At Apprise Wealth Management, we want to help people make better decisions about money. We also read constantly and like sharing some of our favorite commentaries each week.

We hope you will share our blog with your friends. If you are not a current subscriber, please sign up for our mailing list at the bottom of our blog page, or use our Contact Us page. If you would like to discuss the concepts raised in one of these articles further, please email philweiss@apprisewealth.com.

Here are this week’s articles as well as a brief description of each:

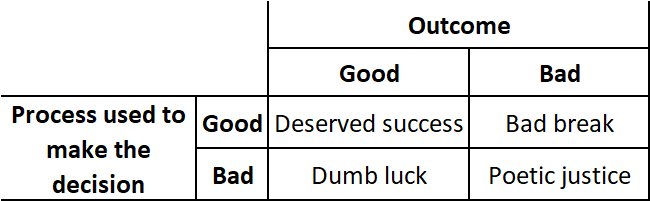

1. How “Resulting” Impacts Your Personal Finances. Oftentimes we fool ourselves into believing a good outcome was the result of a good decision. However, if the decision was made when the odds were stacked against us, we may not realize we were lucky. This can result in a false sense of confidence. In turn, overconfidence can cause us to take even more risks. Unfortunately, you may also make sound decisions and have nothing to show for them. Believing the results of a decision are directly related to the decision-making process is an example of “resulting” or drawing a conclusion based on the outcome rather than evaluating whether a sound decision-making process drove the favorable outcome. If you’re interested in reading more about process versus outcome in personal finance and investing, you can also check this blog.

2. How to Find and Delete Your Old Email Addresses. Do you have any old, unused email accounts? If you do, they could put your privacy and security at risk. When unmonitored, such accounts can provide unscrupulous people with a window into your personal information. This can be particularly true if the passwords you created when you started using email were more generic than those you use today.

3. 3 Costly Tax Mistakes to Avoid. While we may not want to admit it, taxes are a part of life. We must pay them. But, if we properly plan, we can reduce our tax bill and leave ourselves with more money to spend, or, even better, save. For example, if you own your own business or are self-employed, you want to have a record-keeping system that allows you to accurately track your business expenses.

4. The Power of One Push-Up. Many people view tracking their weight as a simple means of evaluating their health. However, there are many other measures that can be more predictive of health status. For example, one study showed higher push-up capacity among firefighters had a strong connection with a decreased risk of subsequent cardiovascular disease. The real key is to be conscientious about your behavior. Understand the connection between how you live and what happens later. Such behavior can be as predictive of mortality as fitness itself.

5. The Rules on RMDs for Inherited IRA Beneficiaries. If you are the named beneficiary of an IRA, and the account owner dies, specific rules apply. Although current law allows you to receive a tax-free inheritance, you must pay taxes on distributions you take from the account. If you inherit a Roth IRA, you can receive tax-free distributions as well. However, under either scenario, current law provides you with three options for receiving the money.

· Deplete the account within five years of death – taking distributions as you see fit during the five-year period.

· Take required minimum distributions over life expectancy (whose life expectancy you use can vary depending on the age of the original IRA owner).

· Take the full distribution immediately.

Please note: There are also special rules for surviving spouses.

We hope you find the above posts valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for your retirement, please complete our contact form, and we will be in touch. We can schedule a call, a virtual meeting via Zoom, or a meeting at Apprise Wealth Management’s office in Northern Baltimore County.

Follow us:

Please note that we post information about articles we think can help you make better decisions about money on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/