Note: This is an updated version of this blog: How Long Should You Keep Financial Documents? It includes some edits to the original post and some additional content.

Are you overwhelmed by the volume of financial documents you receive? Are you unsure about what to do with them, or how long to keep them? We all accumulate financial documents throughout the year. Many more of them come to us electronically than in the past. But we still receive a lot of financial documents. We receive even more documents early in the year as tax-related forms find their way to our mailbox or inbox. Among the more common items we receive or accumulate are the following:

· Purchase receipts

· Bank statements

· Credit card statements

· Brokerage account statements

· Retirement/savings plan account statements

· Written acknowledgment of charitable contributions of $250 or more

· Paycheck stubs

· 1099s, 1098s W-2’s, K-1s, and other tax-related documents

· Warranties for household appliances and electronic items

· Manuals for purchased items

Why You Need to Keep These Documents

The primary reason for keeping many of these documents is that they support information provided in our tax returns. They can also support the tax treatment of withdrawals from our retirement accounts. Because of changes made by the Tax Cuts and Jobs Act of 2017, many of us no longer itemize our deductions. This means we need to retain fewer records than we used to, at least for now. But unless something changes, we go back to the prior rules in 2026.

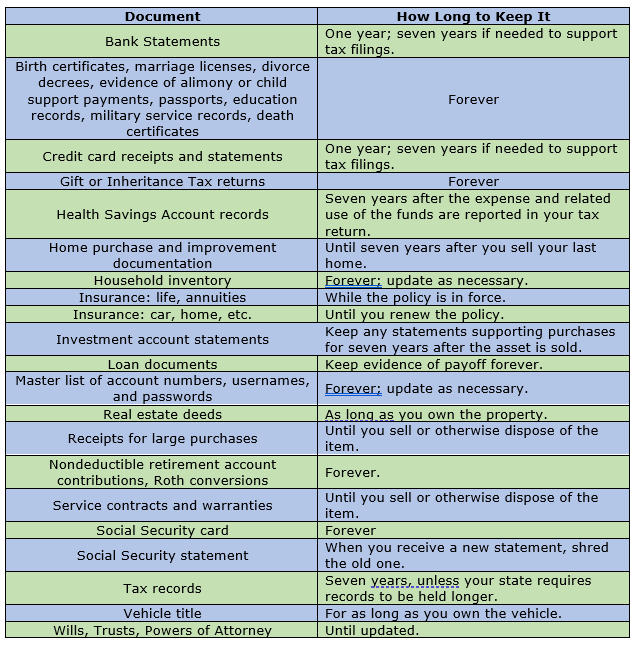

The question is, “What records should we keep?” Unfortunately, the answer is you likely need to keep more than you want. Please note that there is a lot of information here. To help make it easier, check out the summary table listing document types and how long they should be retained near this blog’s end.

How Long to Keep Financial Documents: The IRS Rules

Since we must retain records to support the information reported in our tax returns, use the IRS’s rules as a starting point. If the IRS ever audits you, you want to have the information the auditor asks for available.

First, the IRS expects you to keep your tax returns and any supporting documentation for three years after filing your returns. However, it is not that simple. If you understate your reportable income by 25% or more, you need to save your records for six years from the filing date. When you fail to file a return, the IRS expects you to keep those records forever. If you don’t have records to support your income or deductions, you are more or less at the IRS’s mercy.

According to this IRS tip sheet, the IRS expects you to keep your records indefinitely if you file a fraudulent return. This seems a bit ironic. The IRS says not to cheat on your taxes. We agree wholeheartedly with that view. However, if you did cheat, you would normally destroy the evidence. Instead, the IRS tells you to hold onto it.

You should also keep in mind the rules for state tax returns. You can find general guidelines on how long to retain state tax records here.

Do you need physical copies of these records, or will digital copies suffice? According to Revenue Procedure 97-22, documentation for tax purposes can be retained entirely in digital (and not physical format). This applies as long as the scanned/photographed copy contains all the relevant information.

The bottom line. Keep your tax returns and the related supporting documentation for seven years. While some people recommend six, I suggest seven. Why? You file your tax return the year after you incur the expense. The extra year covers that time lag.

How Long to Keep Financial Documents: Deductible Expenses

Take heart. If you are worried about keeping too much paper, the IRS says you can scan paper documents and save them digitally. Transactions on your credit card statements can also support your deduction. That means you can shred or otherwise dispose of most receipts. Evidence for payment of mortgage interest and real estate taxes, which are primarily reported on Form 1098, should also be kept.

You can find special rules for charitable contributions in IRS Publication 526. These rules are most relevant for contributions of $250 or more to a single charitable organization.

