Market Thoughts

It’s hard not to notice that after strong returns in July and a solid start to August, the market has once again turned lower. While we never know for sure, reports of higher-than-expected inflation in August likely spurred the latest decline. On Tuesday, the S&P 500 Index dropped 4.3% after this data was released.

Tuesday’s decline marked the second time this year that the market fell at least 4% on a single day. Stocks have also declined by at least 3% nine times this year. They have fallen 2% or more on 17 occasions.

At the same time, the market has also delivered gains of at least 2% on 16 different trading days this year. The bumpy ride the market has taken investors on this year can be seen more clearly in this year-to-date performance chart.

The market’s weak performance can lead to investor angst. While I haven’t gotten many calls from clients about the market, I have gotten a handful.

I can understand why some people are concerned. It’s never fun to watch your account balance fall. Unfortunately, down markets are par for the course. If there wasn’t risk in investing, then investors wouldn’t earn the returns they have over the long term. It’s also important to consider that when we invest, we are expressing our belief that the market will provide long-term gains. Otherwise, there would be no reason to invest.

What About Diversification?

It’s probably even easier to be concerned by the market’s decline right now. Normally, bonds help provide some cushion against losses. But with interest rates increasing, that hasn’t been the case. As shown here, all asset classes were down year-to-date through August’s end other than cash and commodities. If we consider inflation, commodities represent the only asset class to provide positive year-to-date returns.

Commodities have a poor long-term track record, so they do not represent an explicit allocation within the portfolios of Apprise’s clients. Plus, if you look at the underlying data, you’ll see that higher oil prices are often the key driver of strong commodity returns.

When I was an analyst covering the energy sector, I had to forecast oil prices as part of my job. Members of the media would call and ask for my price forecast. I’d give it to them. But, first, I’d say the following: “It’s part of my job to forecast oil prices, so I’m going to give you a number. But there’s one number I can pretty much tell you won’t be the average oil price for the next quarter or year. That’s the number I’m about to give you.” There are simply too many unpredictable factors affecting oil prices for anyone to forecast them with any degree of precision.

A Look at History

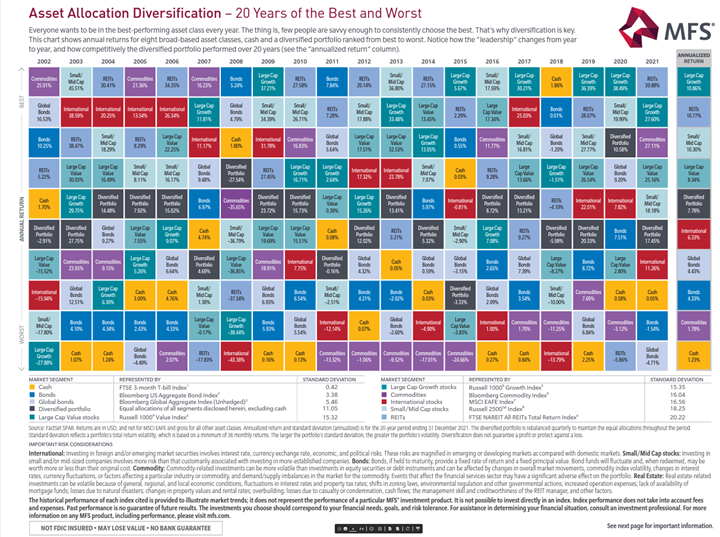

It’s also hard to predict with any degree of certainty which asset class will deliver the best results in a particular year. The following chart shows returns by asset class over the last 20 years. It also represents one of the best arguments one can make for having a diversified portfolio. It might not provide you with the best returns, but it can help you avoid having the worst returns.

When the market falls, it’s even more important to remain focused on the long term. Reacting to down markets can derail your efforts to reach your financial goals. Remember, too, if you are currently employed and contributing regularly to a retirement account such as a 401(k), you are adding money to the market every pay period. That provides you with an opportunity to take advantage of the market’s downturn.

While volatile periods like the one we’re experiencing now can be intense, investors who learn to embrace the uncertainty may often triumph in the long run. That’s why it’s important to keep investing (or stay invested during a declining market). It would be nice if we could know to exit the market before it turns lower, but I know of no one with a successful record of timing the market.

