Please note: This blog was updated in August 2024. The updated blog can be found here.

ASSET LOCATION

A common real estate mantra is “location, location, location.” While many overlook it, location matters to investors, too.

Asset location refers to where an investment is held. Investments can be held in a tax-deferred account (e.g., an Individual Retirement Account or IRA), a taxable account, or a tax-exempt account (e.g., a Roth IRA). Paying attention to asset location can improve your portfolio’s after-tax returns. For every additional dollar your portfolio earns, you can save one dollar less – or spend one dollar more later.

More commonly investors focus on asset allocation and/or diversification. Many studies show that how you diversify your assets across different asset classes drives your investment returns. Asset allocation also helps reduce risk. In short, we do not want to “put all our eggs in one basket.” If we diversify, we can increase the likelihood that we will achieve our long-term goals and enhance our potential to realize long-term gains.

ACCOUNT VS. HOLISTIC

Many advisors manage portfolios and implement financial plans at the account level. This means each account is managed separately without regard to what is in the client’s other accounts. Account-level management typically puts a full allocation of investments into each account. As a result, a client with a 60/40 asset allocation model will have the same investments in the same percentages in each of their accounts, i.e., taxable accounts, retirement accounts, Roth IRAs, etc.

While this approach makes it much easier to manage a client’s assets, there are some disadvantages for the client who holds taxable and tax-deferred assets. Failing to locate specific investment types among particular account types can result in missed tax-saving opportunities. For example, you may need to purchase or sell a duplicate position in each account. If choosing what assets to hold in a 401(k) account with limited options, you may have to select an inferior choice to maintain the desired diversification parameters.

At the same time, we cannot definitively rank the type of investments to place in tax-deferred accounts because such ranking is impacted by several changeable factors:

• Tax rates. – These can change due to the political environment as well as an investor’s income level.

• Investment Holding Periods. – These can be specific to the investor and the strategy she implements.

• Return Parameters. – These are constantly in flux as they are affected by the economy as well as market performance.

Factors Affecting Asset Location

The following represent some of the relevant factors in deciding the type of account in which a specific investment should be held:

• Is the investment qualified to be placed in a tax-deferred account? Unfortunately, not all investments can be held in tax-deferred accounts. For example, the tax code prohibits most collectibles from being held in an IRA. There are some exceptions related to precious metals, including certain gold and silver coins issued after 1986, along with silver, platinum, and palladium bullion.

• Taxation of Interest. While there are some exceptions (e.g., municipal bond income), most interest is taxable as ordinary income.

• Taxation of Capital Gains. A capital gain is realized when an investment is sold or exchanged for more than its cost basis. Short-term capital gains are taxed as ordinary income and arise when investments held for a year or less are sold. Long-term capital gains result from the sale of an asset held for more than one year. Such gains are taxed at rates lower than the investor’s ordinary income tax rate.

• Taxation of Capital Losses. A capital loss is realized when an investment is sold or exchanged for less than its cost basis. In taxable accounts, capital losses are used first to offset any capital gains (short- and long-term gains and losses are also matched as they are taxed differently). If capital losses exceed gains, up to $3,000 of such losses can be deducted annually. Unused capital losses can be carried forward until used. If a capital loss is generated in a tax-deferred account, it provides no benefit.

• Taxation of Dividends. Qualified dividends are paid out of corporate earnings and receive the same preferential treatment as long-term capital gains. Importantly, not all dividends are qualified. For a dividend to be qualified, it must have been paid by a U.S. corporation or a qualified foreign corporation. The stock must also be owned for more than 60 days during the 121-day period that begins 60 days before the stock’s ex-dividend date. Dividends from a corporation that is a tax-exempt organization or that generally are not subject to income tax such as those paid by a Real Estate Investment Trust (REIT) are non-qualified and generally taxed at the same rate as ordinary income.

• Tax-Deferred Accounts. Tax-deferred accounts allow a taxpayer to delay paying taxes on assets contributed to the account until some future date – typically when the assets are withdrawn. Examples of tax-deferred retirement savings accounts include 401(k), 457, and 403(b) plans for employees as well as Keogh plans for self-employed individuals. These plans allow individuals to contribute a percentage of their pretax salary into one or more investment accounts and benefit from tax-free growth. A regular or traditional IRA is also tax-deferred.

• Tax-Deferred Assets. Tax-deferred assets allow a taxpayer to defer at least a portion of the income the asset generates.

