I hope everyone is staying both healthy and safe. For the first time in a while, conversation about relaxing the quarantine is taking place. Do we place more individuals at risk of contracting coronavirus? Do we keep businesses closed and deprive many of the ability to earn income? It’s hard to know the right answer. This week’s first article highlights some ways we can help others during this pandemic.

If you have any friends that are nervous and do not have an advisor or whose advisor is not reaching out to them, feel free to have them give me a call. I’m happy to spend 15 or 20 minutes answering their questions, no-obligation because they are a friend of yours.

We hope you will share our blog with your friends. If you do not subscribe currently, please sign up for our mailing list at the bottom of our blog page or use our Contact Us page.

Here are the links to this week’s articles as well as a brief description of each:

1. How to Help Restaurants, Hospitals, People During the Coronavirus Outbreak. This article suggests some ways you can help others during the coronavirus outbreak. Consider the following suggestions:

· Donate money and food or volunteer at a food bank

· Make and donate facemasks to hospitals

· Volunteer remotely

· Donate blood the safe way

· Buy gift cards and order takeout from local restaurants

· Donate money to organizations helping with medical costs

· Help your neighbors: Groceries, babysitting, video calls

· Help alleviate loneliness in nursing homes

2. Who Pays for This? In mid-April, estimates for the federal deficit were $3.8 trillion for 2020 and $2.1 trillion next year. Additional government stimulus packages mean these numbers will be even higher. The article speculates the federal cost of COVID-19 could exceed $10 trillion. How will we pay for it? Expect more debt to be issued. It’s hard to imagine a future without higher taxes, too. Spending should fall as well. Hopefully, innovation associated with COVID-19 will spark enough prosperity to let us grow out of some of this debt, too.

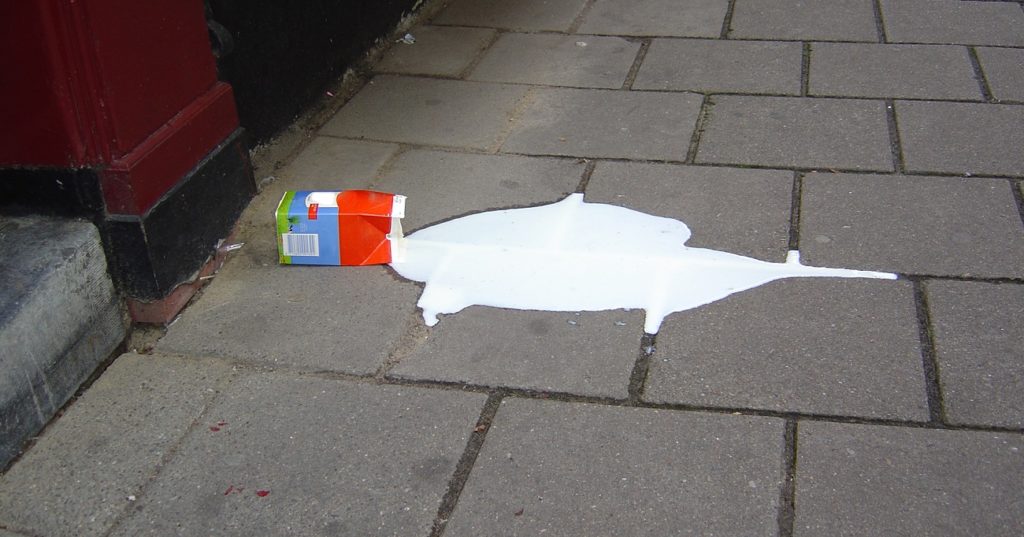

3. Dumped Milk, Smashed Eggs, Plowed Vegetables: Food Waste of the Pandemic. When you go shopping, some of your favorite items may be out of stock or sold at higher prices. Many of the nation’s largest farms are destroying millions of pounds of fresh goods they can no longer sell. Why? The closing of schools, restaurants, and hotels has left many farms without buyers for their crops. Retail food sales are spiking. Sales to schools and businesses have tumbled. We eat more vegetables in restaurants than at home. Shifting goods from commercial to retail customers is harder than it sounds. Equipment is designed to package goods for the desired end market. Consider shredded cheese. Restaurants buy larger bags than consumers. Schools buy smaller milk cartons. Redesigning the packaging would cost millions of dollars. If you expect things to return anywhere near to the way they used to be, it’s hard to justify the investment. Farmers donate what they can to food banks. Unfortunately, those facilities often lack the cold-storage capacity. They can’t accept too many goods requiring refrigeration. This is another of the unforeseen consequences of the coronavirus pandemic.

4. Note to Millennials: 5 Tips to Help You on the Road to Retirement. Although the coronavirus pandemic weighs on their present, for millennials, it is still important to think about the future. Try balancing between what you want to do tomorrow versus paying for things today. Remember that time is on your side. Start by making saving a habit. Read on for other suggestions.

5. The Food Expiration Dates You Should Actually Follow. Are there items in your pantry with expiration dates going back a few years? When should you toss them in the garbage? Do expiration dates matter? Called food product dating by the U.S. Department of Agriculture, the dates you see on your packaged goods have nothing to do with safety. They represent the manufacturer’s best guess about when the product will no longer be at “peak quality.” Some things (vinegar, honey, vanilla or other extracts, sugar, salt, corn syrup, and molasses) can last forever with little change in quality. Canned goods generally last longer than those stored in glass. Food lasts longer in glass than plastic. If there are no outward or visible signs of spoilage, canned fruits, vegetables, and meats should remain edible for years. Be careful about throwing things out simply because the date stamped on the package has passed.

If you need a pep talk or to discuss your investment strategy, please schedule a call or reply to this email. I’m here for you and happy to talk.

P.S. There has been an increase in coronavirus-related phishing and identity theft scams. Please be on alert for “official-looking” emails asking you to open an attachment or click a link to read an official statement – they may contain malware. If you get a suspicious email, check the sender’s name and email address to make sure they’re not fake. When in doubt, delete the email. Do you have someone in your life who you think might be at greater risk of email scams? Forward this to them so they’re aware.

We hope you find the above posts valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. We can schedule a call or a virtual meeting via Apprise Wealth Management’s Zoom account.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn, Facebook, and Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/