What Happens if We Exit the Market?

If we exit the market, how do we know when to get back in? Odds are that if we exit a bad market and re-enter later when things look better, we will have weaker returns. Why? We’ll miss a portion of the recovery. While past performance does not guarantee future results, on a historical basis, staying invested puts you in the best position to capture the recovery. Big return days are hard to predict, and you don’t want to miss them. If you invested $1,000 in the S&P 500 continuously from 1990 through the end of 2020, you would have $20,451. If you missed the single best day, you’d only have $18,329 – and only $12,917 if you missed the best five days.

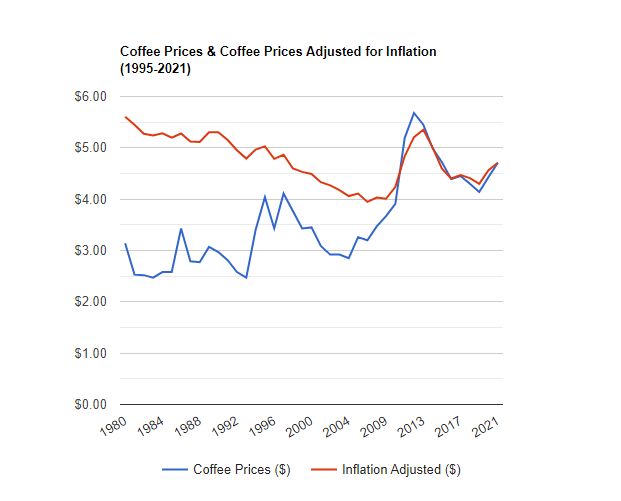

Moving your portfolio to cash will also cause you to lose out to inflation. That means your purchasing power will decline. For example, check out this chart showing the price of coffee since 1980 – including an inflation-adjusted price. In 1980, the average price of coffee was $3.14. It peaked at $5.68 in 2012. It’s fallen some since, but it was still $4.71 in 2021.

Why Do We Invest?

When it comes to investing, is your goal to beat the market, or is it to invest in a way that will allow you to live your desired lifestyle both now and in the future – including retirement? Trying to beat the market implies taking on risk. That additional risk can lead to larger losses when the market declines. Diversification can help minimize your losses in a down market. It may also limit your gains when the market rises. But limiting your losses and lowering volatility can ease your mind.

Positioning yourself to live your desired lifestyle should matter more. The life planning questions that Apprise asks as part of your financial plan are designed to help determine what matters most to you. That should be reflected in your financial plan.

Some Final Thoughts

On average, down markets last 18-24 months. That doesn’t mean the market will recover within that timeframe this time, but that’s a reasonable guideline. We also have a bear market about once every four-to-five years. (We’re considered to be in a bear market when the market falls at least 20% from its highs.) When it comes to investing, down markets come with the territory. Knowing that doesn’t make any feelings that a falling market causes go away. But it can help ease the pain and lower the level of concern. We’ve seen this before. We will see it again.

It’s important to focus on the right things during markets like this one. Your financial plan has to survive difficult times in the market. When we have a difficult market, we need to maintain our focus on what’s important. To me, that’s the long term.

The longer the volatility lasts the easier it becomes to pay too much attention to the market and not what matters. If you’re an accumulator of assets, you should view the volatility as a chance to buy at lower prices, not a risk. If you’ve already accumulated financial assets, this volatility is the other side of more than a decade of extraordinary gains in the U.S. market.

Regardless of whether you’re an asset accumulator or an asset decumulator, keep in mind that volatility – to both the upside and the downside – is an integral part of bear markets.

We can do nothing to control the volatility.

But we can control how we react to the volatility.

I hope this helps. Please let me know if you have more questions or if there is anything else I can do to help. If you’d like to talk about it, please schedule a call.

Apprise’s Five Favorite Reads

When saving for retirement, many of us focus on saving in tax-deferred retirement accounts such as IRAs/401(k)’s or Roth IRAs/401(k)’s. But having a taxable account can help, too. This week’s first article shares six key reasons you may want to consider investing in a taxable account. If you have any questions that are not discussed in any of this week’s articles, please schedule a quick call.

