When asked which would you like to hear first, do you say “the good news” or “the bad news?” I like saving the good news, so I’m going to start with the bad news. Last week was another rough one for investors. The stock market, as measured by the S&P 500 Index fell 15% for the week. The S&P 500 is now down 32% since closing at an all-time high on February 19th. Stocks have fallen this much or more about once every seven years going back to the 1920s.

On average, stocks have fallen 40% or more once every 15 years.

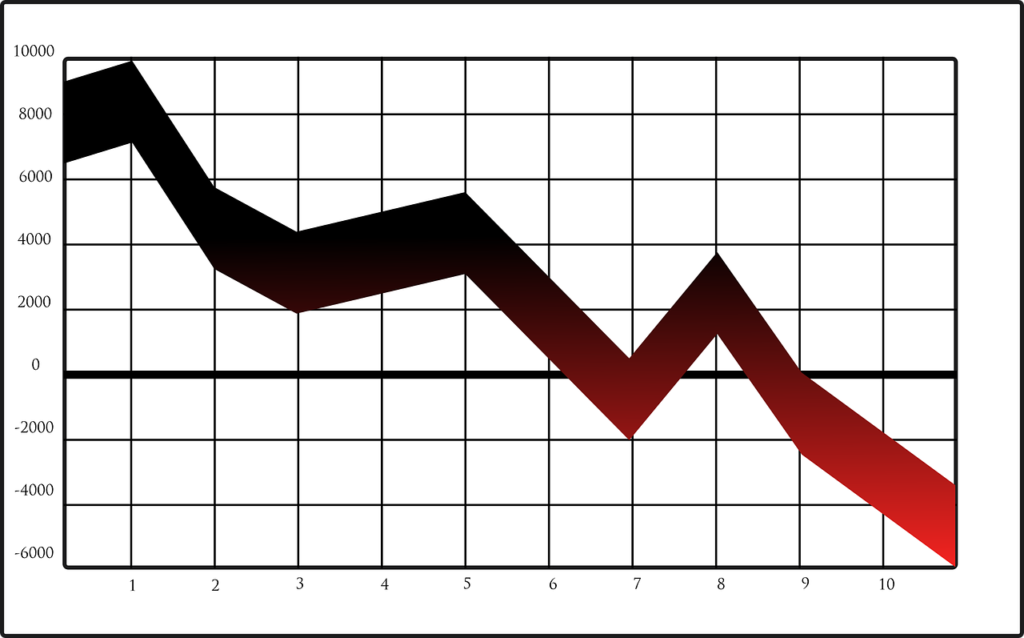

What about declines of 50% or more? On average, that kind of decline has happened once every 18 years. The number of stock market crises this century is certainly on the high side. See, for example, this chart showing the history of bear markets since 1926.

For stocks to fall 40% from their February highs would require another 12% decline from Friday’s close.

Despite recent events, I don’t see any reason not to maintain a positive long-term view. We will get past this. We ALWAYS have in the past. If you don’t share this opinion, then you probably shouldn’t be investing anyway.

At some point, stocks will bottom. From there we will have a big rally. I don’t know when, but I expect it will happen.

Will any of us invest at the absolute bottom. The odds of that happening are slim. To do so, would take incredible luck. The key point to remember is that the bigger the losses the higher the expected returns from there.

Oftentimes, what feels like the worst time to buy stocks turns out to be the best time to do so. Deciding to invest right now is hard. It doesn’t feel like a good time to invest. That means we’ll probably find out it was.

Why is it so hard to invest now? The market’s fall is accompanied by the dread and uncertainty of a global pandemic. As the virus spreads many of us are isolated socially in ways that we’re unaccustomed to. We can’t be with family and friends we’re used to spending time with. This adds to our stress.

Okay. That’s enough bad news. Let’s discuss what we can do to make things better. Last week I shared this list:

What can you do to reduce bear-market related stress?

1. Don’t let the headlines drive your buy or sell decisions. A considerable amount of fear, speculation, and uncertainty are creating market volatility.

2. Don’t watch the financial news.

3. Take a walk and enjoy the beauty that comes with early spring.

4. You are being blessed with a lot more time with your family. Take advantage of it.

5. Focus on staying healthy and taking sensible precautions to keep yourself and your family safe. Be protective of loved ones who are at higher risk of virus-related complications.

