, while we cannot forecast anything with certainty, if we consider whether or not a market crash is coming, normally, the economic data would indicate a rising possibility of a recession. The economic data we’re seeing right now, such as GDP growth in the first half of 2017 of 2.1%, indicate that we’re not in recession, and it’s not imminent.

The fact that recessions occur within economic cycles tells us that recessions are in our future, but the next one is probably out a little bit further. The “Teflon” market comment relates to the fact that despite major events such as two destructive hurricanes in the U.S., a mass shooting, and concerns about a nuclear attack by North Korea, not only does the market keep going up, but the level of volatility remains low at the same time.

Get in on More Upside or Protect?

No one wants to miss out. It’s an investment conundrum of sorts. One of the factors driving the market is that low interest rates are driving investors out of bonds and into equities. The traditional fixed-income investment isn’t yielding much and carries higher downside risk than normal. The U.S. market may be more expensive than some other markets, but that does not mean we can’t keep some of our U.S. positions. At the same time, you might also look at other markets around the world that are not as expensive as the U.S. as a way to stay involved. In fact, year-to-date, non-U.S. developed and emerging markets equities have largely outperformed U.S. stocks. Investing in other markets also potentially provides some downside protection as it helps diversify your portfolio.

Asset Shifting

While we know we cannot forecast what, how, or when the next market correction or bear market will occur, we know it will happen eventually. Despite that risk, we want to stay invested, but we don’t want to be too aggressive. That’s why allocating some of our assets (or simply rebalancing our portfolio to make sure allocations are in line with our plan) into some of the international markets that look like they’re more attractively valued can make sense. Plus, the level of potential risk associated with owning cheaper assets should be less, as lower valuations can translate to less downside risk.

At the same time, we don’t have to exit all our U.S. positions. Once we start trying to predict the next down market, we increase the number of decisions we must make and make it harder to be right. We must be right about our decision about when to sell, we must be right about when to buy again. What happens if we get out too early, or wait too long to get back in? In either case, we’ll likely be in a worse position over the long haul. In short, it’s hard to argue there’s a reason – or a time to exit the market.

Sequence of Return Risk

Instead of worrying about what the market’s going to do, it’s critical to know where you are in your life, what your goals are/what matters to you, and what you should guard or protect yourself from. We know bear markets and crashes can happen at any time. But, every day we don’t have one, the sequence of return risk for older investors increases. Those that are still adding money to the market are affected less by a bear market, as they can buy lower-priced assets when the market falls. In short, it’s a lot harder for your portfolio to recover its value when it falls if you’re not adding money to the market. Ideally, we don’t want to retire during a bear market. Instead, when we retire, we would like to see the market go sideways, if not move higher, in the first couple of years.

We don’t know when the next crash is going to come, and if you’re retired, one of the worst things that can happen is loss of portfolio value during non-income-producing years. So, it is also helpful to think about the income-producing quality of your portfolio through a bear market. Often a dividend portfolio can provide the same income stream for investors even though the portfolio’s value is down. Earning regular dividends can also help keep you from selling underpriced assets to raise cash as the income can help fund your current needs. For retirees, a bear market, especially shortly after retirement, would lower the value of their portfolio and, correspondingly, could force them to reduce expenses, at least until asset prices recover.

Behavioral Aspects

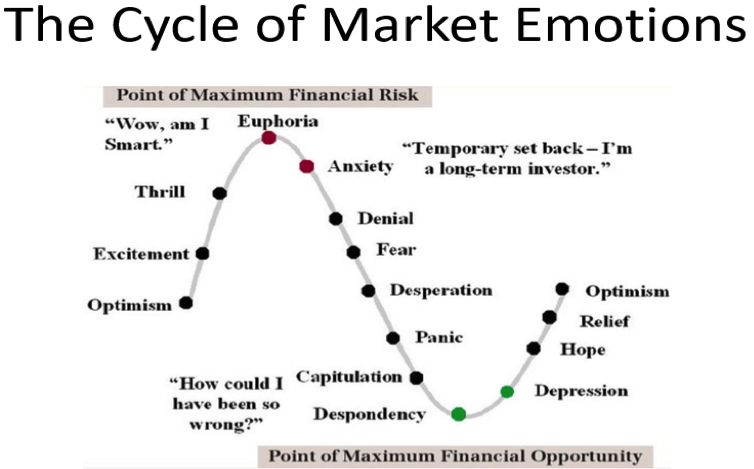

One thing that often gets in the way of performance is investor behavior. As depicted in the “Cycle of Market Emotions” above, we tend to get most excited when the market is going up and feel most despondent when it’s falling. The reality is that as Warren Buffett has said, “Be fearful when others are greedy, and greedy when others are fearful.” The behavioral aspects of investing are an area of great interest to me, especially since I originally was a psychology major in college. It was also the subject of the presentation I gave to the American Association of Individual Investors in Baltimore last month and the one I’m giving to the Philadelphia chapter on October 28th.

If you’re invested in the market, can you keep your emotions in check? When you see the market go down, how do you react? It’s also important to remember what you’re trying to do by investing your portfolio and having a financial plan. We commonly hear references to trying to beat the market. But, if you’re trying to plan for your future, it’s not about beating the market, it’s about preparing for your future – what do you need – and trying to position your portfolio to deliver the returns that can help you achieve your goals.

Get Advice

Another aspect is that when we are younger many of us want to do things on our own. As we get older, life gets more complicated. We have a family that we want to spend time with, we have more responsibilities at work, and, hopefully, our portfolios have grown, too. The question investors must ask themselves is do they have what I refer to as “KIT.” Do we have the time to manage and plan our financial lives on our own? If we don’t, then it makes sense to find a fiduciary that can help us.

The Importance of Keeping Expenses Low

One of the biggest things I find with people I talk to is the expenses related to their portfolios are too high. For example, if you’re working with a broker rather than a fee-only advisor, you will likely find that you own products and funds with high fees. Those expenses hurt your returns. Many investors don’t even realize they’re paying them. Sometimes not all fee structures are transparent, and you might not even know how much you’re paying. Alternatively, you might receive voluminous statements that you don’t understand. As a result, you have no idea how your portfolio is performing or how much you’re paying for it.

Final Thoughts

We do not know what kind of returns the market is going to generate over any given period. As a result, it is important to have a plan, to stay true to your process, and to do your best to keep your emotions in check. Whether we invest on our own, or with help, it is also important that we understand what we are paying. If you choose to work with an advisor, it is important to work with a fiduciary who will put your best interests first. If you are interested in talking to us, please fill out our contact form, and we will be in touch.

Follow us:

Please note that we post information about articles we think can help you make better decisions about money on Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/