On Thursday, I hosted the latest session in my “Ask Me Anything” webinar series: “Living Longer: What Does It Mean for Retirement Planning – and Your Portfolio?” Please click this link Passcode: z?%K7@04 if you would like to view the recording.

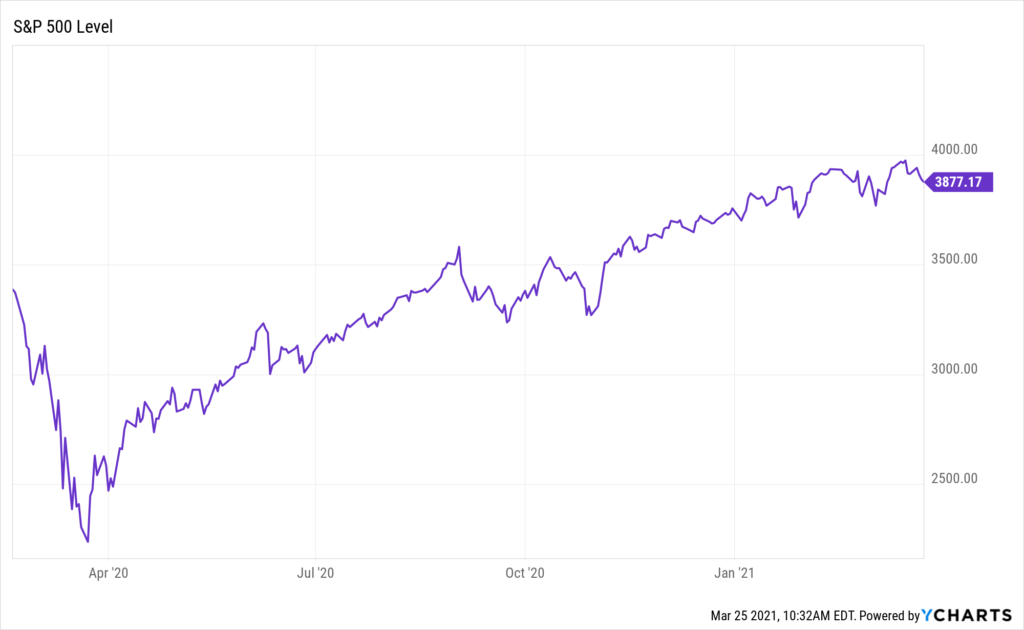

March 23rd marked the one-year anniversary of the market’s pandemic-related low. As you can see from this S&P 500 price chart, the market surpassed its previous high (2/19/20) a mere six months later (8/18/20).

In the early days of the pandemic, we saw market volatility unlike any we had experience in some time. In 2018 and 2019, the S&P rose or fell by more than 2% on a single day 24 times. In the period from February 24th through April 8th, that happened 25 times! For the year, we had 44 such days – 19 up days and 25 down days. Despite this volatility, the S&P 500 finished the year up about 16%.

Why am I sharing this information? To me, it’s a reminder that the long run matters most. It also reinforces the idea that we should not get too wrapped up in the market’s daily activity.

It shows the value of diversification as well. Technology stocks and other firms whose businesses benefited from the pandemic led the market’s recovery. You can find many recent stories suggesting a potential change in market leadership. Remember that when investing for retirement, it’s not about beating the market. The goal should be to invest in a way that allows you to live the life you desire.

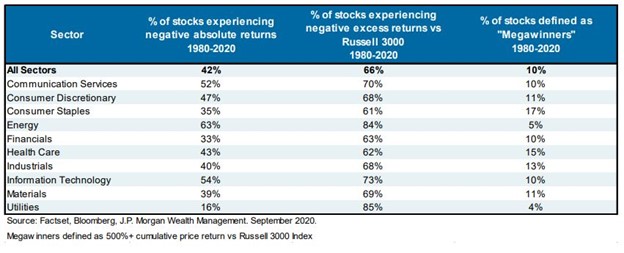

If you need any more convincing about how hard it is to pick the best stocks, take a look at this chart from a recent JP Morgan research report.

