Welcome to spring. The sun is shining, birds are chirping, temperatures are getting warmer, flowers and trees are starting to bloom, and baseball season has started. My wife and I got our first Covid vaccine almost two weeks ago and have our second scheduled for April 19th. I must admit that I’ve never been this excited about the prospect of having someone stick a needle in my arm – not once but twice!

Many clients and prospects I speak to are either self-employed or at least have a side hustle. They also often ask how they can lower their tax bill. Even if you only have a part-time consulting gig, you can still save some of your earnings in a retirement account. You can get a tax break for such savings, too. This week’s first article reviews the five most common accounts you use to save some of your earnings tax efficiently.

After a weak start in March erased most of the then year-to-date gains, stocks have resumed their upward path. The S&P 500 Index rose 4.2% in March and 5.8% in the first quarter. April has also started well. As of Thursday’s close, the S&P is up 3.1% month-to-date and 9.1% year-to-date.

Fears of higher interest rates likely created market uncertainty. As we (hopefully) start to put at least some of the more limiting aspects of the pandemic in our rearview mirror, there are concerns about inflation. Interest rates can impact the way investors think about stock market valuations. Higher rates are often associated with lower stock prices.

At the same time, the economic outlook has improved. Demand for activities that were suppressed during the heart of the pandemic should grow. For example, expectations that vacation travel will exceed last year’s levels appear reasonable.

Yes, the market does not necessarily track the economy. But stocks can more easily tolerate higher interest rates if they are associated with economic growth. Unfortunately, nobody can predict with certainty the market’s future direction, especially over the short term. Against this backdrop, we continue to stick to our process and remain focused on the long term.

Here are the links to this week’s articles as well as a brief description of each:

1. Retirement Planning for the Self-Employed: 5 Options for Lowering Taxes and Maximizing Savings. Whether you own your own business/are self-employed or have a side hustle, you can use tax-advantaged accounts to increase your retirement savings. This article outlines the five most common ways self-employed workers can boost their retirement savings:

· Traditional IRA / Roth IRA

· SIMPLE IRA

· SEP IRA

· Individual 401(k)

· Defined benefit plan

Your potential savings range from $6,000 in a traditional IRA/Roth IRA to nearly $300,000 if you combine a defined benefit plan with a 401(k) profit-sharing plan.

2. 100 Tips for a Better Life. This list includes great suggestions in areas such as possessions, cooking, productivity, body, success, rationality, self, hazards, others, relationships, compassion, and joy. One of my personal favorites: #83 – “Compliment people more. Many people have trouble thinking of themselves as smart, or pretty, or kind unless told by someone else. You can help them out.” I can do a better job of this, too. In the age of Covid, #71 also provides a good reminder: “A norm of eating with your family without watching something will lead to better conversations. If this idea fills you with dread, consider getting a new family.” The best mealtime conversations in my house occur when we follow this suggestion.

3. A Guide to College-Savings Options. Deciding the best account(s) for college savings can be challenging. You have lots of choices; it can be hard to determine the differences. This guide can help you understand the tax treatment of each option, how much you can contribute, and who can contribute. It also includes rules about distributions and suggests which types of saver will tend to benefit most from each investment option. If you would like some help deciding which option would be best for you, please schedule a free call.

4. Avoiding Bad Decisions. Sometimes we can achieve success by avoiding failure. When it comes to decision-making, we don’t often discuss how we can avoid making bad decisions. This article shares five of the biggest reasons we make bad decisions. It also provides warning signs for each as well as a rule that can help keep you from making these mistakes. We can benefit just as much from avoiding bad decisions as we can from making good ones. Knowing the warning signs and having a set of rules for our decision-making process, can limit the amount of luck we need to get good outcomes.

