Buy Experiences, Not Possessions for Better ROL

Pick up your cell phone. If it’s a few months or years old, try to remember when you first bought it. How shiny, light, and scratch-free it was. How excited you were to sync your accounts, take pictures and videos with the new camera, or check out the upgraded features.

And now? Be honest – it’s just your phone. You might not be able to get through a day – or an hour – without it, but even if you’ve kept it in good shape the shininess and the newness are gone.

That’s due to a phenomenon that psychologists call “hedonistic adaptation.” Relatively quickly the things we buy just become more things we have, and that initial burst of happiness we feel when we crack open the box fades away.

On the other hand, buying experiences often create happiness that sticks with us, reverberates with our loved ones, and improves our return on our life.

Here are four reasons why:

1. Anticipation is its own reward.

Yes, spending a few days searching for the best TV deals or comparing specs for a new laptop purchase can be fun. But the payoff for all that planning is still just another thing. And, in many cases, there’s no real payoff at all. How often have you stared at a screenful of open browser tabs and just clicked on something to be done with it? Maybe you suffered analysis paralysis and decided what you were thinking about buying wasn’t worth the hassle.

Imagining yourself on a tropical beach, exploring new places, or zooming around on roller coasters is a much more visceral thought experiment than deciding how big your next TV should be. Plus, the payoff is real: you’ll be there soon enough! And as you and your family plot out the details of your next experience — where you’ll stay, where you’ll eat, what activities you’ll do – your planning will build anticipation that will make the experience itself even more rewarding.

2. Experiences can be shared.

Planning is also only the first step in creating a shared experience with your loved ones. Involving every family member when designing your itinerary helps you create a unique experience reflecting elements of everyone’s interests. It will also give your family a chance to do more of the things you love doing together.

And while buying stuff – especially personal electronics – tends to seal us off in our personal bubbles, vacations and destination activities can shake us out of our comfort zones and show us corners of the world we’ve never seen before. Rather than returning to your favorite theme park, how about exploring some place your family has never been, or even considered visiting? What’s a sport you’ve never tried, a cultural festival you’ve never attended, a cuisine you’ve never sampled? New experiences often teach us the most about ourselves, the people we care about the most, and the wider world.

3. Memories last forever.

Of course, buying stuff can be part of an experience, too, especially if you’re hitting the road with children. Some souvenirs you pick up along the way will end up in a recycling or donation bin – right next to your old cell phone. Others will become treasured reminders of an unforgettable experience, inseparable from the memories you planned for and shared.

Plus, if you’re like most, you’ll take plenty of pictures with your phone to memorialize the event. You’ll also have many mental images you can recall in the future as well as stories you can recall and share. Another benefit can come when you talk with your kids about the trips you took in the past and discuss some of your favorite memories. That’s something that happens often in our family.

4. Benefit from a framework.

While he was alive, my father-in-law included our family and those of my wife’s siblings on several trips. I appreciated seeing how close they were and how well they got along.

Beginning when our first child was born, I told my wife I wanted to take our kids on regular vacations with us. Getting them in the habit of traveling with us when they were young would, hopefully, increase the chances they would continue to travel with us once they were grown. Plus, if we were lucky enough to have grandchildren, we would have a better chance of having them – and their families – continue joining us – at least occasionally far into the future. As a result, my wife and I have taken our kids on vacation and/or to see a historical landmark at least annually. Even though our youngest just started her freshman year of college, she and two of her siblings – the fourth lives with us but doesn’t travel – joined us on our vacations each of the last two summers. One even flew in to join us. He currently lives and works in Seattle.

We have limited time with our kids. The older they get the less time we have. When they go away to college, most of our time with them is gone. This makes spending quality time with your children and being present when they’re young so important. Giving them a reason to spend additional time with you when they’re older is a bonus.

My wife and I feel fortunate that our kids still want to join us for vacation. As we returned from this year’s trip, they asked where we would go next year. We haven’t decided yet. Regardless of where we go, we will appreciate having them join us and help us create even more special memories.

The value of great experiences.

Great experiences are the kind of high-return-on-life investments folks often want to keep making. Many of Apprise’s life planning clients include family travel in their Goals for Life and their Hearts Core Grid. Family trips are frequently integral parts of their vision as well.

If you want to start working on – or update – your life plan, schedule a call, and we can discuss how our Life-Planning process can help you include great experiences in your life plan. Our process can help you better align your use of capital with your values. Remember that, for us, your capital is made up of a TEAM of resources. This team includes Time, Energy, Attention, and Money.

We try to help you find the balance between planning and enjoying the moment with our Life Planning process. Please schedule a call if you would like to discuss your life plan or any other aspect of your financial life.

