Raising Resilient Heirs

Raising resilient heirs can help your wealth survive future generations. Doing so can help you provide a leg up in the world to your kids and grandkids. It can also play an important role in legacy planning. But how much ease should a legacy plan actually provide? If your legacy plan provides your heirs with too much cushion, they may not gain the resilience they’ll need to overcome challenges that money alone can’t fix.

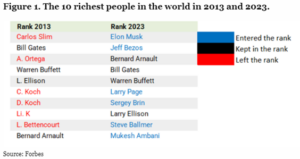

Warren Buffett once wrote, “After much observation of super-wealthy families, here’s my recommendation: Leave children enough so they can do anything, but not enough so they can do nothing.” Why wouldn’t a billionaire want to pass his wealth to the next generation? Buffett’s approach reflects a belief that too much financial security can discourage personal growth and initiative. Strong evidence exists that most rich families will be poorer after several generations. According to the following chart sourced from Forbes, only four of the richest 10 people in the world in 2013 remained among the richest people in the world in 2023. Yes, that’s a small sample size. It may not have significant value. But it’s still worth considering.

A 20-year study by the Williams Group, cited in this article, involved over 3,200 families. It found that 70% of families tended to lose their fortune by the second generation. By the third generation, 90% of families lost their wealth. These statistics underscore the importance of careful legacy and succession planning. However, the article also says that if wealth is well managed and succession carefully planned, it can last beyond the third generation.

Encourage your loved ones to push themselves in these three ways and they’ll learn how to carry on your family’s legacy while also improving their return on their life.

1. Practice a new skill.

Why do so many kids stop playing the piano or throw their sports equipment in the back of the garage?

Because learning new skills is hard, especially if there are other activities a child is naturally good at, or digital distractions that provide simpler gratification.

While sports and music aren’t for everyone, the process of facing a challenge, solving a problem, improving, and moving forward is necessary in just about every walk of life. Support your young heirs as they go through that process. If it turns out they don’t like soccer, help them find another challenge, like drawing or learning a new language, that will give them a different challenge – and, perhaps, rewards that will benefit them throughout their lives.

2. Raise the bar.

And if your heir is a natural athlete, or has zoomed to the head of her class?

Don’t let them get complacent with early success. Talk to them about how they can set more challenging personal goals, so they can keep improving and, hopefully, run into a brick wall or two. Those seemingly insurmountable moments where failure is the only immediate option teach us how to pick ourselves up and keep trying until we break through our plateaus. Challenges also foster perseverance, a quality that will help your heirs not just in personal pursuits but in stewarding family wealth and legacy.

Your heirs might also find high bars they can only clear by leaning on family members, friends, teammates, teachers, coworkers, and mentors. A couple of lessons in humility can help even high achievers appreciate the value of working well with others, admitting to limitations, and committing to continual growth and self-discovery.

3. Earn it.

No matter what size or shape your estate is or how responsible your heirs might be, they might not be ready to handle an inheritance.

You can easily treat large sums of money as a windfall rather than as an asset to be managed over time.

Caring for collectibles, vehicles, art, and real estate often requires very specific knowledge and skill sets.

Family businesses need high-level executive leadership, not recent graduates who view the CEO’s chair as their birthright.

And, most precious of all, the family’s legacy needs to be preserved by heirs who understand your values and are empowered to carry on your mission for the next generation.

Perhaps the easiest way to avoid giving too much too soon is to establish benchmarks your heirs must reach before taking over parts of your estate. Make your wannabe CEO work their way up from the ground floor so they gain an intimate understanding of your company’s culture, employees, customers, and best practices. Insist that your heirs finish school or whatever training you deem necessary to handle more sensitive assets. Talk to them about your long-term charitable goals. Vehicles like trusts and family foundations can protect your assets and wishes while your heirs grow into their responsibilities.

We can help.

You can include your heirs in a meeting where we can discuss how an inheritance will affect their short- and long-term financial planning, as well as your legacy. Schedule a call and we can start extending your Financial Life Plan to the next generation. Together, we can create a plan that empowers your heirs to thrive, honoring your values for generations to come.

Life Planning can help you align your money with your values. Importantly, it’s not only about the money. Money only represents one element of your TEAM of capital – Time, Energy, Attention, and Money. Our process focuses the planning conversation on what your TEAM of capital means to you, what it can help you achieve, and how it can help you prepare for and manage life’s transitions. We want to help you align your use of capital with your values.

