With the market’s continued volatility, I thought it would be helpful to share some additional thoughts. If you would like to discuss the market’s recent performance, please use this link to schedule a personal call.

Market drops can be scary. Perhaps, even terrifying. As we watch stock prices fall, our thoughts can get away from us. What if the market never recovers? What if I have to go back to work or my plan to retire early is jeopardized? What if I must cut my spending? What if I can’t retire? What if my world completely changes? What if…”

These thoughts all represent emotional reactions. As discussed in more detail in this blog, our emotions can hurt our investment returns. In particular, during periods like those we’ve experienced over the last couple of weeks, it is easy for us to be guilty of recency bias – evaluating our investment returns based only on recent results.

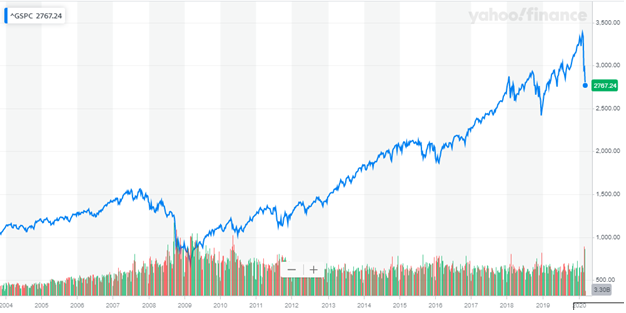

The market has moved from an all-time high to a correction phase (a decline of more than 10%) at a faster pace than we normally experience. But market corrections and bear markets (a decline of more than 20%) happen. More often than not, they are triggered by something nobody ever saw coming.

Sometimes, in as little as six months, no one remembers the event. Sometimes it takes longer. Perhaps, a year or two.

This has happened before. Money you have invested in the market should not be money you need right now. It should not be money you need next month or even next year.

Looking back to 2008/2009 with the benefit of hindsight, we can see that that bear market (shown in the chart below taken from Yahoo! Finance) had little impact on long-term returns. If you left your account statements unopened for a few years or refrained from watching the financial news, you wouldn’t have known it happened. It had little impact on your long-term plan.

Those who choose to react emotionally and change directions during such market downturns, often lock in permanent losses and miss out on the gains that follow.

Last week, despite the large daily movements, the market, as measured by the S&P 500 Index, rose. This week started with the worst one-day loss since 2008. But we don’t know what will happen the rest of the week or even the next few months.

Your financial plans are designed to account for this type of volatility. Despite our best efforts, it can still be scary.

What can you do? If you find your mind full of scary thoughts, consider some practices that can help. Perhaps, a mediation app. Continue to enjoy the things you usually enjoy. Step back and realize thoughts lead to emotions. Getting stuck in unhealthy emotions won’t help. You may also want to avoid watching the financial news networks. They know that fear sells.

For firm disclosures, see here: https://apprisewealth.com/disclosures/