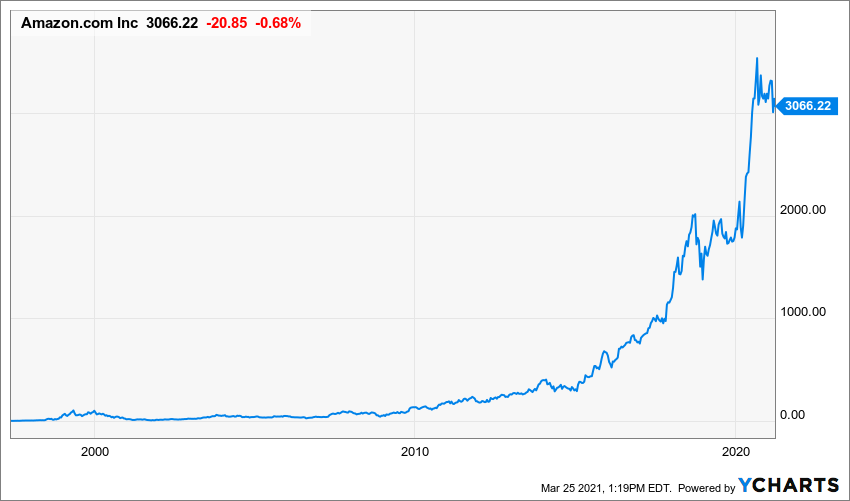

We know with the benefit of hindsight how profitable holding stocks like Amazon and Apple since their IPOs have been. But if you purchased them at the beginning, would you have held on? My guess. The vast majority would have sold at some point.

It is possible (an Apprise client purchased 10 shares of Apple three days after it went public that they still hold. After stock splits, they own 2,240 shares. Unfortunately, that is the exception rather than the rule. The path from the IPO until today for Apple (as well as Amazon) was far from smooth. (Please note: Shares of Apple and Amazon are held in some client portfolios.)

Investing can be emotional. We want to avoid selling at the lows and buying at the highs. Following a process can help reduce the role emotions can have on our investments.

Trying to beat the market involves increased risk. If you choose well, it can bring rewards. But if you choose poorly, you can jeopardize your financial future.

The companies driving the stock market may be changing. But the S&P 500 is up 4.1% year-to-date. Diversified portfolios have exposure to the market’s leaders – and its laggards. We don’t know for sure which stocks will fall into which category. A diversified approach should help soften the lows – and the highs. It should also increase your chances of achieving what matters most to you.

In my market-related discussion, I often say something like the following: We continue to believe it best to maintain our process and remain focused on the long-term. Today’s commentary should give you greater insight into why I say that.

Here are the links to this week’s articles as well as a brief description of each:

1. 4 Strategies to Minimize Your RMDs. When we reach age 72, most of us must start withdrawing money from our IRAs or 401(k)s. We get a tax break when we deposit money in these accounts, but we pay taxes on withdrawals. Whether we need it or not, the tax law requires that we withdraw money from our accounts (required minimum distributions or RMDs). Your first-year withdrawal amounts to about 3.9% of your account balance. It increases every year. By age 90, your RMD represents almost 9% of your remaining balance. Diligent savers may not need all their RMDs. This article shares some options you have if you want to reduce your withdrawals. I would add qualified charitable distributions (QCDs) to this list. (This blog includes more information about QCDs.) If you would like to discuss any of these strategies, you can schedule a call.

2. 5 Phrases to Use to Improve Your Emotional Intelligence and Relationships at Work. Many professionals want to improve their emotional intelligence. The verbal habits discussed in this article can help you shift the focus of a conversation from yourself to others. You can memorize all of them, too. “Tell me more” is a great way to get someone to show interest in what a person is saying. It can also give you a lot more information.

3. 2020 in Review. The latest memo from Oaktree Capital’s Howard Marks includes his reflections on 2020. In it he provides a list of the “jaw-dropping extremes” we experienced in the past year. He shares his thoughts on positioning for the year ahead. His not so surprising conclusion: “With arguments on both sides, I feel the prices of most assets are in a gray area – certainly not low, mostly on the high side of fair, but not so high as to be unreasonable.”

4. 5 Time Management Tips When Working From Home. Many of us struggle with time management. Working from home can make it even more challenging. These time management strategies can help you increase your productivity and maintain your sanity. As someone who worked from home frequently even before the pandemic, I must stress the importance of the first suggestion: Find your own space.

5. The 10 Biggest Money Mistakes. We all make money mistakes. (I shared some of mine as well as those I saw growing up in this blog.) We do some foolish things with our money. We may also pass on some things that are reasonable. These sins of omission can damage our finances as much as our bad choices. Remember that we all make mistakes. If we learn from them, they can be valuable. If we don’t, they will continue to hurt us. The following items from this list stood out for me:

· Timing the market.

· Paying attention to other peoples’ finances.

· Too much lifestyle creep.

P.S. I’d love to hear your thoughts on this list. Send me an email if you have a story you’d like to share.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above posts valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or virtual meeting via Zoom.

Follow us:

Twitter Facebook LinkedIn

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/