At Apprise Wealth Management, we want to help people make better money-related decisions. We also read constantly and like sharing some of our favorite commentaries each week.

We hope you will share our blog with your friends. If you are not a current subscriber, please sign up for our mailing list at the bottom of our blog page or use our Contact Us page. If you would like to discuss the ideas presented in any of these articles, please email philweiss@apprisewealth.com. You can also schedule a free 15-minute call.

Here are this week’s articles as well as a brief description of each:

1. Why You Need to Make a ‘When I Die’ File—Before It’s Too Late. While this idea may sound a little morbid, creating a file your loved ones can refer to when you’re gone can make a difference. It may save them considerable time, money, and suffering. The article provides some great suggestions about what should be included in such a file. For example, it can be stored on your computer, in the cloud, in a binder, or even a shoebox. Using a password manager can help both now and later. Password managers can make it easier to create more unique passwords. The idea of writing letters to your loved ones is also a nice touch.

2. A Microsoft Manager Answers Your Most Annoying Email Questions. While there are numerous other ways to communicate, the average person still spends a lot of time on email. The suggested tips can improve your email etiquette:

· In business, the greeting and the sign-off still matter.

· Don’t fall back on stock phrases when following up; they can grate.

· Schedule your emails.

· Read your email aloud to check for tone.

· Let people find you.

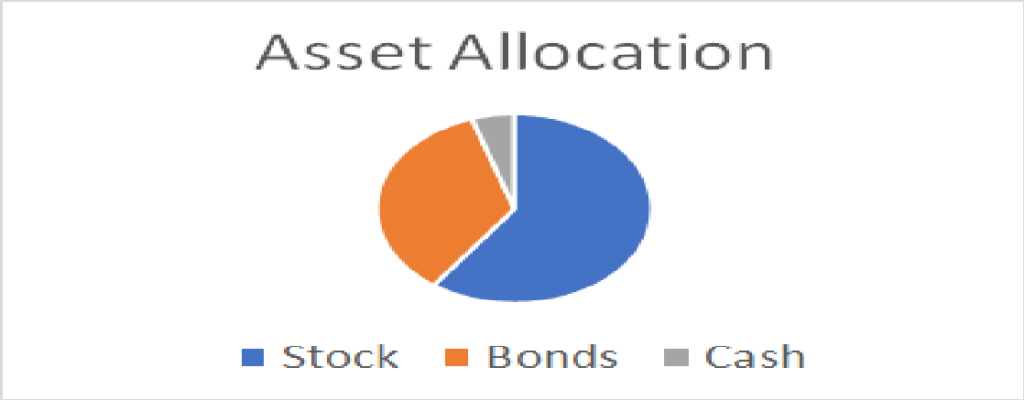

3. A Eulogy for the 60/40 Portfolio. Most fiduciary financial advisors speak about the benefits of asset diversification – owning both stocks and bonds. It’s not surprising to see those in the broker world talk about how the end has come for diversified portfolios. The latest such claim was made by Bank of America on October 16, 2019. As this tongue-in-cheek article suggests, it seems unlikely this proclamation will come true.

4. 3 Ways to Make Better Decisions for Your Career. Having the ability to make decisions is important, especially if you’re in a leadership role. Acting decisively shows you are reliable and experienced. This article provides some tips to help improve your decisiveness. One of the most important: realizing that failing to make a decision is a decision.

5. How to Cut Your 2019 Tax Bill Before It’s Too Late. Believe it or not, December 31st is fast approaching. Think about taxes now. Don’t wait until you start gathering the information needed to prepare your return. It can help you pay less. If you would like to cut this year’s tax bill, check this article for some suggestions.

We hope you find the above posts valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. We can schedule a call, a virtual meeting via Zoom, or a meeting at Apprise Wealth Management’s office in Northern Baltimore County.

Follow us:

Please note. We post information about articles we think can help you make better decisions about money on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/