Your bank may be able to provide transaction data years later. However, you should ask before assuming anything. By law, banks are required to keep most records of checking and savings accounts for five years. Some banks keep records for as long as seven years. If you move your account to another bank, your old bank will still look up the information (you will not be able to as you will no longer have online access). However, you may have to pay a fee.

The primary items to keep are those related to your taxes, business expenses, home improvements, and mortgage payments. You should retain home improvement records for as long as you own the home you own and live in. Why? Your cost basis in the last home you own can be impacted by what you paid and what improvements you made to every previous home you owned. You should retain such records for seven years after selling your last home.

How Long to Keep Financial Documents: Brokerage and Retirement Accounts

If you have a taxable brokerage account, you should keep track of what you paid for a stock, bond, or mutual fund (your tax basis) to calculate any gains and losses. If you reinvest dividends or hold an interest in a master limited partnership, your basis will not simply equal what you initially paid for the shares. This means you should retain records supporting reinvested dividends as well as copies of any K-1s received due to ownership of partnership interests.

As a general rule, your brokerage firm will keep track of your basis for you. New record-keeping rules went into effect for most transactions beginning in 2011. These rules took effect for fund companies in 2012. (See here for more information about these rules.) You are on your own for purchases before those rules took effect. If you transfer your account to another firm, the old firm will also transmit your cost basis information to the new firm electronically.

At the same time, it can help to keep these records in your files as a backup. For example, you could archive all your electronic trading notifications in your email, or scan paper statements or a year-end summary of all transactions and store it on the cloud or an external hard drive to be safe. Your financial advisor should also maintain records of transactions that take place while you are working with him or her.

Remember electronic transaction records only go back so far. As a result, you may need to rely on your own records for supporting your cost basis in investments held for a considerable period.

In summary, you should keep records supporting your tax basis in an asset held in a taxable account for seven years after you sell the asset.

Some Special Considerations for Brokerage and Retirement Accounts

If you make nondeductible contributions to your individual retirement accounts, your brokerage firm may not be able to help you substantiate such contributions. Brokerage firms do not typically have access to the relevant IRS document – Form 8606 – which you use to report such information. This means you should maintain those records until after you withdraw all nondeductible contributions to the account.

You should also hold onto any records of conversions from regular Individual Retirement Accounts (IRAs) to Roth IRAs to substantiate your eligibility to withdraw the money free of taxes years later. If you work with an accountant, they may have copies of such documents as well.

You should keep quarterly statements from your retirement/savings plans until you receive the annual summary. If everything matches up, you can get rid of the quarterly statements. Keep the annual summaries until you retire or close the account.

How Long to Keep Financial Documents: Items Related to Your Home

You should keep a copy of purchase and sale contracts for any home you own to support your claim of basis. Similarly, retain home improvement records. Why? They also increase your cost basis. Note that the cost of ordinary maintenance and repairs does not impact your cost basis. The value of your home can increase meaningfully over time. The tax rules allow those who file joint returns to exclude up to $500,000 of gains on the sale of their personal residence ($250,000 for individuals). IRS Publication 523 provides further guidance related to the rules for excluding the gain from the sale of your home.

You should also track expenses incurred when buying and selling property, such as legal fees, any real estate agent’s commissions, and transfer taxes, as these can also increase your tax basis in the property.

If you own two homes and would like to change your residency to save on state taxes it gets a little more complicated. You should retain receipts and travel records to substantiate which home qualifies as your primary residence.

If you claim a Home Office Deduction, you will also need to maintain additional documents. Receipts related to this deduction (for example, utilities, insurance, repairs, and depreciation) should be retained for seven years as well. In this case, the simplified option requires significantly less recordkeeping.

In general, keep records related to owned real estate for seven years after filing the tax return that includes the sale of your final home.

Being a tenant is a lot easier. You can shred rental agreements after you move out and the landlord refunds your security deposit.

If you are a landlord though, the guidelines for homeowners generally apply.

How Long to Keep Financial Documents: Bills

Review your bills annually. In most cases, after the canceled check from a bill is returned, you can shred the bill.

But you should keep invoices for big purchases; e.g., jewelry, rugs, appliances, antiques, cars, collectibles, furniture, computers, etc. in an insurance file – paper or electronic – for proof of value in the event of loss or damage.

In the case of credit card receipts and statements, keep your original receipts until you get your monthly statement. You can shred the receipts if the two match up. Keep the statements for seven years if they document tax-related expenses.

How Long to Keep Financial Documents: Pay Stubs

When you receive your W-2 from your employer, you should match it to the information on your pay stubs. If it does, you can shred the stubs. If it does not, you should request a corrected form, known as a W-2c.

