Many of us are living longer than previous generations. As a result, we must plan to fund our lifestyle for more years. Retirement planning helps us put the resources in place to maintain the desired quality of life in retirement.

While the gap narrows as we age, women also tend to live longer than men. Plus, on average, women are younger than their husbands. This magnifies retirement risks for women.

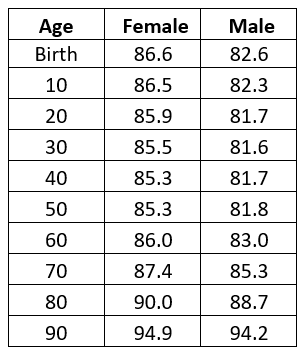

The following table, derived from the Social Security Administration’s website, shows our life expectancy at various ages. Notice that life expectancy gets shorter through age 40 and longer once we reach 50.

The potential longevity-related retirement risks women face include the following:

· Outliving assets

· Loss of a spouse

· Decline in functional status

· Healthcare and medical expenses

· Inflation

The issue goes beyond longevity-related risk. Women also earn less than men. Based on 2018 census data, women of all races earned, on average, just 82 cents for every $1 earned by men of all races.

Women are also more likely to exit the workforce to take care of children or aging parents. When they return, they may have to take several steps back in terms of responsibilities and career level. We have experienced that firsthand in my home. My wife worked for herself for many years while our kids were younger. She decided to go back to the workforce a couple of years ago. The work she did for herself was largely ignored by potential employers. As a result, the positions she has found are beneath her capabilities when it comes to both responsibilities and pay.

MAKE PLANNING A JOINT EFFORT

First, financial planning for couples should be a joint effort. Oftentimes one person takes responsibility for managing family finances and retirement savings. Odds are that one member of a couple (more likely the woman) will end up living alone. At that time, she will have to take care of her own finances and understand how they work. Even if you delegate to your spouse, you want to remain plugged into family finances.

It starts with making sure you know where all the accounts are and how to access them. You can maintain a book with account passwords. You can also use a service such as LastPass to store your passwords. If you keep a book, make sure your spouse knows where you store it. If you use a software tool, make sure your spouse knows how to access it, including the master password.

MAXIMIZE SOCIAL SECURITY BENEFITS

Your claiming strategy should aim to maximize your benefits over your joint life expectancy. You can maximize your Social Security income by waiting until age 70 to start claiming benefits. If you are in good health, waiting until 70 can prove beneficial. In fact, your benefit increases by 8% per year from full retirement age to age 70. A guaranteed 8% annual return is hard to beat. (Note: Your full retirement age is 67 if you were born in 1960 or later. It’s 66 if you were born in 1953 or earlier. If you were born from 1954-1959, add two months for each year from 1954 to 1959 to determine your full retirement age.)

Consider having the higher-earning spouse wait until age 70 to start collecting benefits. In general, waiting until 70 to start claiming benefits works to your advantage if you live to at least 81/82. Importantly, a surviving spouse can claim the higher of the couple’s two benefits. The odds that at least one member of a couple lives until 81/82 are higher than they are that either individual does so on their own. The lower-earning spouse can start collecting Social Security before age 70, depending on the facts and circumstances of the couple’s financial situation.

Waiting to start collecting your Social Security income can have other benefits. You can use withdrawals from your tax-deferred accounts such as 401k’s to cover any income shortfall. This can reduce future required minimum distributions (RMDs), lowering taxable income in future years. It can also make it easier to complete Roth conversions, which can also reduce future RMDs.

WHAT ABOUT WORKING LONGER?

You can also consider working longer. The extra income can provide several potential benefits:

· Reduce and/or delay withdrawals from your retirement portfolio.

· Increase your Social Security benefit if you can replace lower-income years with higher-earning years.

· Allow you to make additional contributions to your retirement accounts.

· If you qualify for a pension, your benefit could also increase.

Of course, you may not be able to work longer. Perhaps your health won’t allow it. You could also have other caregiving responsibilities. For example, you may need to take care of aging parents, your spouse, or your grandchildren.

THINK ABOUT LONG-TERM CARE

If one member of a couple becomes ill, their spouse is likely to provide as much of their care as they can. That can have several implications on their retirement:

· Money spent caring for the first spouse is no longer available for the second spouse.

· If your spouse dies, then a family member may not be available to help with your care. This will increase the cost of your care.

· Living longer can also lead to more chronic illnesses.

Long-term care insurance can help address this issue. Because of many of the issues discussed above, long-term care insurance tends to cost more for women than men. If you think long-term care insurance could make sense, don’t wait too long to make the decision. It only costs more as you age.

You can self-insure. If that’s a consideration, you must account for those potential costs in your financial plan, too. You also should compare your plan’s probability of success with and without such coverage.

SUMMARY

Your estimated longevity plays a key role in your financial plan. It can impact the decisions you make as well as how you invest your portfolio. In this blog, I have focused on some important financial decisions. Your investments matter, too. When it comes to your financial plan your longevity, your goals, and your risk tolerance all play a role. In Apprise’s next webinar, I will discuss the interaction of these issues with your portfolio in more detail. I also believe that taxes and investing are “joined at the hip.” During the webinar, I will also address some important tax considerations from a longevity perspective. Please see the link in the bolded paragraph below if you would like to register.

If you would like to take through these issues and others related to your financial plan, I’d be happy to help.

On Thursday, March 25 at 5 p.m., I will host the next session in Apprise’s “Ask Me Anything” webinar series: “Living Longer: What Does It Mean for Retirement Planning – and Your Portfolio?” In it, I will discuss the above issues related to the impact of longevity on your financial plan as well as your investments and your tax situation. Please use this link to register. You can also ask any questions you have related to Roth IRAs or any other personal finance-related topic.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above information valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or virtual meeting via Zoom.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/