• U.S. Savings Bonds. Owners of U.S. savings bonds can wait to pay taxes until they cash in the bond, when the bond matures, or when the bond is transferred to another owner.

• Master Limited Partnerships (MLPs). If you own shares of a master limited partnership, you can take advantage of the tax deferral embedded within its structure. MLPs can use depreciation to offset distributed cash flows. This causes the taxable amount they distribute to unitholders to be lower than the actual cash distribution. The amount of cash that is not immediately taxed when distributed must be subtracted from the original purchase price to compute the investor’s tax basis. As a result, when the MLP is sold at a gain, some of the gains will be taxed at the lower capital gains rate. Note that the flow through entity positions of the recently passed tax law may also help reduce the tax rate associated with MLP-related income.

• Tax-Exempt Status. Tax exempt refers to income earned or transactions that are free from taxation. Examples of tax-exempt retirement accounts include Roth 401(k), Roth 403(b), and Roth IRA accounts. Such accounts are funded with after-tax dollars. However, they provide future benefits because withdrawals taken following a five-year period after the contributions to the account have been made, and generally after the account owner is at least age 59 ½, are not subject to taxes.

• State and Local Taxes. Some securities are exempt from federal and/or state taxes.

• Municipal Bonds. Interest income received from investing in municipal bonds is free from federal income taxes. In most cases, interest income investors receive from securities issued by municipalities within their state of residence is also exempt from state and local taxes. Interest income from bonds issued by U.S. territories and possessions is exempt from federal, state, and local income taxes in all 50 states.

• Interest Income from Treasury Bills and U.S. Savings Bonds. While interest income from Treasury bills, notes, and bonds is taxed at the federal level, it is exempt from all state and local income taxes. Income from U.S. savings bonds is taxed at the federal level but not at the state or local level.

Other Tax-Exempt Accounts:

• 529 College Savings Plans. The 529 savings plan is also a tax-exempt account. Contributions are made with after-tax dollars. However, portfolio earnings are not taxed provided the funds are used for educational purposes. Many states also allow taxpayers to deduct contributions to such accounts from taxable income.

• Health Savings Accounts (HSAs). HSAs allow for deductible contributions as well as tax-free withdrawals for qualified medical expenses. Assets held in such accounts can also generally grow tax-free.