6. Show others around you some extra kindness in these anxious days. Be grateful for those medical professionals who are working hard to keep us healthy. The same goes for those helping to keep our stores stocked.

7. Remember that our nation has been here before. We have the resources needed to get through this.

8. Exercise. It helps relieve stress. I continue to use my elliptical in the early morning. When appropriate, I will also go bike riding with my children during off-hours.

I’m going to add some more suggestions. You can find many ways to take advantage of the present situation.

Those of us with older children often don’t get to spend enough time with them. When you look at the bigger picture, we don’t get to spend much time with our children at all. View this extra time you have with your children as a gift. I want to thank my wonderful wife Diana for reminding me of that.

Here are some of the things I’ve done over the last week:

· Played basketball with all four of my children on Sunday afternoon.

· Played ping pong with one of my sons and my daughter on Saturday evening.

· Played the video game “Just Dance” with my wife, my daughter, and one of my sons on Saturday night.

· Played cards and board games with my children at various times during the week.

· Have my kids help me cook our family meals.

· Worked on a jigsaw puzzle with my family.

Want some more good ideas? Try these:

· Try to maintain a routine. This will help keep you feeling more “normal” and productive. Staying in your pajamas all day or spending lots of time looking at a screen can be tempting. But try to limit that by making other positive choices in your day. You will be glad you did!

· Drink lots of water.

· Read a book.

· Do something creative.

· Learn about something new that you have always wanted to know more about.

· Bake something.

· Spend some time writing in a journal.

· Practice Self-Care.

Let’s also talk about what you can do to help your portfolio:

· Does your portfolio include assets you no longer want to hold? This could be a good time to sell low-quality assets. You can replace them with high-quality securities.

· If you have a taxable portfolio, consider “harvesting” some losses. You can deduct up to $3,000 of capital losses on securities you sell. You can also use losses to offset any gains you may have already recognized.

· Are all your retirement assets in a 401(k), a 403(b) or similar account? If so, this could be a good time to consider a Roth Conversion. In my opinion, current tax rates may be the lowest we’ll ever see for the rest of our lives. If you can afford to pay taxes now, it can make sense to complete partial Roth Conversions while stock prices are depressed. I have had this conversation with some of my clients and prospects. It can make tremendous sense. The passage of the SECURE Act this past December also helps make Roth Conversions more attractive. Please schedule a call if you would like to discuss these concepts further.

· Do you have any available cash in your accounts to invest? This could be a good time to put it to work.

· If you’re investing for the long term, this is a time to buy. If you stop contributing to your 401(k) during downturns, you’re not buying stocks when they’re cheap. Because the stock market has lost more than 20% so far this year, stocks, overall, are cheaper than they were three months ago. Perhaps this example can help you understand why you should keep investing: Say you contribute $400 to your 401k every paycheck. Say that the asset you buy was priced at $40 per share at the market’s high. That meant you bought 10 shares. Today, assume that same asset sells for $30 per share. Now you get 13.33 shares when you invest. If the price goes back to $40 per share, the 13.33 shares will be worth $533.20. The 10 shares you bought when the market peaked will only be worth $400. Investing when the market is falling leads to bigger returns when market conditions improve.

· If you’re planning to make contributions to a 529 plan or a SEP-IRA, make those contributions now. You may not be getting the lowest price. But a 25% or 30% discount to the prices of a month ago is almost certain to look like a steal years from now when you look back.

Bear Markets Happen, but they don’t last forever

We think stocks will eventually recover from the effects of this pandemic, and that the long-term effects on the economy will be minimal. That doesn’t mean we don’t think the coronavirus concerns are a big deal.

Because this sell-off is tied to a global health epidemic, it’s especially scary. People feel like their safety and their financial security are threatened.

But bear markets, no matter their cause, don’t last forever. Markets and economies are resilient. Losses can be severe, though–and they can last for extended periods.

If you or any of your friends are feeling uneasy, please schedule a call. I’ll be happy to have a conversation. In addition, please stay tuned for information about a webinar I plan to hold in the next week or so. I plan to share lessons I’ve learned over the past month as well as do my best to answer any questions you may have.

I’d like to close by sharing something written recently by Morgan Housel of the Collaborative Fund:

It looks bad today.

It might look bad tomorrow.

But hang in there.

We’ll get through this.

For firm disclosures, see here: https://apprisewealth.com/disclosures/