For couples, deciding how to manage money is a personal decision. You should make the decision that works best for you and your spouse. There is no objective “right answer” to the question “Should you keep your finances separate or manage them jointly.” It depends on the context of your relationship.

The decision works best if you communicate openly, honestly, and frequently about money. (If you would like some suggestions to help get the conversation started, please click this link.) It also only works if the two of you work together and actively participate in the process.

Unfortunately, our societal norms often result in men handling family finances. Married and single women, whether they have a career or not, often have little familiarity with matters related to personal finance, including financial plans. The same applies to divorced or widowed women. If they were honest about it, most men would admit that they do not have a lot of familiarity with matters related to personal finance either. After all, schools don’t provide much in the way of financial education.

We often see one spouse check out and leave their partner to manage family finances. Surveys show more than half of millennial women defer financial decisions to their spouses. It would not be surprising if this trend increased even more during the pandemic. According to a guest on the podcast Pivot, over the last nine months the labor force participation rate among women has fallen to where it was in the 1980s. In other words, it took nine months to erase almost 30 years of progress.

It should be easy to understand why this has happened. With schools closed, many women have become teachers, nannies, and the providers of tech support for their kids. They do this while trying to keep their full-time jobs – at least those that are fortunate enough to still have them. This leaves many of them with little time for anything other than trying to meet their professional obligations and take care of the kids.

Don’t let a change in circumstances take away your right to be part of the decision-making process. Deciding not to participate in matters related to your financial life is a much bigger issue than whether you combine or separate your finances from your spouse’s. After all, your money and the decisions related to it, determine much of what happens in your life. Almost everything is, at least in part, a financial decision.

Decision making related to financial planning should not be exclusive to men. There is no reason women should feel uncomfortable dealing with financial matters. Whether you work with a financial advisor or do things on your own, both spouses should be involved in discussions around finances.

When I work with couples, I include both in the discussion. I can only think of one couple that is an exception to this general rule. In that case, I work almost exclusively with the wife. I have only spoken to her husband once or twice. There are specific reasons this relationship is managed this way. In many other instances, I work with women who are single, divorced, or widowed. In fact, about two-thirds of Apprise’s client relationships are led by the female member of the household. (See this link for some thoughts on why.)

When it comes to managing finances, the fundamentals are straightforward. It starts with gathering basic data. You need to understand what you own (assets), what you owe (liabilities), what you earn (income), and what you spend (expenses). These represent the key components of your personal finances. Many folks find gathering this information the most difficult part of putting together a financial plan.

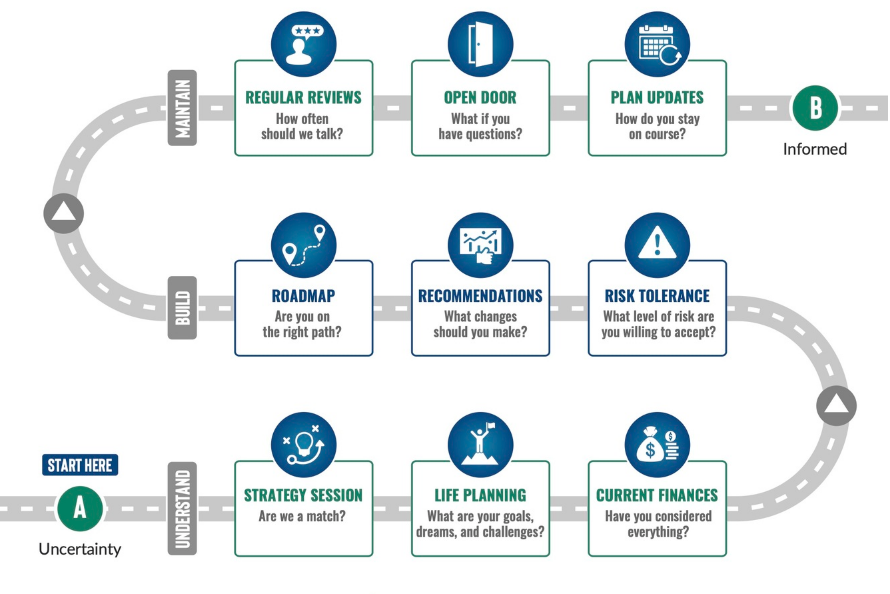

Apprise’s “Pathway to an Informed Retirement” is a process used to take clients from “Retirement Uncertainty” (Point A) to an Informed Retirement (Point B). Your assets, liabilities, income, and expenses are all part of the foundation of your financial plan. They are addressed by the box in the lower right corner of Apprise’s Pathway.

The idea behind a financial plan is to accumulate sufficient assets over time to allow you to maintain a desired lifestyle when you retire. When you retire, you move from asset accumulation to asset decumulation. The assets you accumulate while working need to provide the income you need to live your desired lifestyle in retirement.

Sometimes people save enough for the future to live their desired life in retirement. Others do not. In the latter case, adjustments need to be made. You must prioritize your goals. The necessary adjustments can include some or all of the following:

· Retiring later

· Saving more

· Adjusting your investment allocation

· Spending less.

It can also mean that you will be unable to do all you desire in retirement.

In the initial stages of preparing a financial plan, I ask clients a series of life planning questions to help identify what matters most to them. This discussion helps clients prioritize their goals and identify their challenges. A financial plan also helps in the identification of the asset allocation that fits best with your plan and risk tolerance.

Could you complete this exercise on your own? Yes. But the variables involved may well be more than you should attempt to tackle without help. It requires more than tweaking your budget or investments. For many, determining expenses can be quite revealing. People rarely have complete awareness of how they spend their money.

Preparing your own financial plan and managing your own finances, requires three things: Knowledge, Interest, and Time (collectively, “KIT”). You can read or watch YouTube videos about basic concepts including asset allocation, diversification, and appropriate holdings within asset classes. But doing so on your own can be difficult, if not fraught with risk. Seeking to make your own decisions may also include a heavy emotional overlay. Engaging a professional can help you make productive decisions without that obstacle.

You can’t do anything without taking a first step: GET STARTED. Once you begin the process, you can always change direction. After all, the journey from Point A to Point B on the pathway shared earlier is rarely a straight line.

In the end, you should not abdicate your ability to be part of the process of setting your financial future. You should play a role in determining the actions needed to get where you want to go. Doing so should help make it more enjoyable when you arrive at your destination!

What matters to the financial success of married couples is that they manage finances together and work as a team toward a set of common goals. Your financial plan should reflect everyone’s participation. It should be something that everyone understands and can take part in.

For firm disclosures, see here: https://apprisewealth.com/disclosures/