Watch the conversation

🎥 Four Sources of Capital (TEAM) with Carl Richards → [WATCH LINK]

Prefer to read? The edited transcript appears below.

What we cover in Episode 2 (TEAM)

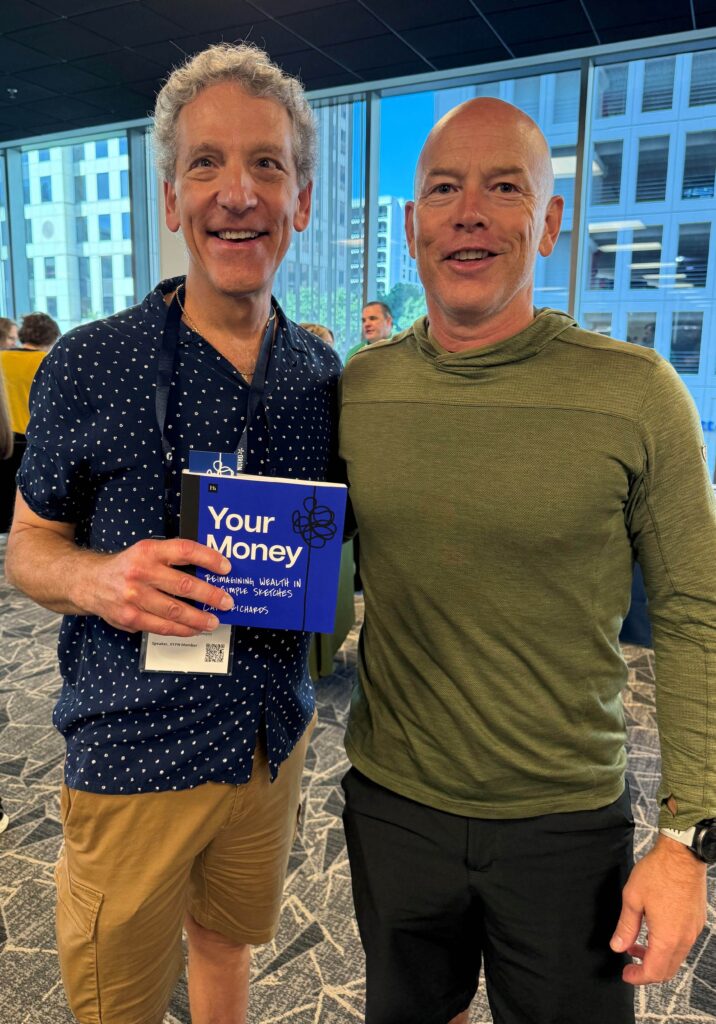

In this episode, I sit down with Carl Richards—a certified financial planner, author, and creator of The Sketch Guy column in The New York Times. Carl is known for his simple yet powerful sketches that make financial concepts easy to understand, as well as his best-selling book The Behavior Gap.

If money is only one tool, what are the others? In this episode, Carl and I explore TEAM—Time, Energy, Attention, and Money—and how small reallocations can quietly change outcomes. We share ways to protect attention, recover energy, guard time, and then let money support the rest (buy time, reduce attention drain, fund recovery).

Key ideas

- Attention is scarce—and often the most valuable capital to protect.

- Money is a tool—best used to reinforce Time, Energy, and Attention.

- Rebalance, don’t overhaul—small weekly shifts compound.

| One Small Step (this week)

Run a 20-minute TEAM audit 1. List one drain in each area (Time, Energy, Attention). 2. Pick one drain to reduce this week (turn off one set of notifications, add one recovery ritual, protect one 30-minute block). 3. Let Money support that change (e.g., pay for grocery delivery to buy back 60 minutes). |

Phil Weiss

The next one I’d like to discuss is the four sources of capital, which I know you just mentioned. And I’ve rearranged those. I use TEAM because I like to think that we have a team of capital.

Carl Richards

Nice.

Phil Weiss

But I’d love to hear you talk a little bit more about that.

Carl Richards

That’s great. I have no problem. But just to go over them. So, money, energy, time, and attention, or in your case, time, energy, attention, and money. Both are great. Let’s just talk real quickly about attention, because I think that’s kind of fun. Money seems obvious because we talk about it so much. And I think time is really interesting. One of the fun thought experiments with money and time is what if somebody asked me this: ‘What if we treated money like it had the same characteristics as time?’ Meaning like you couldn’t save it up. You can’t store it. At the end of the day, that time’s gone. And I’m not sure it’s the best financial planning practice, but it’s an interesting thought experiment. Like, how would you treat your life differently? Because one day that will actually be true, right? You can’t save it up. I mean, the Egyptians tried that, and all it got them was robbed. So I think that’s interesting.

