At Apprise Wealth Management, we want to help people make better decisions about money. We also read constantly and like sharing some of our favorite commentaries each week.

We hope you will share our blog with your friends. If you are not a current subscriber, please sign up for our mailing list at the bottom of our blog page, or use our Contact Us page. If you would like to discuss one of these articles further, please email philweiss@apprisewealth.com.

On May 8th, I gave a webinar: 5 Shifts: Will You Retire With Confidence? Please click here if you would like to listen to the replay.

Here are this week’s articles as well as a brief description of each:

1. Juggling the Costs of Retirement vs. College? Parents are often faced with competing objectives: Saving for their children’s higher education versus saving for their retirement. It can be hard to sort out these competing priorities. Good financial planning can help you do both. Whether we realize it or not, it is important to remain focused on retirement savings, even as our children get ever closer to college age. The article offers some suggestions for paying for college as well as ways to save. (See this blog post for some additional details on your college savings options.)

2. The Best Advice You’ve Ever Received (and Are Willing to Pass On). Have you ever received life-changing words of advice? Reading this article made me think about my answer. Given that on June 11th my wife, Diana, and will celebrate our 24th anniversary, I thought I’d share this story. Before I met Diana, I worked for a pharmaceutical company. One of our executives told me that when looking for a spouse, we often focus on finding the perfect mate. Perfection is hard to find. He said sometimes we’re better off focusing on finding someone that can make us happy. I took his advice to heart and met Diana not long afterward. Before talking to him, I’m not sure that I would have pursued a relationship with Diana the way I did. In the past, I shared a couple of stories (here and here) about some of the difficulties I experienced growing up and their impact on my academic and professional life. I no longer lament those circumstances the way I once did. In fact, if I hadn’t gone through them, I think it’s unlikely that I would have ever met Diana and ended up with the wonderful family I have. It turns out Diana was perfect for me. Happy Anniversary, Diana!

3. 5 Ways to Avoid Regret With Social Security, Retirement Planning. We must make many choices in our lives. Unfortunately, some of them will result in regret. This certainly applies to our personal finances. This article shares five issues related to retirement and Social Security that can cause second-guessing years from now. One of the most important is to not wait too long to start saving. These two blog posts (one and two) provide examples of the benefits of starting to save at an early age.

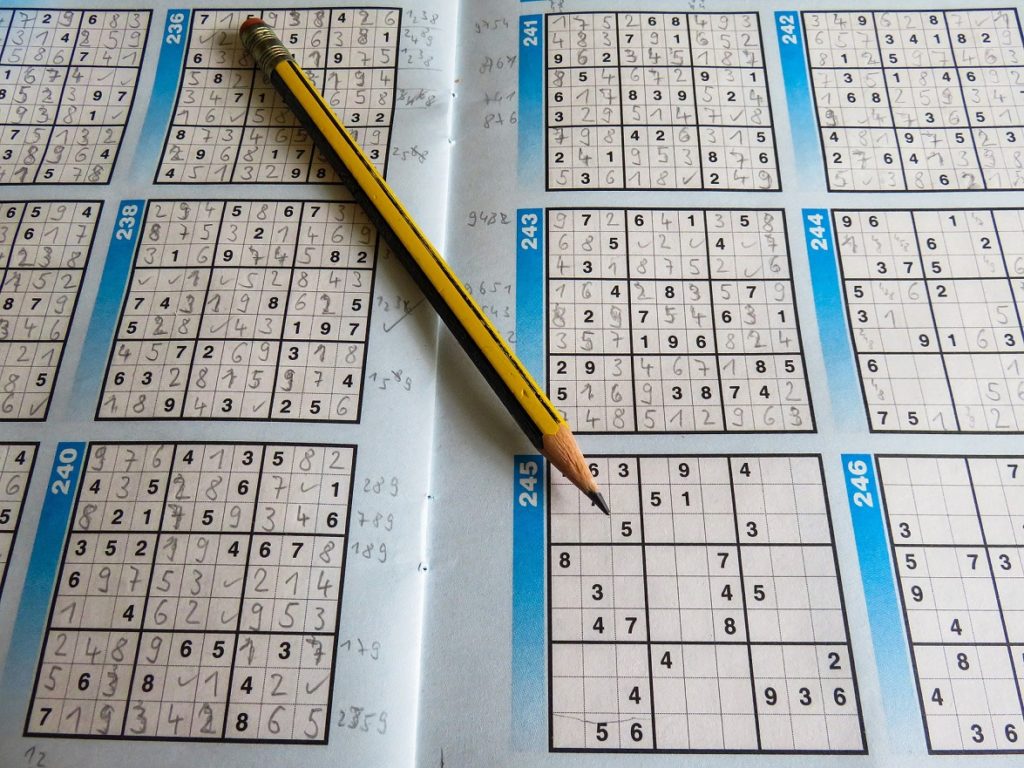

4. Older Adults Who Do This Have the Brain Function of People a Decade Younger. Are you worried about staying mentally sharp as you age? According to this article, two papers recently published in the International Journal of Geriatric Psychiatry recommend word and number puzzles like crosswords and Sudoku if you want to help your brain function better.

5. The Equality Equation: Three Reasons Why the Gender Investing Gap Is Closing. If you follow the “hot” topics in the investment world, you may be familiar with the gender investing gap. This article refers to five distinct financial gaps between men and women; two constitute investment gaps: The Retail Investing Gap and the Institutional Investing Gap. The article predicts that by 2025 there will no longer be a meaningful gender gap in stock market participation in the U.S. Read on to find out why. In addition, you might want to check out this story discussing a new book about gender discrimination. I haven’t had a chance to read the book yet, but it is on my reading list.

We hope you find the above posts valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for your retirement please complete our contact form, and we will be in touch. We can schedule a call, a virtual meeting via Zoom, or a meeting at Apprise Wealth Management’s office in Northern Baltimore County.

Follow us:

Please note that we post information about articles we think can help you make better decisions about money on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/