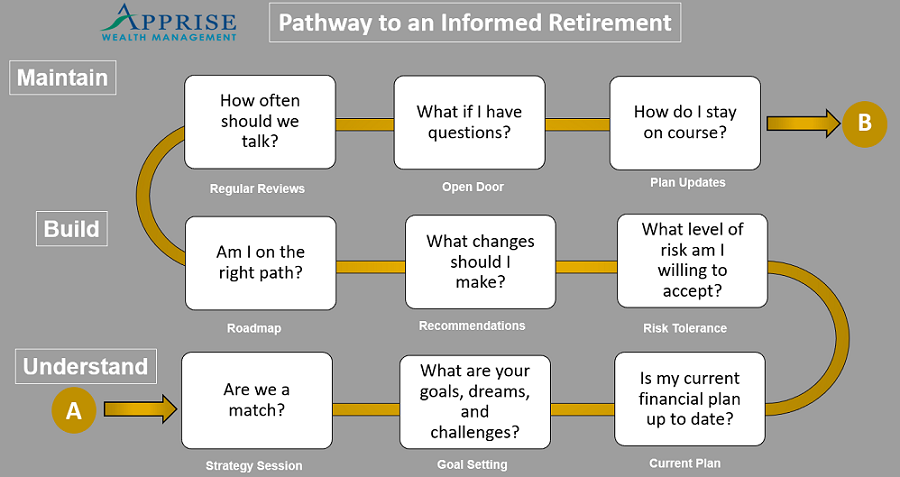

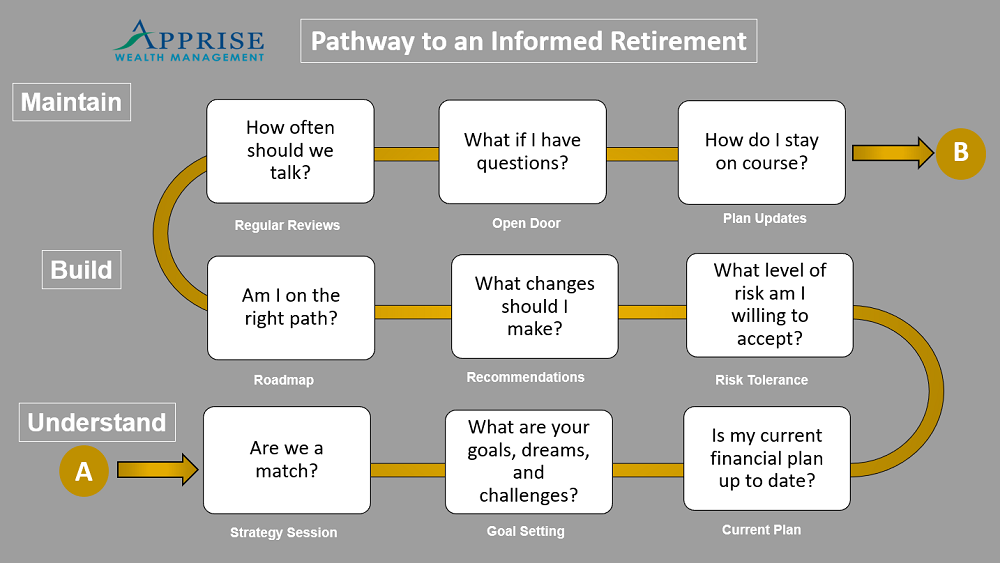

5. A Retirement Readiness Checklist. We often have in mind a time or age at which we want to retire. But we don’t know if we can retire at that age or time. Would you like to determine if you’re on track to retire? Breaking the process down into smaller steps can make it a lot easier to analyze. Before you retire, you should assess your financial affairs. At Apprise, we call this process our “Pathway to an Informed Retirement.” Its purpose is to take you from Point A – “Retirement Uncertainty” to Point B – “An Informed Retirement.” The checklist in this article provides more specifics. It includes some of the key things you want to consider when determining if you are on track for retirement. If you would like some help determining whether your retirement is on track, please schedule a free, no-obligation call.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above posts valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

Phil Weiss founded Apprise Wealth Management. He started his financial services career in 1987 working as a tax professional for Deloitte & Touche. For the past 25+ years, he has worked extensively in the areas of financial planning and investment management. Phil is both a CFA charterholder and a CPA.

Located just north of Baltimore, Apprise works with clients face-to-face locally and can also work virtually regardless of location.