If you are facing new beginnings including divorce, loss of a loved one, an empty nest, or retirement, you can take our Flourish Though Life’s Big Changes Assessment to discover how ready you are to embrace and thrive through your significant life transitions.

Schedule a call so we can discuss how Life Planning can cascade your financial goals through every part of your life.

This Week’s Favorite Reads

This week’s favorite reads include articles discussing the following topics: avoiding the widow’s penalty after losing a spouse, putting pets in your will, filing for Social Security benefits early and investing in the market, “not-to-do” lists, and the benefits of estate planning for those as young as 18.

Here are the links to this week’s articles. You will also find a brief description of each and the reason you should check it out:

1. How to Avoid the ‘Widow’s Penalty’ After the Loss of a Spouse.

Surviving spouses often face higher tax rates after losing their partner. Why? Their filing status changes from “married filing jointly” to “single.” They may be subject to higher taxes on the same or similar income. While a surviving spouse will lose the lower of a couple’s Social Security benefits, other items of income may not change. This can impact Social Security, Medicare premiums, and retirement account distributions. Taking proactive steps, such as completing Roth conversions while still eligible for joint status, can help reduce future tax burdens. These actions help alleviate the widow’s penalty, allowing more financial control and stability for surviving spouses in the long term. You can read “How Roth Conversions Can Help You, Your Surviving Spouse, and Your Heirs” for additional information.

2. Putting Pets in Your Will Is No Longer Just for Eccentric Billionaires.

If you have pets, what will happen to them if they outlive you? Have you thought about including them in your estate plan? Believe it or not, including pets in estate planning is no longer just for the wealthy. With Americans increasingly treating pets as family, the “pet directive” has become a popular way to ensure pets are cared for if their owner dies. This directive, a section in a will, allows owners to name pet guardians and allocate funds for their care. Without proper planning, pets can end up in shelters. As a result, online platforms now prompt users to designate guardians. Pet directives are now common for ensuring pets’ futures.

3. Does It Make Sense to File Early for Social Security and Invest in the Market?

On numerous occasions, I have been asked if it makes sense to claim Social Security early and invest the proceeds. Some believe they can achieve investment returns that outpace the returns of delayed benefits. While it’s true that investments can earn high returns in some years, those returns are not guaranteed. Markets don’t always go up. You will lose money in some years. On the other hand, if you delay Social Security past full retirement age (67 for those born in 1960 or later), your benefit will grow 8% annually. For most retirees, Social Security represents their only guaranteed, inflation-adjusted income. As Social Security expert Mary Beth Franklin stated in this article, breakeven analysis suggests that waiting until age 70 increases benefits significantly for those with longer life expectancies. The breakeven age is about 83. Ultimately, claiming early is best for those needing immediate income, but delaying can maximize lifetime benefits.

4. Stop the Time Suck! The Power of “Not-to-Do” Lists.

When others ask us to do something, it’s easy to say, “I’ll add it to my list of things to do.” But learning to say “no” can improve your productivity. Creating a “not-to-do” list can be an effective way to manage time and productivity. By removing low-value activities –such as unnecessary meetings, frequent social media checks, and constant email monitoring – you can better allocate your energy to meaningful tasks. This proactive approach helps set boundaries, reduce overwhelm, and maximize efficiency, ultimately protecting valuable time for high-impact work.

5. Why Anybody Over 18 Should Have an Estate Plan.

Estate planning isn’t just for the elderly or wealthy; anyone over 18 can benefit from having a basic plan. After her grandmother’s passing, the author saw the importance of her mother’s “Book of Life” — a binder holding essential documents and instructions. It’s important to remember that at 18, legal decisions no longer fall to parents. This makes documents like a healthcare directive, power of attorney, and a simple will essential.

You need a healthcare power of attorney in case your child gets hurt while away at college. A friend of one of our children was at an out-of-state college. He was hit by a car while jogging. Without a healthcare POA, his mother had to fly to where he was to learn the extent f his injuries. Fortunately, her son recovered. But not knowing her son’s condition only added to the stress of the situation. Estate plans also cover more than assets; they include directives for pets, digital accounts, and other personal items. Starting a plan opens necessary family discussions. Doing so is also a part of adult responsibility.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

If you would like to talk to us about financial topics including facing new beginnings, managing your investments, creating your life plan, or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Follow us:

Please note. We post information about articles that can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/