But attention’s really interesting to me, too. We have all this language around, and I don’t think we spend enough time talking and thinking about attention. I would argue, at least culturally and commercially, that the most valuable commodity on the planet right now is our collective attention, as well as your individual attention. The richest people in the world, if we’re just going to look at what society values, the richest people in the world are often titans of attention. You know, Facebook and Amazon, I think you can argue. Twitter, in the old days, whatever it’s called now, X, those are all platforms that are battling for your attention. So, if it’s that valuable to them, in other words, it’s made them the richest people in the world, it must have some value. Like titans of it, it’s no longer railroad titans, it’s titans of attention. That’s pretty wild to think about.

So, if we just start thinking that way, we might realize that this must be really valuable. I’ll be a little bit more careful about how I allocate it. And then we have this phrase: ‘Pay attention.’ And I would argue that the currency, the way you pay for a good relationship, is with the currency of attention. I think the way you buy a meaningful life is by paying attention to what you pay attention to. I just think it’s fun to play around with attention. Apparently, it’s really, really valuable, and it’s very hard to allocate.

Phil Weiss

That’s a really interesting concept. I hadn’t thought about attention quite in that way, but what you’re saying makes a lot of sense because when you think about it, there’s a question also about time that I got from my life planning training, that if I asked you how many hours in a day, you’re going to tell me 24. And if I asked you how many hours there are going to be tomorrow, it’s still 24. And a week from now, it will still be 24. But then the exercise asks, ‘If there’s some type of cosmic event and suddenly, the earth started to spin a little bit faster and there were only 22 hours in the day instead of 24, what would you do? What changes would you make?’ And you can’t tell me you’d sleep less because that’s really not going to do it. So, you have to figure out what to cut out. And what you’re cutting out really ties into the idea of attention.

Carl Richards

I agree. I think any exercise that helps us understand that attention is actually a source of capital you get to spend and invest, and that it provides a return. And I actually would argue that it’s the most, apparently, it’s maybe the most valuable source of capital we have.

Phil Weiss

Social media companies would certainly argue that, right?

Carl Richards

Yeah, and I think too, just when you start to realize, like, you can certainly spend time with one of your children. That is a completely different experience. You and that child will have a completely different experience if you also pay attention during that time. And they will know the difference. They will know the difference. Time is one thing. And you could also spend time, money, and energy. We’re going to go on an experience. It’s going to cost us money to ski. So, we’re going to be together. It’s going to cost us money to ski, and it’s going to take energy to go do it. And you could not even be there with your attention. And the whole experience could actually end up being a net negative experience, depending on your child’s perspective. I mean, it could also be awesome that I got to ski all day, and I didn’t even have to talk to my dad. But there’s a real, tangible difference there. And I think we just don’t pay enough attention to attention as a source of capital.

FAQ—Four Sources of Capital (TEAM)

1. What are the four sources of capital?

Time, Energy, Attention, and Money. Money is a tool, but it’s not the only tool. Good planning balances all four.

2. How do I “rebalance” my TEAM?

Identify where you’re overspending (e.g., attention on headlines) and under-investing (e.g., energy on health). Shift small units—like 30 minutes per week—to restore alignment.

3. What’s a quick TEAM win for someone starting fresh?

A weekly 30-minute money check-in (Bills → Balances → Calendar → One small improvement). It reduces noise and builds momentum.

4. How can money support the other three?

Use money to buy time, reduce attention drain (e.g., outsource one task), or fund recovery (e.g., health/energy).

All Episodes:

- Real Financial Planning → [EP1]

- Four Sources of Capital (You are here)

- A One-Page Plan → [EP3]

- Goals Are Guesses → [EP4]

- Tax Planning, Not Reporting → [EP5]

Next up: We compress priorities into an actionable One-Page Plan—purpose, top priorities, near-term actions, and a clear cadence for review.

Subscribe to receive the next part directly in your inbox → https://apprisewealth.com/blog-sign-up/.

Our practice continues to grow through introductions from our clients and friends. Thank you for your trust.

If you would like to discuss financial topics, including navigating new beginnings, managing your investments, creating a life plan, or saving for retirement, please complete our contact form or schedule a virtual Zoom meeting. We will be in touch.

Follow us:

Facebook | LinkedIn | Instagram | YouTube

Please note: We post information about articles that can help you make better money-related decisions on LinkedIn, Instagram, and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/