Greetings!

The middle of February might be my favorite week of the winter. Why? First, winter is a little more than half over. Second, I’m a baseball fan. Pitchers and catchers report this week. Spring will arrive before we know it.

I started my career as a tax professional. As a result, I pay close attention to the effect taxes can have on your retirement portfolio. As discussed in this week’s first article, having retirement accounts with different tax treatments matters. Having a distribution strategy also helps. Another thing to consider: Asset location (or which type of asset belongs in which type of account).

If you would like to discuss this article or any of the others shared in this week’s blog, please email philweiss@apprisewealth.com. You can also schedule a free 15-minute call.

Here are this week’s articles as well as a brief description of each:

1. Leverage These 5 Retirement Tax Diversification Strategies? I believe taxes and investing are joined at the hip. In other words, it makes sense to do whatever you can to reduce the taxes owed on your savings and your investments. If you want to reduce your tax bill in retirement, consider saving in a variety of different retirement accounts. These accounts should also be treated differently for tax purposes. In addition to the strategies suggested in this article, you should also consider asset location. Asset location refers to which type of assets belong in which type of account. Want to learn more? Read this blog.

2. How to Get More Done by Doing Less. Popular suggestions for enhancing productivity include prioritizing tasks and working smarter. What if we focused on doing less instead? If we reduce unnecessary tasks and streamline the must-dos, we can free up time. The big benefit of this approach: Having more time to spend in other areas. I’ve focused more on time-boxing (doing one thing at a time) recently. It helps.

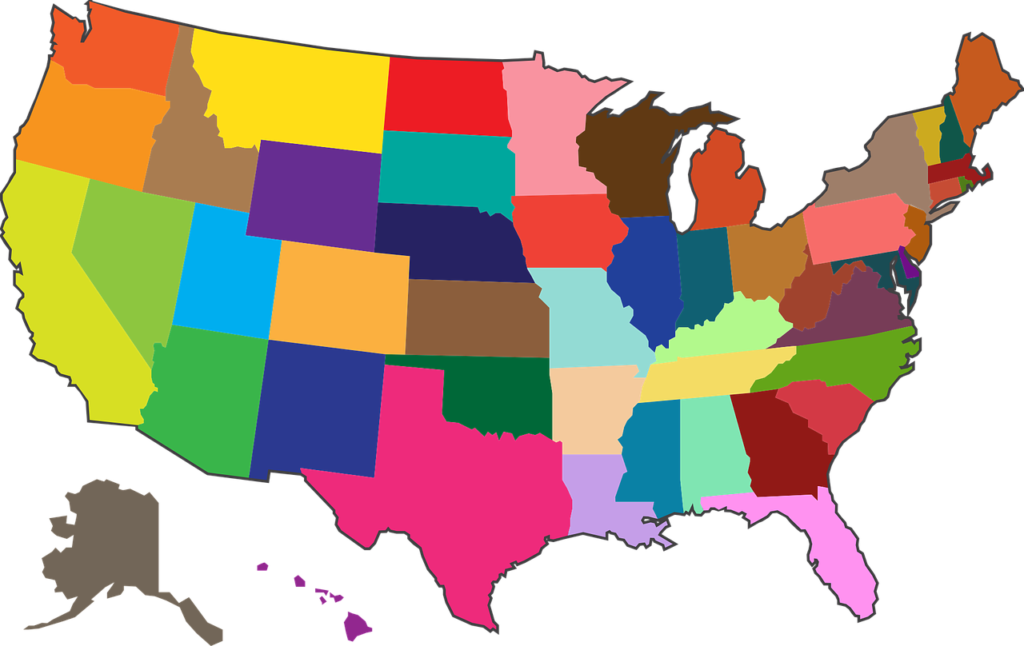

3. Here’s How Much It May Cost to Retire in Each State in America. Many people think about relocating when they retire. Check out this article if you’re wondering what states might be cheaper for retirees. A sneak preview: Hawaii costs the most; Mississippi costs the least.

4. How to Keep Your Work From Creeping Into Your Personal Life. Do you feel like you can’t ever turn work off completely? Does work creep into your personal life? There are two primary ways in which this can happen:

· You have unfinished tasks that need to be completed.

· People want something from you due to their own personal emergencies.

5. Updating My Favorite Performance Chart for 2019. Do you wonder why most people recommend that we diversify our portfolios? If you do, look at the asset allocation quilt in this article. It shows annual returns by asset class for each of the last 10 years. As you can see, the top-performing asset class in one year is rarely the top performer in the following year. Emerging markets stocks and cash have both delivered the best and worst returns in certain years during the last decade.

We hope you find the above posts valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. We can schedule a call, a virtual meeting via Zoom, or a meeting at Apprise Wealth Management’s office in Northern Baltimore County.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn, Facebook, and Twitter.