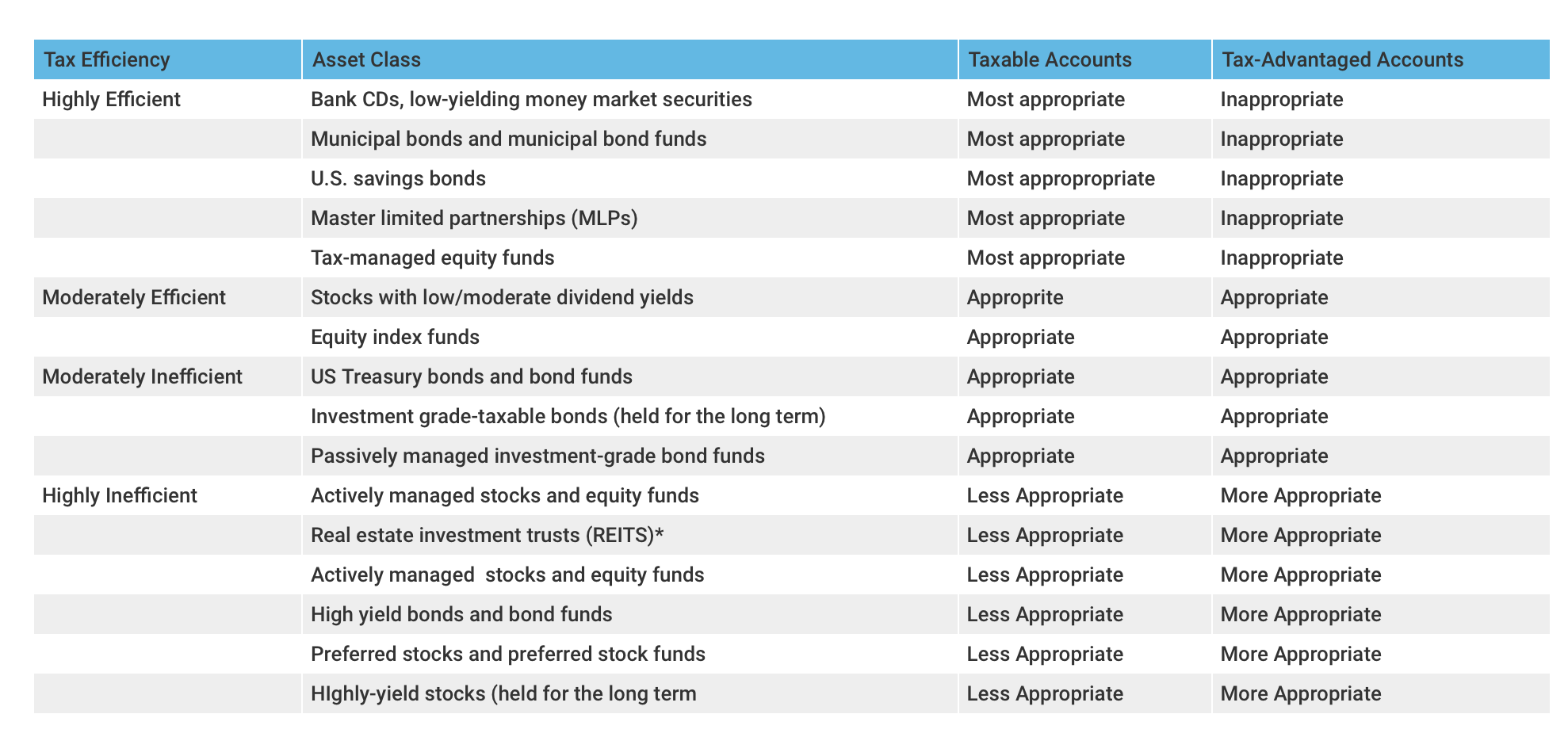

Right Place, Right Time

Generally, tax-inefficient investments should be held in retirement accounts, tax-efficient investments in taxable accounts, and high-return investments in Roth IRAs. Why? Appreciating investments held in an IRA will ultimately be taxed at ordinary income rates. This tax will even apply to your heirs. If held in a taxable account, the appreciation is not taxed unless and until the asset is sold – at lower capital gains tax rates. Therefore, holding appreciating investments in retirement accounts is like telling the government it is okay to potentially pay much more in taxes. Another advantage: If you are a long-term buy-and-hold investor and do not need to sell appreciated assets held in taxable accounts during retirement, heirs see the basis in these assets stepped up to fair market value, potentially resulting in no tax at all.

Holding tax-inefficient investments such as U.S. bonds in a retirement account effectively defers tax until you start drawing down the account. Although this will result in ordinary tax when earnings are realized, the income would have been subject to ordinary tax anyway. While municipal bonds can be held in a taxable account, these still typically provide lower returns. Also, fixed-income investments tend to produce lower long-term returns than equities, resulting in lower required minimum distributions and less potential for income inclusion when the assets are passed on to your heirs.

Holding the highest return investments in a Roth IRA ensures the greatest tax efficiency from an account that may never be subject to tax. Because this account will likely be the last account tapped for cash flow needs, it can handle volatile investments that can potentially produce higher returns in the long run.

There is one other factor to keep in mind, however. If investments held in retirement accounts or Roth IRAs are sold at a loss, such losses will not be realized for tax purposes. We know all our investments will not go up in value; some are bound to decline.

Don’t Let the Tax Tail Wag the Dog

Limiting the amount of taxes you pay is a proper approach as long as it maximizes after-tax returns. The goal of tax location strategies is just that. However, remember not to make decisions solely based on tax implications. In addition, to implement such a strategy, portfolios must be managed at the household level and not on an account-by-account basis. This can add complexity. It can also make the returns in individual accounts uneven. Overall, utilizing such a strategy can allow you to benefit from lower current and future taxes.

Summary

Considering where to own investments can help investors with both taxable and tax-advantaged accounts improve their returns. It is often best to consult with a professional before making asset location decisions. Suggestions in this blog may not apply to everyone as its primary purpose is providing general guidance.

Tax-inefficient investments typically include those providing a high expected return that is in the form of current income. Investments with the greatest potential tax liability are those that should be prioritized when considering tax-advantaged accounts. Investors should also be aware of the tax benefits associated with certain securities. For example, municipal bonds, U.S. government securities, and MLPs all have tax benefits that make them more appropriate for taxable accounts.

A holistic financial plan views all aspects of the client’s financial life as part of a unified whole. If you would like to discuss your personal situation with us in more detail, please complete our Contact Us form. We will be happy to schedule a time to meet with you.

Follow us:

Please note that we post information about articles we think can help you make better decisions about money on Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/