When we save for retirement, we operate under one set of tax rules. When we retire and start withdrawing our retirement savings, we operate under a different set of tax rules. Understanding the difference between the two sets of rules can add value to your retirement nest egg. How? It can help you lower the amount of taxes you pay when you withdraw money from your retirement accounts. This week’s first article digs a little deeper into this topic.

————————————————————————

Here are the links to this week’s articles as well as a brief description of each:

1. Is Your Retirement Portfolio a Tax Bomb?

For most of our lives, we accumulate assets and operate under one set of rules. When we retire, we draw down our assets. A different set of rules applies. This can cause considerable confusion. Why? We often think our tax bill will fall in retirement. After all, we no longer receive a regular paycheck. But we don’t pay taxes on the amounts we save in our 401(k), 403(b), or traditional IRA. Unfortunately, that means we pay taxes on the amounts we withdraw. That can cause large tax bills in retirement. We may also be subject to Medicare surcharges. Amounts left in our accounts after we die could lead to a big bill for our heirs, too. When working on a financial plan, I regularly discuss tax planning ideas that can help lower the cost of withdrawing money from your retirement accounts. If you have any questions about how tax planning strategies can help you, please schedule a free call.

2. How to Get More Time.

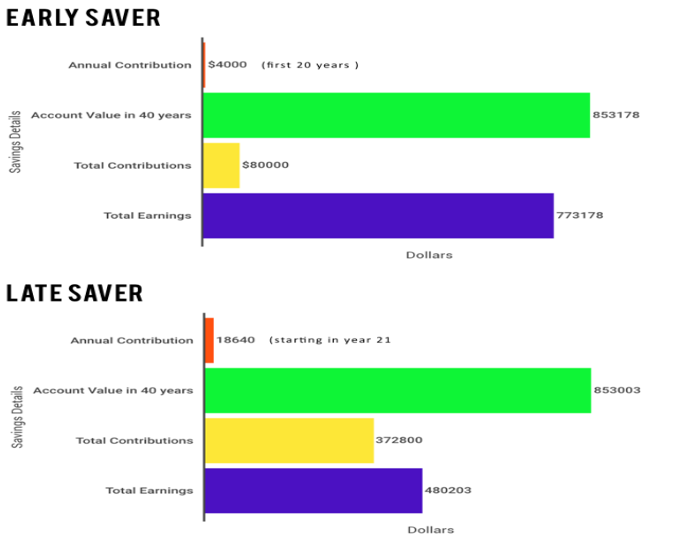

In this blog, I shared the following chart:

The chart shows what happens if you start saving $4,000 per year at the beginning of your career and stop saving after 20 years. (The chart assumes an average annualized 6% return.) If you work 20 years before starting to save, you must save more than 4.5-times as much each year to have about the same ending balance. The author of this blog shares some suggestions to help those who start investing later in life. We can’t buy more time. Can we earn it? If so, how? Read the article to find out.

3. How the Worst Market Timer in History Built a Fortune.

Timing the market isn’t easy. What would happen if you only invested at market peaks? When we invest, we express a belief that the market will deliver long-term gains. If we don’t believe that we shouldn’t invest. Nobody likes watching the balance of their account decline. Markets don’t only go up. But we invest assuming they will go up more than they go down. This story provides us with three important lessons:

- Maintain a positive long-term bias

- Losses are part of the game

- Save more and think long-term.

4. How to Be a More Mindful Listener.

Last week, I went to Denver for a conference. I arrived a couple of days early to take a course offered by the Kinder Institute of Life Planning. Life planning helps you focus on what matters most to you. It can help you spend your money with purpose. I have asked clients the three “Kinder Questions” for a while but want to improve my technique. One of the key elements of life planning is active listening. Active listening involves letting your conversation partner talk without interruption. It includes more than hearing their words. You must also show that you understand them. This article shares some great tips to help you practice more mindful listening.

5. Why Claiming Social Security at 64 or 67 Could Be a Big Mistake.

You can start claiming Social Security benefits as early as age 62. You can wait until age 70. The size of your benefit increases as you progress from 62-70. But it does not progress in a straight line. It increases at certain ages. (This table shows why the author suggests that you may not want to start at 64 or 67.) In general, waiting until age 70 – at least for the higher wage earner in a couple – is the recommended approach to claiming your benefits. When you retire, you do not have to start claiming your benefits. Waiting can increase the size of your benefit, it can also facilitate tax planning and lead to” greater retirement wealth and a more secure lifetime income.”

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above articles valuable. We would be happy to address any follow-up questions you have. You can complete our contact form if you would like to talk to us about financial topics, including your investments, creating a financial plan, saving for college, or saving for retirement. Once you do that, we will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/