Overcoming “What’s Next?” Anxiety: Financial Planning for Life Changes

Feeling uncertain about your next chapter? Discover how financial planning for life changes can bring clarity and confidence.

Feeling uncertain about your next chapter? Discover how financial planning for life changes can bring clarity and confidence.

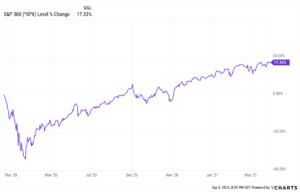

How to stay grounded amid market volatility in 2025—what the April 9th rally teaches us about long-term investing.

Declutter your estate plan with three simple steps to align your legacy with your life, values, and goals. A timely nudge for your spring review.

Selling your family home? Are you aware of the hidden tax consequences you might face, including capital gains taxes, the exclusion, and why timing matters?

Worried about the market correction of 2025? Learn what history tells us about volatility—and how to stay focused through today’s uncertainty.

Spring cleaning for retirement! Let go of stress, busy work, and financial worries to create space for joy, fulfillment, and a better life.

Financial planning for women: Learn how to build a strong financial foundation and take control of your future with smart money moves.

Navigate gray divorce financial planning with confidence. Learn key financial, tax, and emotional strategies that can help you have a more secure future after 50.

Not all advisers put your interests first. Learn why working with a fiduciary matters and how to avoid hidden fees. Read on to learn more.

Boost brain health and prevent cognitive decline with simple lifestyle changes for a sharper mind and a more fulfilling life.

Be prepared! Organize key financial & family documents to help you prepare in the event of a natural disaster.

Women in their 50s and 60s: tips for thriving after an empty nest! Rediscover joy, embrace independence, and live your best life.

"*" indicates required fields

Alleviate stress and see where you are and what you need to do next for a comprehensive financial plan tailored for you.