——-————————————————————————

Here are the links to this week’s articles as well as a brief description of each:

1. 6 Key Reasons Why Investing in a Taxable Account Is Underrated.

When it comes to what types of accounts to use when saving for retirement, taxable accounts often get overlooked. We like the current tax break that comes with funding our Individual Retirement Account (IRA) or our 401(k). These accounts provide tax-free growth as well. While they get funded less frequently, Roth IRAs/401(k)’s should also be part of our retirement savings. We don’t get a tax break when we fund these accounts. But they can deliver tax-free growth. Funding a taxable account doesn’t provide a current tax break. But it helps us diversify our accounts by tax treatment. That allows us to better manage our tax bills in retirement. How so? If we follow the rules, withdrawals from IRAs get taxed at our current marginal tax rate (the tax rate we pay on our last dollar of income). If we continue to follow the rules, we pay no taxes on money withdrawn from a Roth IRA. When we need money from our brokerage account, we only pay taxes on gains. If we’ve held the asset for at least a year, then we pay taxes at the lower capital gains rate. Taxable accounts also provide a benefit to our heirs. Read the article to learn about some of the other advantages of a taxable account. If you do have different types of accounts from a tax perspective, don’t forget about asset location. If you’d like to discuss some steps you can take to improve the tax efficiency of withdrawals from your retirement accounts, please schedule a free call.

2. Spam Texts Are Surging. Here’s How to Avoid Being Swindled.

Have you seen a big increase in the amount of spam finding its way to your phone? I know I have. This happens even though federal law requires carriers to provide us with anti-spam technology to help combat robocalls. This article offers some good suggestions to help you protect yourself. It starts with paying attention. You don’t want to act on a text from an unknown sender too quickly. The article also shares the steps you can take to report the text and block the sender. Your phone comes with some built-in protection as well.

3. 7 Surprisingly Valuable Assets for a Happy Retirement.

To live a happy retirement, you need more than money. This article shares seven habits happy retirees adopt. These are in addition to making sure you save enough to quit your regular job. Once you retire, your focus should shift more to the things that money can’t buy. It shouldn’t surprise you that staying healthy is first on this list. You should also continue to exercise your mind. As a long-time dog owner, I love the last habit on this list. Before my wife and I got married, I made sure she understood that she was also committing to own a dog for the rest of our lives. We’re both happy with that decision. So our all of our kids.

4. Leisure Activities May Lower Dementia Risk.

On average, according to the US Department of Health and Human Services Administration on Aging (AOA) around 70% of people over 65 will require long-term care services at some point in their life. Long-term healthcare costs often represent one of the biggest risks to a successful financial plan. According to the AOA, the average woman will need long-term care services for about 3.7 years. The average man will need them for 2.2 years. These figures may include some time in the home (provided by family members and/or paid caregivers), in an assisted living community, and/or care in a skilled nursing facility. Apprise’s financial plans typically provide for at least three years of long-term care for all clients. The duration of long-term care can rise considerably in cases of dementia. When we get dementia, our bodies may still be healthy even though our brain isn’t. Research cited in this article states that leisure activities appear to be beneficial to our cognitive health. It found that those who participated in leisure activities lowered their risk of dementia by 17%. Older adults need to engage in leisure activities they can enjoy and sustain. While all mental, physical, and social activities can benefit our brains, mental activities help the most, followed by physical activities, and then social activities. Check the article to learn more.

5. Rate Resets on 9.62% Interest, Taxes, Inherited Assets: Experts Weigh in on 3 Tricky Questions About Series I Bonds.

A few weeks ago I shared an article discussing the merits of I bonds and why you should consider them if you have extra cash. This article addresses some of the nuances related to I bonds. For example, the interest rate you earn on an I bond is set for six months from the purchase date. It doesn’t get reset when the US Department of the Treasury announces the new rates. The article also discusses your choices when it comes to paying taxes on any interest – you don’t receive the actual payment until you redeem the bond. The last question provides an important reminder about naming beneficiaries.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above articles valuable. We would be happy to address any follow-up questions you have. You can complete our contact form if you would like to talk to us about financial topics, including your investments, creating a financial plan, saving for college, or saving for retirement. Once you do that, we will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/