As a general rule, you should keep copies of your W-2s for seven years. But you should also match them to your Social Security earnings history through your my Social Security account. If you find a mistake, your W-2 can help you correct it.

How Long to Keep Financial Documents: Estate Planning and Inheritance-Related Documents

Estate planning documents can give rise to numerous issues. You should retain originals of any will, trust, durable powers of attorney for both medical or financial affairs or related documents, as well as beneficiary designations from insurance policies or investment accounts. If you are married and have a pre- or post-nuptial agreement, you should keep it as well.

If you received an inheritance or gift, you must document its value as well. As a result, you should keep the related IRS forms. As a result, you should keep the related IRS forms – 706, 709, and 8971 – forever.

While it does not relate directly to document retention, you should also keep a secure file with account numbers, usernames, and passwords for all online accounts. This will help family members when they need to access accounts after you are gone. At Apprise, we provide new clients with a password book they can use to record this information. If you don’t want to keep a paper record, you can use a service like LastPass, Dashlane, or 1Password.

In the event of your sudden death or incapacity, it helps if your named agents for medical and financial affairs are fully informed of the details of your personal data. This will make it easier for them to act on your behalf.

How Long to Keep Financial Documents: Other Stuff

There are many other records you should maintain. For example, keep receipts related to a Health Savings Account in accordance with the rules for deductible expenses outlined above. You want to keep a record of who you paid, the amount, and the date you made the payment. Your healthcare provider may provide relevant data as part of its explanation of benefits forms as well.

You should hold onto copies of all major insurance policies. You should also develop a home inventory of things you will want to replace if they are damaged or stolen. Such records are best kept in a safe deposit box. Taking pictures of such items can also make any insurance claims a lot easier to process.

You should retain agreements for all major loans, such as student, auto, and your mortgage along with any letters confirming payoff.

You should maintain records of child support, alimony, and other records forever, too. Keep divorce documentation, particularly if the relationship is unfriendly, as well.

Documents related to personal identification (Social Security card, birth certificate, and Driver’s license) must be kept in their original physical form. Store this information safely along with key legal documents such as wills, trusts, and Powers of Attorney. That helps prove their authenticity.

If you served in the military, discharge papers may come in handy, too.

Retain documentation related to warranties for as long as the warranty is in effect. Keep manuals for as long as you own the item – today most manuals are electronic.

For each vehicle you own, keep the title. If you are meticulous, you can retain the repair and maintenance records as well.

How Long to Keep Financial Documents: Staying Organized

Adopt a filing system and stick with it. Be careful about falling back into bad habits. Don’t wait too long to file your documents. Otherwise, the idea of how long it will take to get caught up may keep you from putting things where they belong.

At the beginning of each calendar year, it can help to establish an accordion file (or, an electronic equivalent for scanned documents). Label a divider – or file folder – to cover each bank or investment account as well as income or expense type. This file can help you match receipts to credit card and bank statements as well as when you prepare your tax return.

At the end of each year, you should purge this file, keeping items you need. There is no need to keep documents longer than necessary. If the document contains personal information, shred what you no longer need.

If you fall behind, do not despair. Schedule time to get things back in order when you have more free time. Tackle the problem a little bit at a time. Focus on keeping your goals achievable, so you can get back to being organized.

How Long to Keep Financial Documents: The Consequences

What happens if we don’t keep key documents? It can have a serious negative effect in at least some cases. Consider the following:

· You could pay penalties or undergo an audit if you don’t maintain adequate tax records.

· If someone challenges the validity of your ownership of an item or property, you can use deeds and other title documentation to prove legal ownership of an asset.

· If you apply for a loan, you will need to provide several financial records. If you don’t have the documents readily available, you could miss the chance to lock in a more favorable mortgage rate. You might not qualify for the mortgage at all. This could cause you to miss out on the desired purchase altogether.

· In today’s environment, the amount of documentation needed to refinance a mortgage can be considerable. If you don’t have the necessary information, you may miss out on the opportunity to borrow at a more attractive rate.

· In litigation or other legal disputes, you may need to provide certain documents to prove your case or claim. If you don’t have copies of these documents, you may not be able to find them elsewhere. Your personal file organization could be the difference between winning and losing your case.

Summary

Below is a summary table showing how long you should keep specific documents.

Maintaining your records can be helpful if you want to create or update your financial plan. They can help you and your financial advisor identify what is important to you as well as what your assets are and what your future income and spending requirements might be. If you would like to talk to us about creating a financial plan, please fill out our contact form, and we will be in touch.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above information valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/