A Bonus Chart

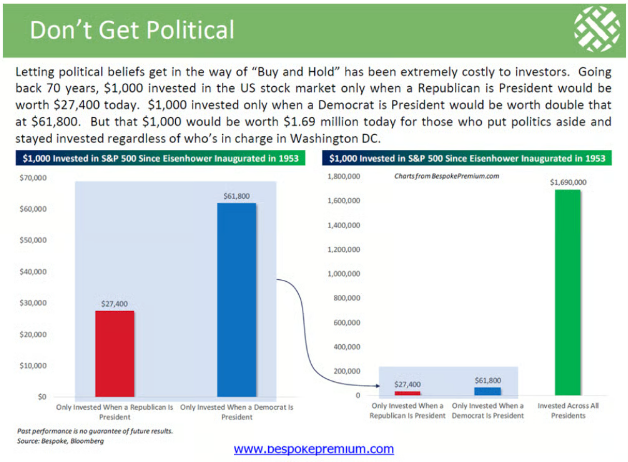

Clients and regular readers of this blog know that Apprise follows a long-term investment approach. They also know we do not practice market timing. I don’t get asked often about the impact of elections and politics on the markets. The following chart, which was shared here, provides an example of how letting political beliefs get in the way of sticking to their long-term investment approach can hurt your investment returns:

While past performance does not guarantee future returns, this chart offers another example of how trying to time the market based on external factors can hamper your investment results and negatively impact your ability to live your most fulfilling life.

This Week’s Favorite Reads

This week’s favorite reads include articles highlighting the following topics: Social Security claiming options for couples, avoiding online scams, the importance of taxes in retirement planning, self-awareness, and the role of investor behavior in markets.

Here are the links to this week’s articles as well as a brief description of each and why you should check it out:

1. 5 Social Security Claiming Options for Couples.

Deciding when to start claiming Social Security benefits represents one of the most important decisions a couple must make. As of 2024, Social Security rules have changed, eliminating one of the most popular strategies – “file and suspend.” However, couples can still tailor their approach to maximize benefits based on their circumstances. Those who can afford it can delay benefits until age 70 for maximum income. If other income sources are sufficient, you may claim benefits early. You could consider using a split strategy where one spouse delays while the other claims. Planning for survivor benefits is also crucial, especially if there’s a significant income or age disparity between partners. Careful planning ensures long-term financial security. (You may also want to check this blog discussing claiming mistakes couples frequently make.)

2. How to avoid online scams and what to do if you become a victim.

Cybercrime incidents continue to increase. Unfortunately, it is getting harder to spot online scammers, especially because they are becoming increasingly sophisticated, using emotional manipulation to trick victims. This article outlines common scams, such as social engineering and fraud schemes targeting vulnerable individuals, particularly older adults. Scammers have more entry points today, including social media, text messages, dating sites, and online groups. The article suggests practical tips to help you avoid falling victim, such as recognizing phishing attempts and securing your personal information. You will also find details of the steps to take if you’ve been scammed, including reporting to financial institutions and law enforcement agencies. Doing so can potentially help you recover lost funds.

3. Retirees: Want to Keep Your Money? Make a Tax Plan.

Taxes are discussed frequently in this blog. Why? They represent a significant expense. Our current tax rules sunset at the end of 2025. Today’s rates are low. We don’t know where they will go from here. This makes Tax Planning 2025 an important consideration. A solid tax plan can help you keep more of your money in (and for) retirement. As discussed in this article, it’s important to understand how taxes impact Social Security benefits, required minimum distributions (RMDs), and different income sources. Retirees with accounts treated differently for tax purposes should strategically manage withdrawals from taxable, tax-deferred, and tax-free accounts, to minimize tax liabilities. Tax planning, especially with potential tax law changes on the horizon, can significantly improve your financial security in retirement.

4. Know Thyself.

If you want to grow, you must understand what’s going well and identify areas for potential improvement. As your self-awareness grows, your ability to implement change increases, too. Regularly checking in with yourself plays a key role in building self-awareness. This article explores how understanding your values, motivations, and emotional triggers can lead to making more intentional choices and a more fulfilling life. We find this particularly relevant as our EVOKE life planning process aims to help you live your most fulfilling life. The article encourages you to engage in self-reflection. It also suggests the importance of embracing both strengths and weaknesses as a path to deeper self-knowledge. Ultimately, this can lead to more authentic and meaningful actions.

5. Market Miscalculates.

In his latest memo, Oaktree Capital’s Howard Marks explores how market fluctuations often result from investor psychology rather than fundamental changes. He explains that while markets should reflect intrinsic value, they frequently swing between extremes of optimism and pessimism. These mood-driven movements create opportunities for investors who can remain rational and avoid getting caught up in emotional reactions. Marks emphasizes the importance of independent analysis and cautious decision-making in navigating these market miscalculations. Marks’ message is even more relevant when considering the stock market’s August performance. Early on, the S&P 500 was down more than 6%. It ended the month up 2.3% overall. This isn’t to argue whether either performance extreme was necessarily right or wrong. Instead, it serves as a reminder of how investor psychology can impact market performance. This video blog offered suggestions to help you stay calm during market volatility.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

If you would like to talk to us about financial topics including facing new beginnings, managing your investments, creating your life plan, or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/